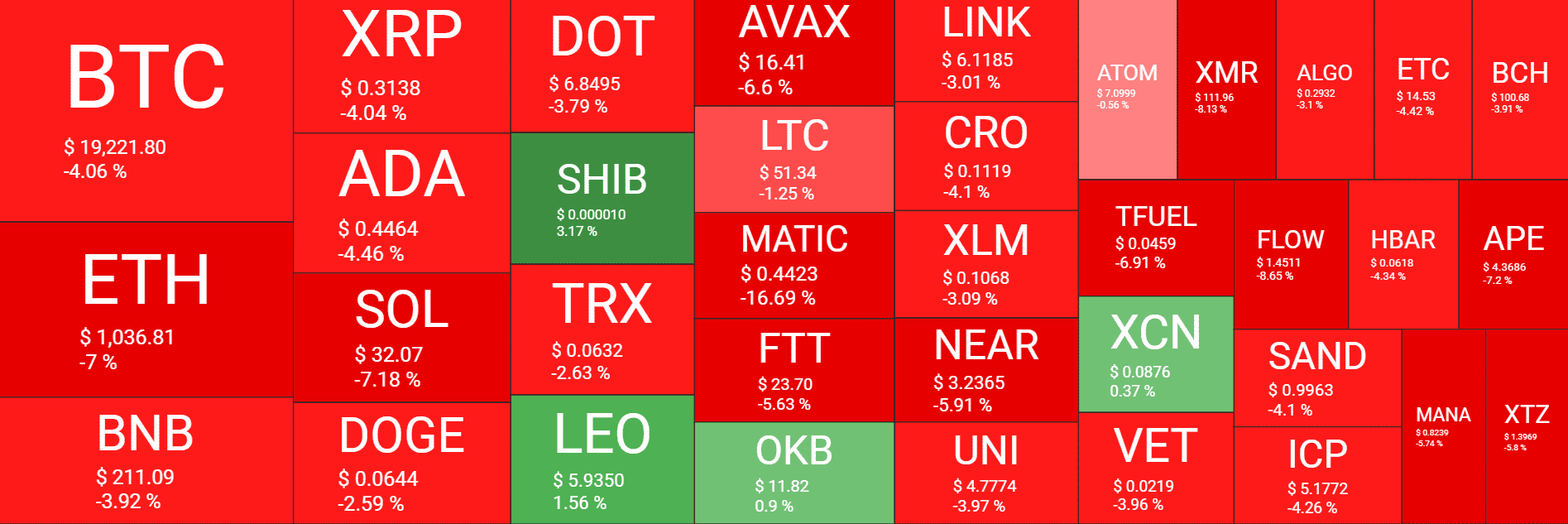

BTC slips below $19K while Ethereum dropped by 9% to $1000 continuing its bearish action overnight so let’s read more today in our latest altcoin news.

Bitcoin continued its bearish action overnight and the leading crypto dropped to $18,993 as per the data from CoinMarketCap. After staging a recovery, BTC is changing hands for $19,140 down by 4.8% on the day. BTC lost nearly half of its value in the past month due to serious inflation concerns and rate hikes by the central banks such as the US FED. The market cap of BTC dropped from $1.27 trillion to under $366 billion. Ethereum as the second biggest crypto in terms of the market cap also dropped to $1030 with a 9% drop over the past day.

With the current market cap of under $125 billion and ETH is down 80% from its ATH of $4,891 which was recorded back in November 2021. BTC slips below $19K and the main catalysts behind the weeks-long crypto crash include sluggish DEFI activity that swells the digital asset fund outflows and the FED rate hike. The inflation rate peaked at 8.6% forcing the US FED to icnrease the interest rates by 0.75% has been a huge factor in the bearish action.

Bank of Canada raised the interest rate from 1% to 1.5% and with the increased interest rates the bond yields spiked, reducing the demand for high-risk investment assets including crypto. The total outflow of funds from digital asset funds hit an ATH of $453 million according to the data from the Coinshares report. As per the data from DeFiLama, the TVL acorss the blockchains are down over 3.6% in the past day indicating reduced user interest. The DEFI platforms like Aave, Compound, Maker, and LIDO all saw their TVL drop by double figures in the past month.

As recently reported, The outflows for BTC-specific funds totaled $453 million and wiped off the inflows made over the past six months according to the CoinShares data. The funds measured are investment products that give traditional investors exposure to crypto without having custody of the said crypto. When investors buy a crypto-based fund and it is called inflows and is usually a sign of bullish sentiment. The opposite process when investors rotate out of these funds and call outflows and are often bearish. In terms of assets under management, last week’s outflows were the third biggest on record and represent 1.2% of the entire AUM of the funds that Coinshares tracks, and the worst were outflows of 1.6% recorded in the 2018 bear market.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]