Grayscale Investments has explained that there may be another 250 days of the current bearish crypto market, citing patterns in previous cycles. In addition, “Bitcoin is 222 days off the all-time high, which means we may see another 5-6 months of downward or sideways price movement,” the world’s largest digital asset manager detailed.

Grayscale’s Crypto Market Outlook

Grayscale Investments, the world’s largest digital asset manager, published a report titled “Bear Markets in Perspective” this week.

The firm explained: “The length, time to peak and trough, and recovery time to previous all-time highs in each market cycle may suggest that the current market may resemble previous cycles, which have resulted in the crypto industry continuing to innovate and push new highs.”

The report details:

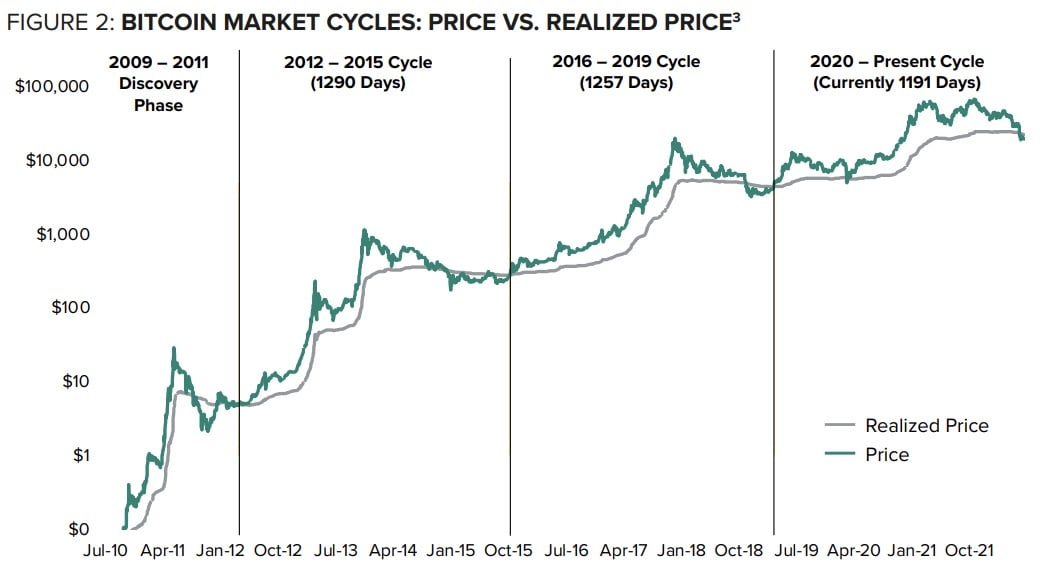

Crypto market cycles, on average, last ~4 years or approximately 1,275 days.

While most bitcoiners are familiar with market cycles based on bitcoin’s halving cycle, Grayscale has defined an overall crypto market cycle that also roughly works out to a four-year period.

The digital asset manager explained: “While methods vary for identifying crypto market cycles, we can quantitatively define a cycle by when the realized price moves below the market price (the current trading price of an asset), using bitcoin prices as a proxy.”

“As of June 13, 2022, the realized price of bitcoin crossed below the market price signaling that we may officially have entered a bear market,” Grayscale described.

The report proceeds to explain that in the 2012 cycle, there were 303 days in the zone where the realized price was less than bitcoin’s market price. In the 2016 cycle, there were 268 days in the zone.

Noting that in the 2020 cycle, we are only 21 days into this zone, the digital asset manager noted:

We may see another ~250 days of high-value buying opportunities when compared to previous cycles.

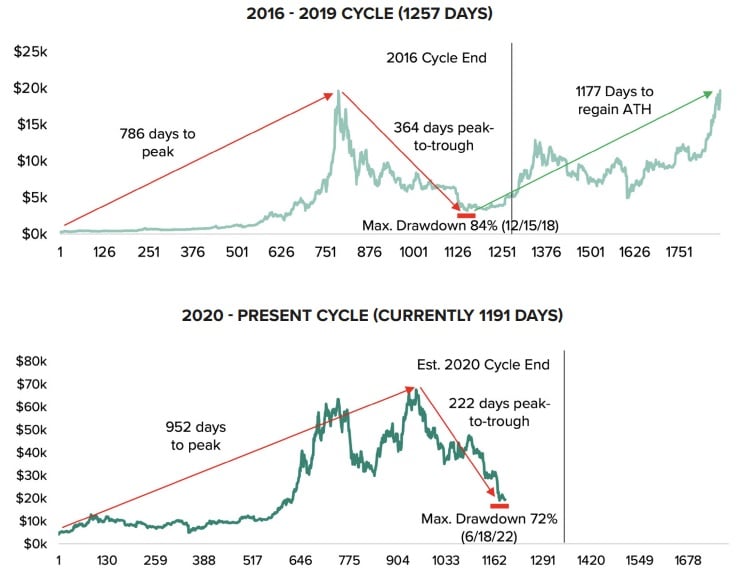

In addition, the report notes that crypto market cycles have been taking about 180 days longer to peak each time.

“From peak-to-trough, the 2012 and 2016 cycles lasted approximately 4 years, or 1,290 and 1,257 days respectively, and took 391 days to fall 73% in 2012, and 364 days to fall 84% in 2016,” Grayscale said.

“In the current 2020 cycle, we are 1,198 days in as of July 12, 2022, which could represent another approximate four months left in this cycle until the realized price crosses back above the market price,” the firm continued, elaborating:

Bitcoin is 222 days off the all-time high, which means we may see another 5-6 months of downward or sideways price movement.

What do you think about Grayscale’s explanation of where the crypto market is headed? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.