With very interesting performance results.

It must’ve been past midnight. I do not remember where (maybe Medium?), but I learned one could use Google Finance’s API within an online spreadsheet to query stock price data. ???? So, half-heartedly, I query some data and start playing around. My go-to was the S&P500 (ticker: INDEXSP:.INX; referred to as SPX) and an equivalent ETF (ticker SPY).

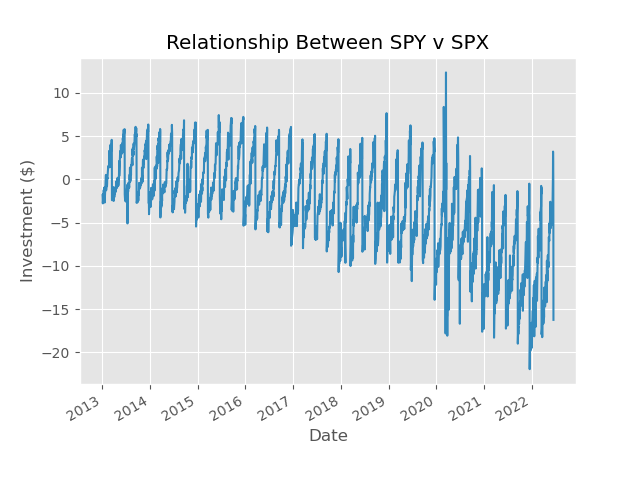

Fast forward several minutes, I am looking at the graph below.

Exploration

Three pieces stick out to me in the graph above: first, there seems to be cyclicality, then I see reversion behavior, and lastly, there seems to be an exponential growth/decay factor at play (a long-term trend, if you will). Moreover, it seems there are times when the price of the index and the price of the ETF vary towards and away from each other — there seems to be an arbitrary, slow-moving, middle point.

From this, I jump to the conclusion this could be a profitable finding.

Fast forward a little more, I found that during certain parts of the year — four times EVERY YEAR in fact, since 2013 — the price of the relationship comes off quickly, it usually takes +/- five days to complete, then the remainder of the period the price of the relationship slowly creeps upward, only until it comes off again.

For more context, I take the S&P500 away from a factor of the ETF, so when the price of the investment drops, it implies the S&P500 weakens relative to the ETF. Or you could state it in the reverse, the ETF strengthens relative to the S&P500 during that period.

Furthermore, it doesn’t matter which leg is doing the work, because the investment is predictable. Now, knowing which leg is likely to do the work would be an even more profitable strategy, but we’ll leave that on the table for now.

Initial Evaluation

In a situation like this, where we observe a pattern with all our data, I am always skeptical of evaluating results. It’s the classic, “You cannot use the same data point for rigor, if it was used for inspiration.” Doing so is akin to tasting a beverage first before hypothesizing whether or not you are going to enjoy it— you just cannot do that.

Of course, I am going to break that rule, because this article would not be as interesting. It would be valuable to check even more ETFs (than SPY) to see if this is a phenomena that occurs in more places than one. If you do that work, please give your insights in the comments below.

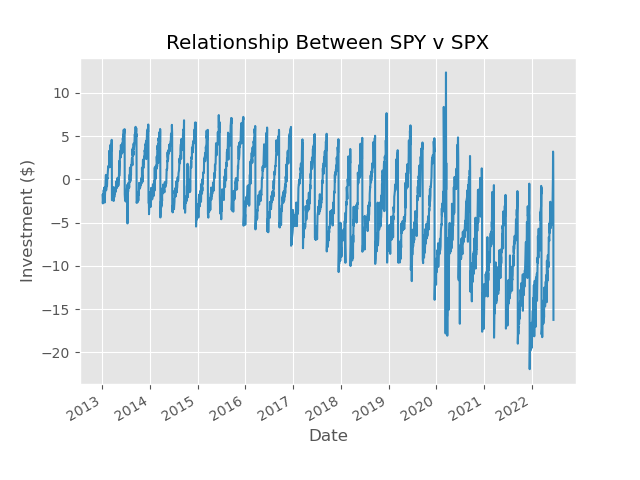

The strategy here is to be long the investment the large majority of the year, except when we think the relationship will drop, then we would flip our position to short. Remember, I mentioned this occurs four times every year and only for a +/- five days, so the strategy will be short for 20–30 days per year and long the rest of the year. The performance of this strategy is shown in the graph below.

Stats: Win%=57.4; WghtWin%=64.2; AvgAnnPL=77.4; AvgAnnVaR=3.9; MaxDraw=26.2; AnnPL/MaxDraw=3.1; AnnPL/VaR=23.9; AnnPL/$Inv=0.015

It seems the strategy performs better, in a shorter window, during the large drops in the investment. I think this is why we see the weighted win percent higher than the (unweighted) win percent. It would be good to size positions according to the probability of higher gains.

Again, the bet of this strategy is, for most of the year, the S&P500 will strengthen relative to the ETF, and once in a while, we flip the logic of the bet.

Why does this behavior exist? What forces drive the continued divergence and quick reversion at different times of the year (and the exact same times from year to year)?

Review

Let’s take a step back, now that we understand the strategy a little better, and critically think about what these results tell us.

The annualized PL / max daily drawdown as well as annualized PL/value at risk both look great. But, the biggest issue I have with the performance stats is the annual PL/money invested. 0.015 is horrible. That value means I will make 1.5% of whatever I invest, in an average year. Average Annual PL says we’ll make $77, but I have to invest, on average, $5,133. So, if I want to make any kind of money on this strategy, in a full year — assuming I want to make $10K — then I need to allocate $667K for the whole year.

I do not even think it is worth pursuing the analysis further. Do you?

Final Thoughts

In this article we discussed a really interesting arbitrage between the S&P500 and one of its ETF’s: SPY. The strategy we employed seemed promisingly predictive. When we evaluated the decisions the strategy would have told us to make through history, we learned the performance looked amazing. Put into context, after reviewing summary statistics, we learned it would take a large amount of capital to make any reasonable amount of cash for someone like me.

The question I am left with is, “Would it be worth the investment?”

Leave your thoughts in the comments below. I would love for someone to disagree with me.

***Please be advised, I have not made any recommendations for trading or investments. This article is for the interested reader — not to be taken as investment advice. Contact a financial advisor for such inquiries. I am not a financial advisor.

If you are interested in stocks and trading analysis, I highly recommend Webull. Webull provides an amazing amount of resources for analytics within their app and/or website.