Crypto Daily Mixer 7.14.22

A free daily newsletter to keep you in tune with crypto markets, protocols, news, and more!

Overview

- Inflation is the worst in 40 years!

- Bitcoin surprisingly holds 19k support.

- Celsius files for bankruptcy.

- Major L2 confirms future token airdrops.

Good morning Banter Fam,

Inflation data came in yesterday morning, and it was not pretty.

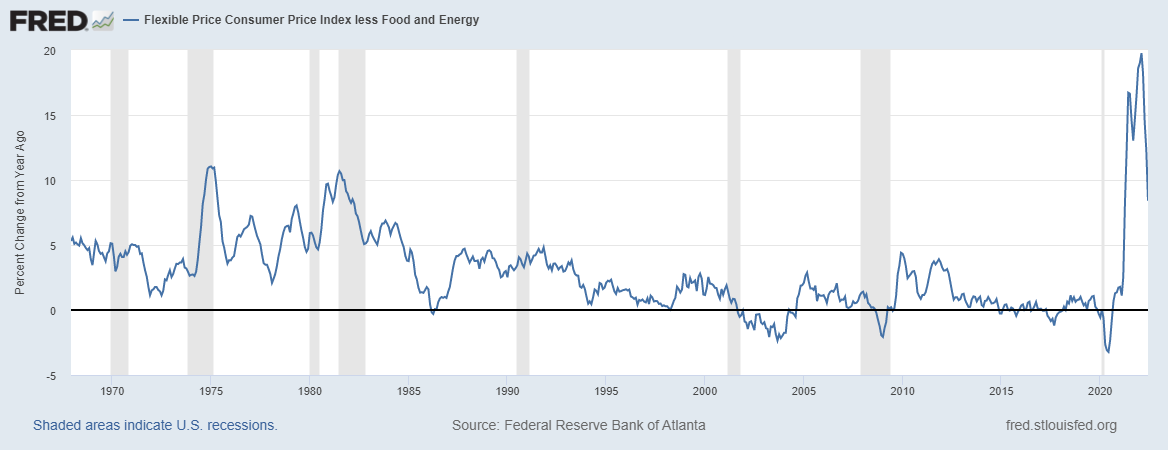

The US Consumer Price Index (CPI), which measures the price of an average basket of goods, ruptured through the 8.8% consensus forecast and came in at 9.1%. The Core CPI (minus food and gas) came in at 5.91%. It’s the worst rate of inflation in over 40 years. Simply put, stuff is getting really expensive for the average consumer! The chart provided by the FED’s economic data highlights the change.

Source: FRED

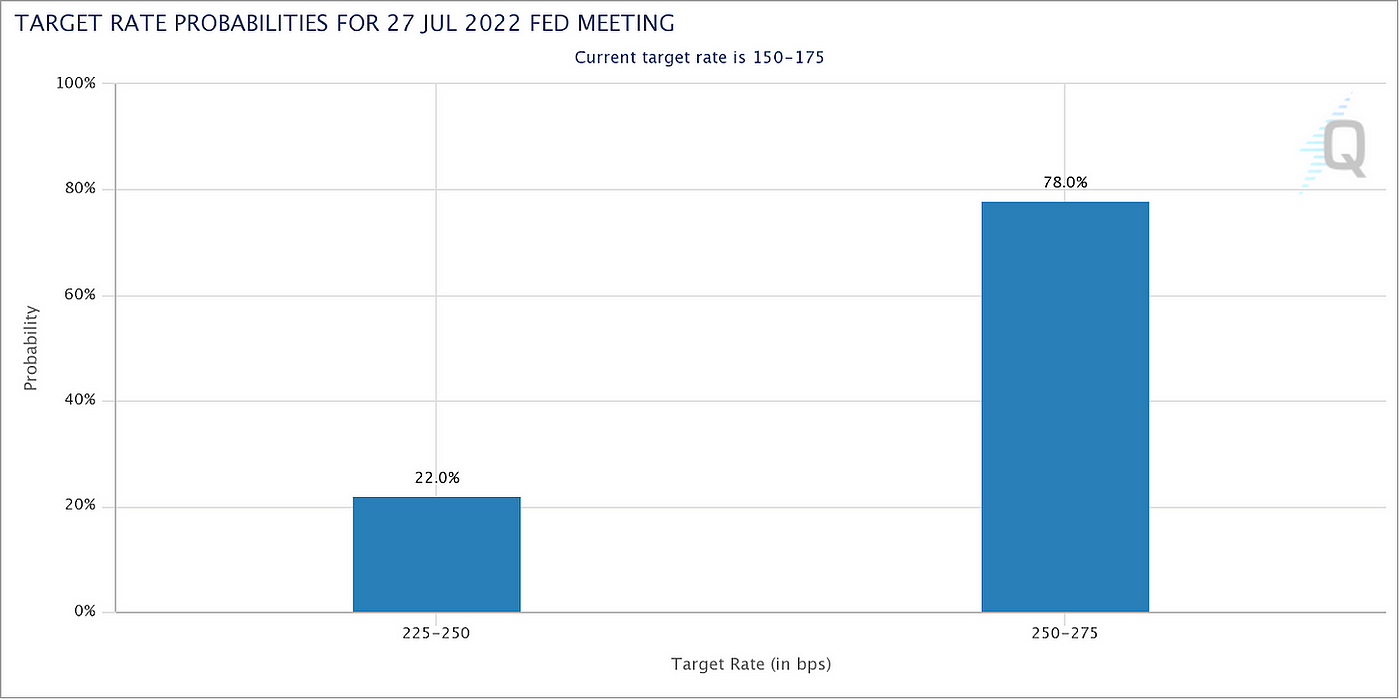

Now that inflation has come in worse than forecasted, the expectations of the Federal Reserve (Fed) to raise rates during the July 27th FOMC meeting has, in turn, increased from 75 to 100 basis points. As a result, there is a 78% probability of a 100 bp hike. The current rate sits at 150–175 bp.

Source: CME group

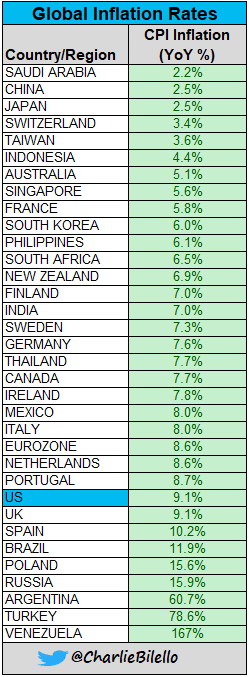

The inflation is not limited to the US dollar. Global inflation rates are elevated throughout the globe noted in this Tweet by Charlie Bilello.

With these latest numbers, it is evident the FED will continue to wage war on inflation at the expense of markets. With the increase in interest rates, it becomes harder and harder to borrow money. That, in turn, translates into slower economic growth. And when does it all stop? Not until the FED breaks DEMAND and inflation begins to show signs of decreasing. A recession might be the final signal.

BE FIRST to receive this daily newsletter by subscribing at NO COST.

If you’re enjoying this report and think it’s worth 20 sats (.01 cent) please press the clap below to help support my writing. (Up to 50 times!) THANKS!

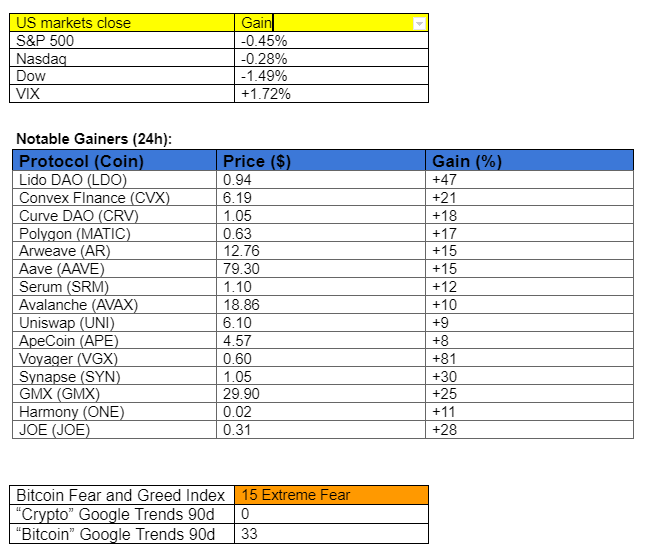

BTC/USD

Watching inflation come in at a higher than expected forecast wasn’t all that surprising, but the market’s reaction to the negative news was. Post-release, Bitcoin began to dump with a decrease of -3.21% in one hour until hitting the seemingly ever-important 19k support level. Then surprisingly, the price started to climb. Bitcoin will probably revisit this support zone in the near term, but for now, the price continues to rise despite the looming interest rate hike later in the month. BTC completed the US session at $US20,131.

High-resolution chart

Celsius pays off debt and declares bankruptcy. The embattled crypto lender has paid off a debt to the DeFi protocol Compound of $50m worth of DAI tokens and, in turn, filed for chapter 11 bankruptcy. With a chapter 11 bankruptcy, the firm would renegotiate terms with the creditors without having to liquidate assets. This adds the possibility that Celsius credits users over time. Still hope!

JP Morgan loses three executives to crypto. Three top executives have quit their positions at JP Morgan, one of the most influential banks in the world, to pursue web3 positions. Looking towards the future is always a smart move!

News Tidbits:

- Micheal Barr was voted in as Vice Chain for supervision for the Federal Reserve.

- Solana dApp support is now available on desktop Brave Browser.

At the protocol level ⛓

StarkWare confirms the launch of StarkNet token! The StarkWare team has announced the future release of the StarkNet token is likely to airdrop in September 2022. Starkware is a leading decentralized layer-two Ethereum solution. The firm released the news after Zhu Su implied a token drop in a Tweet.

Protocol Level tidbits:

NFT & metaverse update ????

- “Move-to-Earn” project STEPN intends to burn $6m worth of GMT tokens with Q2 profits. The game has additionally added support for Ethereum.

- The NFL has expanded NFT Ticket Stubs for over 100 games in the 2022 season.

- Everything you need to know about ERC-4907.

- Netflix to launch a Stranger Things NFT collection with Candy Digital.

Writer’s take

Inflation bomb!

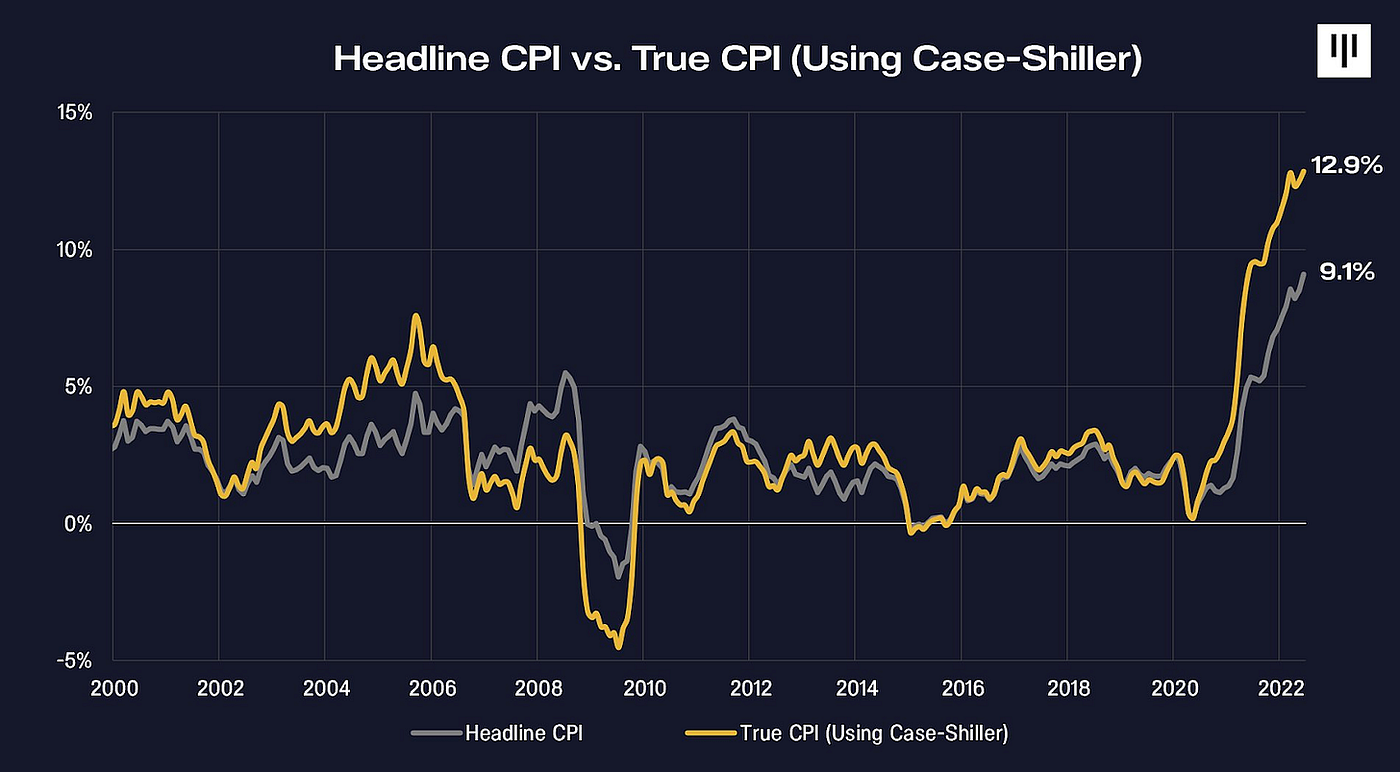

It is not looking pretty for the US dollar. It lost 9.1% of its value in the last year. It’s only 9.1% if we’re lucky! The way the government measures it is in a constant flux. Another method used to measure inflation is the Case-Shiller Index. This index is noted as the more consistent of the two and puts yearly inflation at 12.9%! Youch!

Source: Dan Morehead

Now imagine if the inflation problem persists for a few years. In three years, that’s a 36% decrease in the value of the US dollar or 60% in 5. It’s likely not the case, but it shows that stocks, commodities, and crypto aren’t the only volatile assets out in the wild. Sometimes it’s our supposedly “stable” currencies.

It makes me wonder if there’s a fixed supply, immutable asset that could improve many of these problems? Hmmm.

BE FIRST to receive this daily newsletter by subscribing at NO COST.

If you’re enjoying this report and think it’s worth 20 sats (.01 cent) please press the clap below to help support my writing. (Up to 50 times!) THANKS!

Follow me on Twitter for daily updates! Disclaimer All opinions expressed by the publisher, writers, and chartists should not be construed as financial advice and do not necessarily reflect the views of Crypto Banter. The publisher, writers, and chartists may hold positions in the tokens and assets discussed. Readers are encouraged to do their own research.