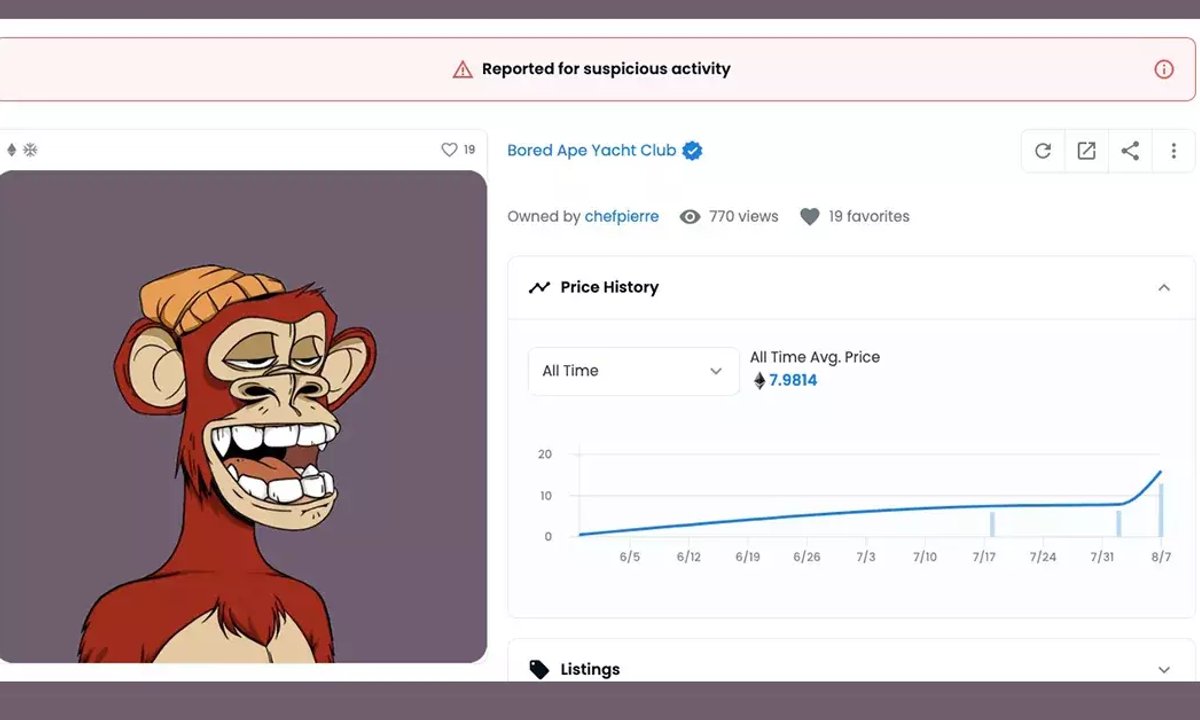

A Singapore man has won a court injunction to stop the sale of a non-fungible token (NFT) that once belonged to him and was used as collateral against a loan. The NFT in question is from the Bored Ape Yacht Club (BAYC) series, a collection of 10,000 simian avatars whose floor price has reached 108 Ethereum (ETH), or $368,000, due, in part, to a significant celebrity following.

The Singapore High Court’s decision to freeze trading of the NFT was based on a judgement to consider it as a digital asset—the first instance of such a ruling anywhere in the world for a commercial dispute, according to the claimant’s legal representatives Withers.

The claimant is an NFT investor who owns several BAYC NFTs. In March, the claimant used one ape, BAYC No. 2162, to borrow Ethereum worth $143,346 from the defendant.

While the claimant’s identity has been redacted in court documents, The Art Newspaper can confirm via the court’s website that he is the 38-year-old Janesh Rajkumar. The defendant, who did not respond to a request for comment, uses the alias chefpierre on social media platforms such as Twitter and in the metaverse game Gino’s Big Town Chef. Their real identity is still unknown, even to Rajkumar.

The loan transaction took place through NFTfi, a community platform that functions as an NFT-collateralised cryptocurrency lending marketplace.

The parties entered into a loan agreement on 19 March, whereby Rajkumar transferred BAYC No. 2162 to NFTfi to be held until he repaid the loan to the defendant. It was stipulated in the agreement that Rajkumar would never relinquish ownership of the NFT, and if he was unable to repay the loan in time, an extension should be granted prior to a foreclosure on the agreement. When Rajkumar found himself unable to repay the loan in time, the defendant, in violation of their contract, shifted the NFT to their personal Ethereum wallet and listed it for sale on OpenSea.

Rajkumar is now requesting the defendant accept repayment of the loan and return BAYC No. 2162 back to his cryptocurrency wallet.

“This landmark ruling is significant because it recognises that Singapore courts can take jurisdiction over assets sited in the decentralised blockchain,” says Withers KhattarWong partner Shaun Leong.

Unusually, the Singapore court allowed the freezing order to be issued via social media platforms including Twitter and Discord.

Other notable aspects of the case include a statement from the claimant, issued by Withers, that testifies to the rarity of BAYC No. 2162, which he says is the only one in the world “wearing a beanie”. He adds that the NFT’s high value derives from the fact it is a “virgin ape”, meaning it has “not been fed with mutant serum”.