Take a look at the factors to consider when making project investments during the cryptocurrency bear market.

Crypto winter has arrived. With a drop of more than 20% in prices, the digital asset market is displaying bearish trends. Bitcoin is down 35% as of June 2022. Ether followed a similar pattern. and dropped below $1,000.

While bearish markets are challenging, they also create opportunities for investments to produce significant yield in the long term. In this article, we discuss factors to consider when investing in a crypto bear market.

A financial market, whether it is digital assets, stock, or real estate, can display bullish or bearish sentiments. In a bull market, there is a continuous upward trend in the market, and in a bear market, the trend is declining.

Typically, a crypto bear market is characterized by greater supply than demand, continuous falling prices, and low market confidence. The investors are pessimistic (referred to as “bears”) about the market and predict that market prices will fall further. A bear market can be extremely challenging for new investors.

With the recent fall in the prices of the two most prominent cryptocurrencies, Bitcoin and Ethereum, the global crypto market has witnessed a sharp fall below $1 trillion in January 2022 to as low as $926 billion from a market peak of $2.9 trillion in late November 2021. Furthermore, the recent fiascos of Terra-Luna and the Celcius Network did not help with market sentiments.

A bear market can be stressful, especially for beginners who may be looking to sell their assets. For savvy investors, it is an opportunity to study the market and develop long-term investment strategies and research projects so that they can invest when the market recovers.

Before plunging into potential crypto project investments, it is important to do qualitative research and understand the market value of the project. Here are a few things to consider:

1. Why are you investing in the project?

Do a preliminary study and determine the value of the project. Analyze the features, check the history of the currency, and see how trending the currency is. Is the currency performing well? What is its market value? There are several qualitative factors that determine the utility of a project.

Just as there are promising and legitimate projects, the digital assets and NFT space have also attracted bad actors which have often participated in malicious activities, like rug-pulls. Before investing, learn about the growth potential, APYs, and long-term values of these projects and see whether they will be able to survive in a bear market.

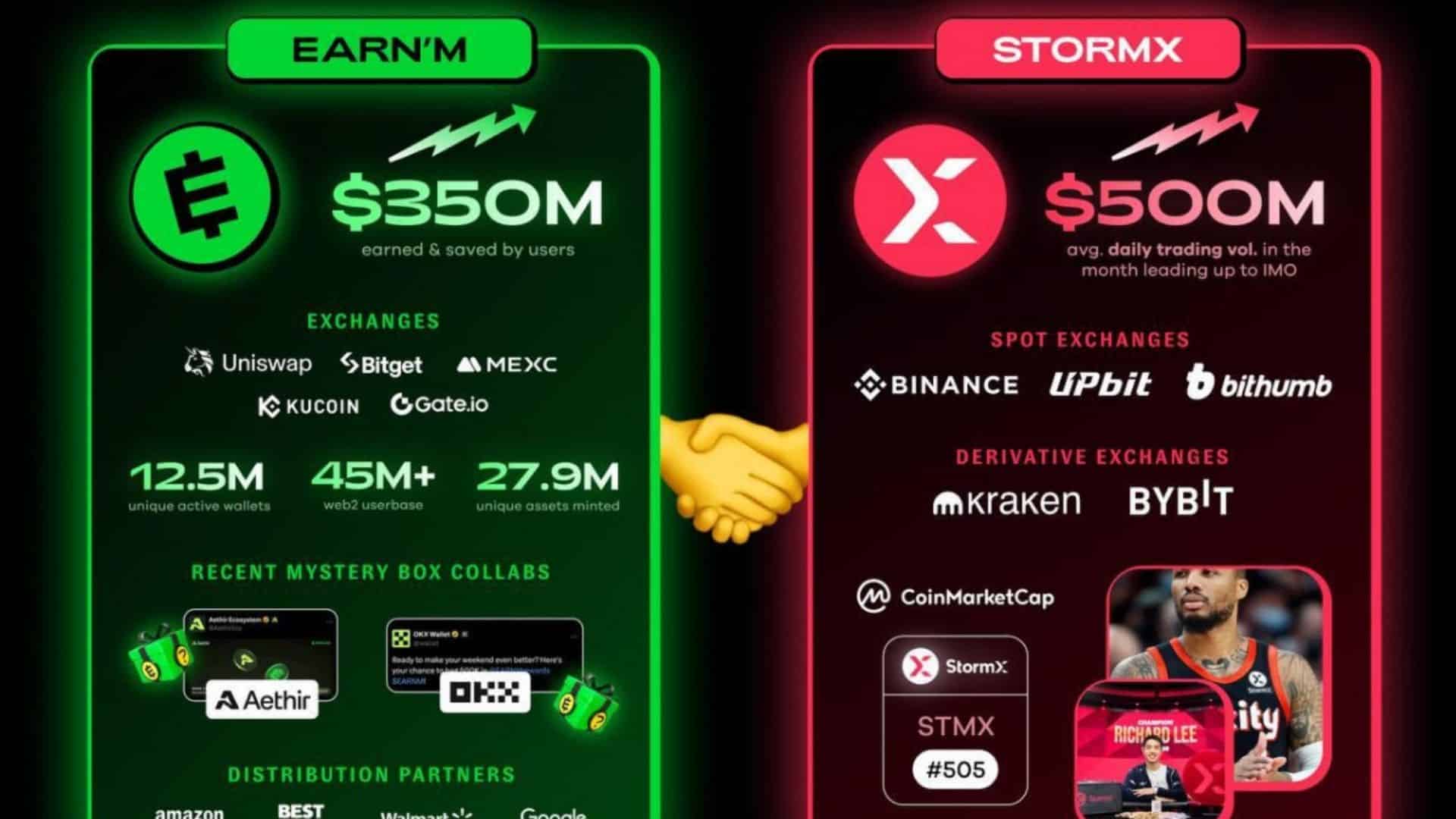

2. Does the project have a competitive advantage?

Hundreds of nascent digital assets make their entry into the crypto market every day. But does your currency have a competitive edge in the market, or is it just a copycat of similar cryptocurrencies?

What is its real-world utility? Are the coins serving a purpose, building a community, and do they have a strong technological foundation? The project should be backed by a dedicated group of developers. They must adapt to new technological advancements and understand the sentiment of community members. “Lyndiness”, or how long the asset is going to stay around, is crucial for a currency’s survival in the crypto space. It is also correlated to the asset’s security and distinguishes it from other nascent digital assets.

Does the token have a viable community network? It takes a long time to establish a network. A community grows by the widespread adoption of the token by its users and is popularized by its developers. The longer the token survives in the crypto space, the more secure its network.

3. How much revenue does the project generate?

Look into the long-term potential of the De-Fi project. Consider projects that have real-world use cases, have a supportive community, and have the ability to withstand bull-bear market cycles. Consider the liquidity level of the currency and how fast one can liquidate the tokens in major exchanges. Currencies that are not heavily regulated and have a high trading volume tend to have a high liquidity value.

It also helps to review the market cap of the crypto project. DeFi projects with a high market cap signify a high trading volume and determine their overall worth in the market. There are several tools available to determine whether the project is generating any revenue, such as Crypto Fees or Token Terminal. You can also calculate the P/E ratio to determine the profitability of a protocol.

{P/E ratio = Token price/earnings per share.}

4. Does the protocol have a sustainable cash reserve?

very DeFi project needs a viable reserve, a fund, or a treasury to survive the fluctuating market trends. A treasury is a reserve of tokens that the company maintains for the development and maintenance of protocols. The reserve is used to pay for operational expenses, salaries of the employees, development, research of the ecosystem, and marketing purposes. A diversified treasury with different crypto assets like Bitcoin, ETH, and reliable stablecoins apart from its native coins are vital for the upkeep of the protocol even during tough times.

5. Does the protocol have a well-defined white paper and a road map?

A solid crypto project will have a well-documented white paper and a road map illustrating all the technical information, in-depth reports, statistics, and the project’s purpose. It will help you understand the merit of the project. A roadmap gives out a general timeline of the project’s milestones, a documented report of how much it has accomplished, setbacks, measures taken to overcome the drawbacks, its future plans, etc. If the roadmap is dull with little to no activity, then it’s time to leave the project.

6. Who is the team leading the project?

The team behind the project is vital to determining a project’s success and failure. A good project openly discloses its team members and their performance history. It is advisable to check who are the investors behind the project. Do they properly address the community’s grievances and issues? Check the project’s social media channels and websites to see if they are socially active.

The crypto market is highly volatile and things may change overnight. They don’t follow the typical rules and metrics of centralized financial markets like stock markets. To survive the bearish market, it is important to make investments with precision, take advice from seasoned investors and financial advisors, calculate risks, and always keep some funds in reserve for unforeseen market crashes.