As cars get smarter, the volume and granularity of real-time data generated is on the rise. With connected cars set to grow further, newer opportunities for digital innovation are springing up across the auto insurance value chain, bolstered by growing ecosystems. While consumers gain in increased convenience, AI-enabled connected platforms deliver cost savings and multiple benefits for insurers.

Take the case of China, with an estimated 340 million cars. Ping An Insurance has created a digital offering for car owners by integrating more than 190,000 outlets, including nearly 60,000 maintenance outlets, 78,000 repair shops, and 30,000 car dealers. It provides users with a one-stop experience, not only for accidents but for an ever-expanding range of auto services from roadside recovery to valeting, parking payment, fuel card recharge, vehicle loss calculation and refueling discounts. The results are impressive: 83 million bound vehicle users on their app.

In the past, car owners needed to navigate repair shop rules, structure of vehicle parts, and haggle over prices. The Ping An smart car loss calculation function is convenience personified. During a traffic accident, the car owner needs to take a picture of the scene, especially the damage caused by a collision, and uploads it to the app. The loss report is generated within seconds, and the premium for the following year is estimated immediately to help customers decide whether insurance needs to be used or not. Additionally, a reasonable repair price is generated, and a reliable repair shop recommended. In 2020, the online claims settlement service was delivered to nine million customers, 95% of whom used the “one-click claims service” function, scoring a 95.7% rating.

Leading insurers are redefining claims experiences to seamlessly anticipate and meet customers’ needs. An example is a claims department communicating updates based on customers’ engagement preferences, be it social network apps, text messaging or a one-stop, omnichannel hub. Using video and data-sharing capabilities, claims teams provide customers with rich, real-time information, answering 100% of claims status questions digitally and eliminating the need for phone calls—except when customers prefer a human touch.

A pertinent example of a growing auto insurance ecosystem centered on the claims experience is that of Singapore-based Fermion Group. Fermion (formerly Merimen) has processed US$10 b+ in premiums and claims, with 150,000+ claims processed monthly from 12000+ ecosystem partners across 10 markets in Asia. It creates ways for businesses to integrate insurance ecosystems into customer journeys to build differentiated ecosystems. As Asia’s leading insurance SaaS provider, Fermion serves more than 150 insurers and over 9000 repair shops, loss adjusters, lawyers and part suppliers.

AIG embedded the Fermion system in its auto claims service chain to streamline the process of claim notification and management. More than 95% of garage quotations and repair details are reviewed and approved within 24 hours. More than 97% of payments for repair costs are approved within one day of garage operators submitting documents. Most garage operators are satisfied with the speed and process and willing to provide service priority for AIG-insured vehicles. The system enhances communication with customers, such as when the company approves repairs quotation and assigns work to garage operators. New forms of service are being introduced, such as ‘live’ service and the ability for customers to open their claim via mobile interactive-video with claims completely opened in five minutes.

As ecosystem platforms create more capacity in claims organizations, insurers can differentiate themselves by dedicating additional resources to claim prevention. Preventing claims will change the relationship between insurers and customers—from a loss focus to a partnership with shared interest in loss prevention. Telematics capabilities coupled with connected devices and third-party data alert customers to risks before losses occur. Furthermore, platforms help businesses move from solely customer to ecosystem value that extend from digitizing processes to facilitating external partnerships.

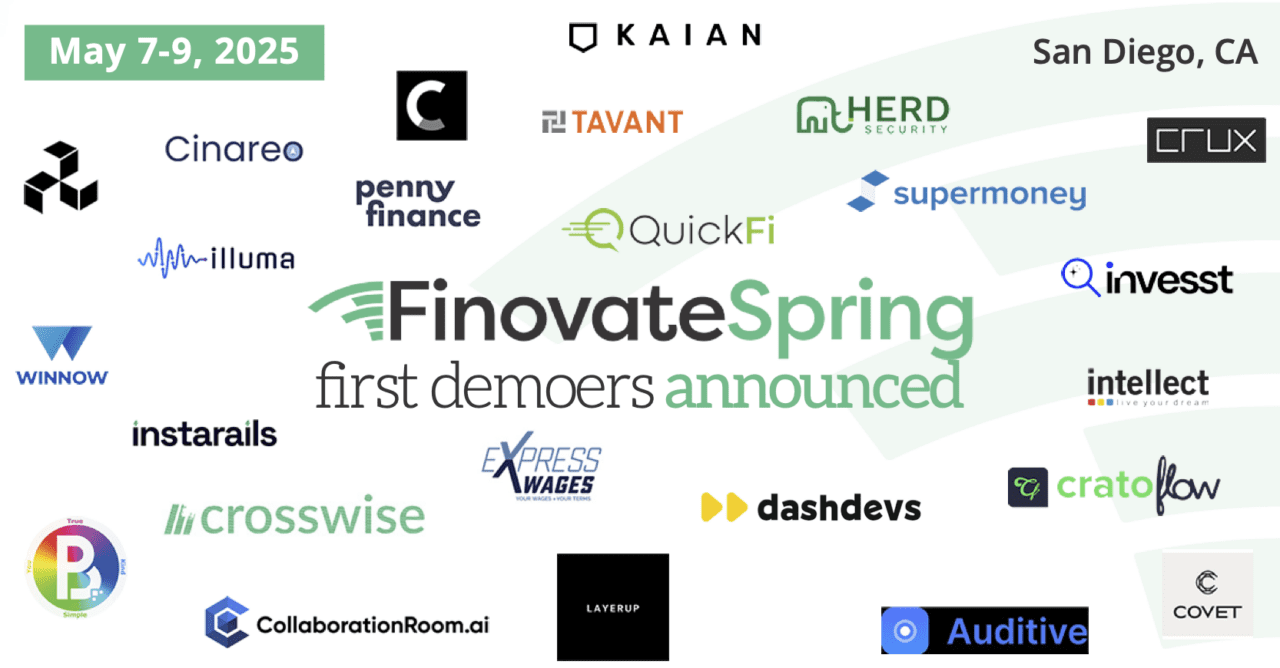

Cover Image

You get 3 free articles on Daily Fintech. After that you will need to become a member for just US$143 a year (= $0.39 per day) and get all our fresh content and our archives and participate in our forum.