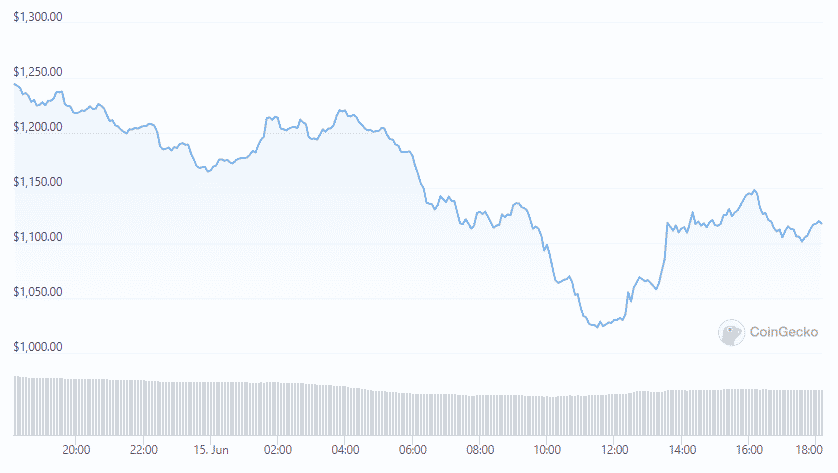

Ethereum could continue declining below $1100 with the bears being in control against the US dollar so let’s read more today in our latest ETH news.

Ethereum could continue declining unless it surges past the $1280 resistance and the price is now trading below the $1250 level and the 100 hourly simple moving average. There’s a key bearish trend line forming with the resistance at $1245 on the hourly charts of the pair which can resume its decline below the $1120 and the $1100 levels in the near term. Ethereum settled below the $1500 support zone with the price trading as low as $1073 and started a small correction. There was a recovery wave above the $1120 level and ETH climbed above the 23.6% Fib retracement of the recent decline from the $545 high to the $1072 low but the price is still trading near $1250 and the hourly 100 simple moving average.

The bears were active near the $1260 resistance and there’s also a key bearish trend line forming with the resistance at $1245 on the hourly charts of the pair. On the upside, there’s initial resistance near the $1240 level and the first major resistance is close to the $1280 and the $1300 levels so the 50% fib retracement level of the decline from $1545 swings high to $1072 low is near $1300 zone. A clear move above this trend line could start a new recovery wave and the next major resistance will be near the $1350 level and the 100 hourly simple moving average. More gains could start a new move above $1440 resistance.

Ethereum could continue declining as ETH fails to rise above $1280 resistance and can continue to move down with the initial support on the downside near the $1120 zone. The next major support is close to the $1070 zone and the clear move and break below this level could put more pressure on the bulls and in this case, the price can slide towards the $1000 support zone in the near term.

As recently reported, Bitcoin lost the $25,000 level while ETH slid to $1200. The crypto-tracked futures lost over $1 billion in the past day and were weighed down by a weak sentiment for BTC and other coins amid the weak global economic outlook. The liqudations refer to when the exchange forcefully closes a trader’s leveraged position because of a partial or total loss of the trader’s initial margin and it happens when a trader is unable to meet the margin requirements of the leveraged positions.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]