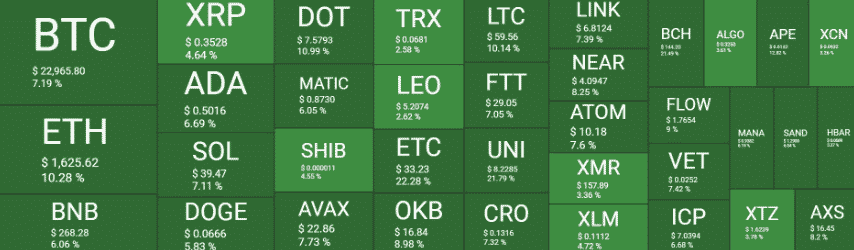

Ethereum could climb above $1700 against the US dollar and the coin increased 15% in the past day which is making it stronger to reach this level so let’s read more today in our latest Ethereum latest news.

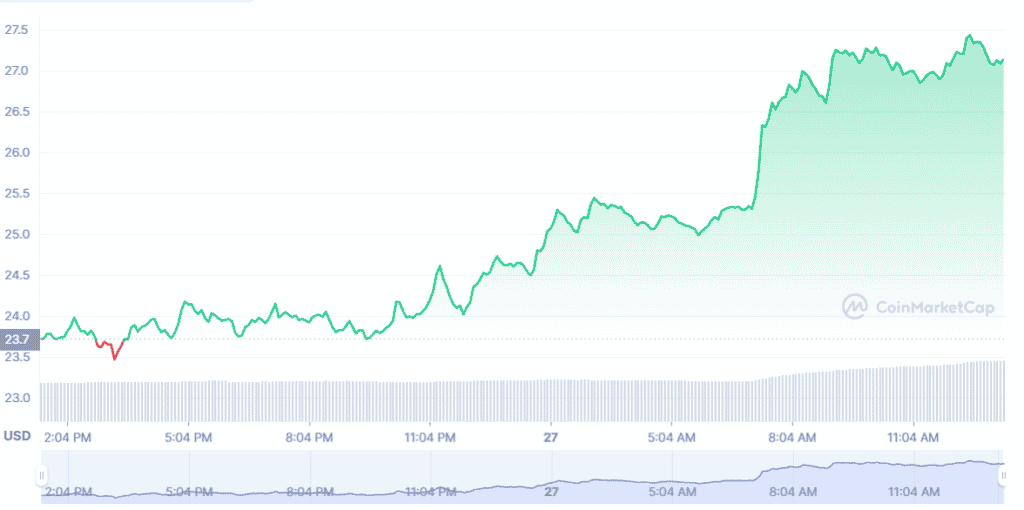

Ethereum started a new increase above the $1550 and the $1600 levels with the price trading above these levels and the 100 hourly simple moving average. There was a break above the key bearish trend line with the resistance at $1450 ont eh chart of the ETH/USD pair which could continue to increase if there is a move above the $1675 level. Ethereum could climb above $1700 after forming a base above the $1400 and started a major icnrease and was able to clear the key hurdles close to the $1500 level.

The price jumped over 15% and then surpassed the $1600 level and there was a break above the key bearish trend line with the resistance being near $1450 on the hourly charts of the pair. The pair climbed dramatically and surpassed the 76.4% fib retracement level from the downward movement of the $1663 swing high to the $1357 low. It broke the $1650 level and now traded near the $1660 zone with the ETH price now trading above the $1600 simple moving average and the immediate resistnace on the upside is close to the $1675 with the first major resistance being $1700.

The main resistance is forming near the $1735 zone and it nears the 1.235 Fib extension level of the downward move from $1663 high to $1356 low moving above the $1735 level could even push the price higher and in this case, the price could even hit $1800 resistance zone. If ETH fails to rise above this zone, it could start a downside correction with the initial support on the downside being $1620.

A clear move below this support zone could spark a move to the $1580 level with more losses that might even push the price to $1510 support and the 100 hourly simple moving average in the near term. The MACD for the pair is losing momentum in the bullish zone and the RSI for the pair is in the overbought zone.

As recently reported, A recent SEC insider trading lawsuit reignited discussions over which crypto assets should be considered as securities and whether Ethereum might be classified as one after the Merge. Some argue that the ETH passes the Howey test due to the way it was launched and because of its PoS transition. The ETH stakers earn revenue from validating blocks on the network so there’s an argument that the investors will buy the asset with the expectation of a profit but a security classification from the SEC seemed unlikely.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]