Inflation. Recession. And, one question. Actually, two. Have you decided already? Where are you going to invest (save) your money?

If you have any, to begin with. This dilemma doesn’t concern only your personal finances, but the future of finance of the whole world. Or, what’s going to be left of it.

In one of my previous stories, Rich Dad, Poor Dad, Bitcoin & Canned Tuna, I honestly, and one may say naively, expected to get the answers to these costly questions from the “Daddy of Investment” himself (in case you didn’t know, we already have the “father of investment,” that’s Benjamin Graham).

It turned out that Robert Kiyosaki’s books and tweets are two totally different things. I experienced the Strange Case of Dr. Jekyll and Mr. Hyde while going through his most recent tweets about Bitcoin, gold, silver, guns (!), bullets (!!), and “cans of tuna fish,” because “you can’t eat gold, silver, or Bitcoin,” can you?

God have mercy on us.

But, Kiyosaki didn’t have mercy when calling the “Bitcoin LOSERS,” in his latest tweet ().

This tweet has some very “interesting” choices of words, and future financial activities by his author. I mean his Twitter handle is challenging enough. Is that the “real” Kiyosaki or someone else “impersonating” him on Twitter? The blue verified badge says that this account is authentic. I found it to be problematic, as well.

I mean, make up your mind man:

Should I sell? Should I buy?

Should I wait? Should I celebrate or cry?

You want Bitcoin to “test” (bite) the dust at $11K, so you can buy more. “If it recovers,” but “if it does not,” he will wait for Bitcoin losers to “capiulate” (capitulate, right?!). I mean, this tweet is so high that I have to move on.

Let’s see (read) what the other financial experts and analysts have to say (write) about it:

“It is now clear that bitcoin trades parallel to the risk assets, rather than [as] a safe haven,” Ipek Ozkardeskaya, an analyst with Swissquote, said in a report earlier this month. “Bitcoin is still not the digital gold, it’s more of a crypto-proxy for Nasdaq, apparently.”

“A crypto-proxy for Nasdaq?!” What does that even supposed to mean? The next analyst is worried about our future, as we all are, but he wants us to have a historical perspective. Why? Because old is gold, I guess:

“Stagflation risks are rising, and geopolitical tensions show few signs of a quick resolution,” said Louise Street, senior markets analyst with the World Gold Council, an industry research firm. “Gold is historically one of the strongest performers in a stagflationary environment, in which equities suffer, and commodities often retreat.”

So, where do we go from here through…

The numbers always tell the truth, or so we were told. I had to check the latest commodity trading prices at CNN Business. Here are some interesting comparisons. I’m saving the best for last: Bitcoin vs. gold. But, right now, I’m curious to see for myself, which shines longer, gold or silver? I mean, both financially and historically.

“Only” a ten percent price difference, give it or take. I don’t know about you, but that’s not enough to convince me to join the “gold team” of investors. The next comparison, though, leaves no room for doubt that corn is true gold.

By now, we should’ve all learned what blue and yellow represent on the Ukrainian flag. Right? Blue for the sky, and yellow for the endless wheat fields, but also for corn. Did you know that Ukraine is one of the top five corn producers in the world? I know someone who knows that corn doesn’t grow on digital fields.

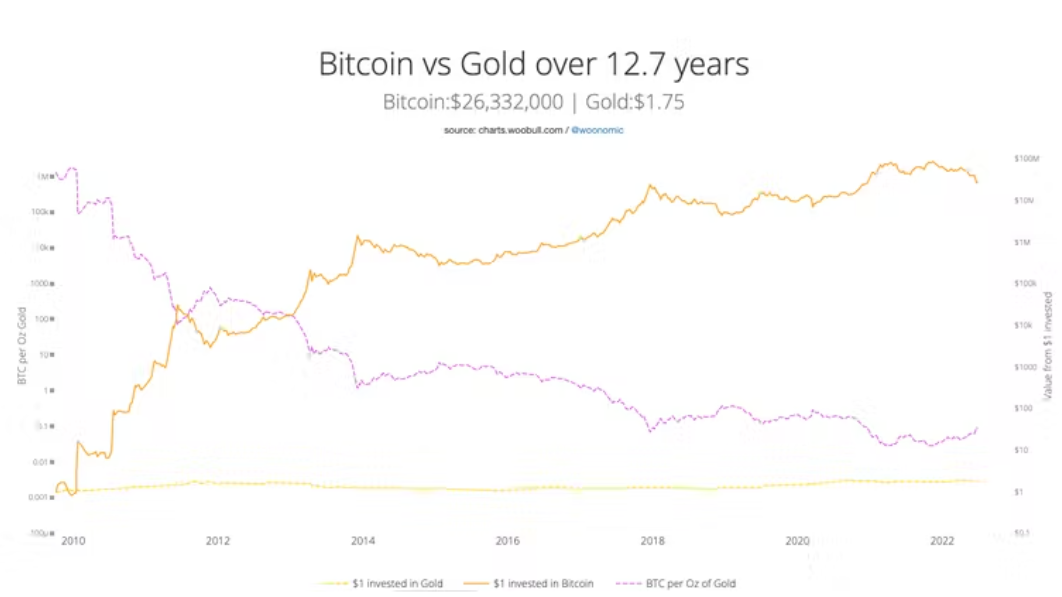

I stumbled upon a busy little crypto bee that has compared Bitcoin against gold since the dawn of cryptocurrency. Now, I’m going to do your eyes a favor, and quickly explain that the first line you see at the bottom of this chart represents what would have happened if you had invested one dollar in gold. The more appealing one represents the same investment, but in Bitcoin. The colorful line, which goes down, represents the so-called “the Bitcoin gold ratio,” or how many ounces of gold you could’ve purchased with Bitcoin at a certain point in time. I hope, I got it right.

Just in case, this table really comes in handy. Unless you’re superstitious, and believe that the 13th Bitcoin birthday isn’t going to be a happy one, after all. There are many “Back to the Future” fans who wouldn’t mind traveling back in 2009 and investing in Bitcoin. That’s no surprise. What comes as a surprise, though, is the “relative volatility” of gold. You’ve been warned, haven’t you? It’s all a matter of personal perspective.

My story begins with the “Rich Dad’s” lesson. Let’s see is there a happy ending for rich and poor dads’ kids.

“When inflation goes up, we’re going to wipe out 50% of the U.S. population,” he told Stansberry Research earlier this year. Kiyosaki is really dark these days in whatever he tweets, writes, or says.

“The average American doesn’t have 1,000 bucks,” Kiyosaki says. A recent Bankrate survey showed that most Americans do not have enough money set aside to cover an unexpected $1,000 expense. It also spells trouble for those who want to enjoy their golden years. When the bubbles burst, Kiyosaki says, the stock market will crash. So those relying on their 401(k) plans “are toast.”

It’s not easy to concentrate on making the right investment when a “safe (financial) heaven” is nowhere to be found.

We don’t have a retirement, our pensions are bust.

I don’t know whether you should invest your money in Bitcoin or gold, but I’m absolutely sure that investing your time in quality content is a safe bet because that’s the only inflation-proof thing these days.