Many cryptocurrencies lost the majority of their price advances from the 2021 bull market. Some even retraced their steps to revisit the 2018/19 bear market. The question that remains now is which cryptocurrencies could survive the bear market, recover their former prices, and possibly march to new all-time highs. Read along as we articulate the factors that could impact the survival as well as the future performance of cryptocurrencies.

The cryptocurrency ecosystem has witnessed the rise and fall of countless hyped projects which claimed to be the “next Bitcoin,” or the “Ethereum killer,” or having invented the most revolutionary use case in the history of finance.

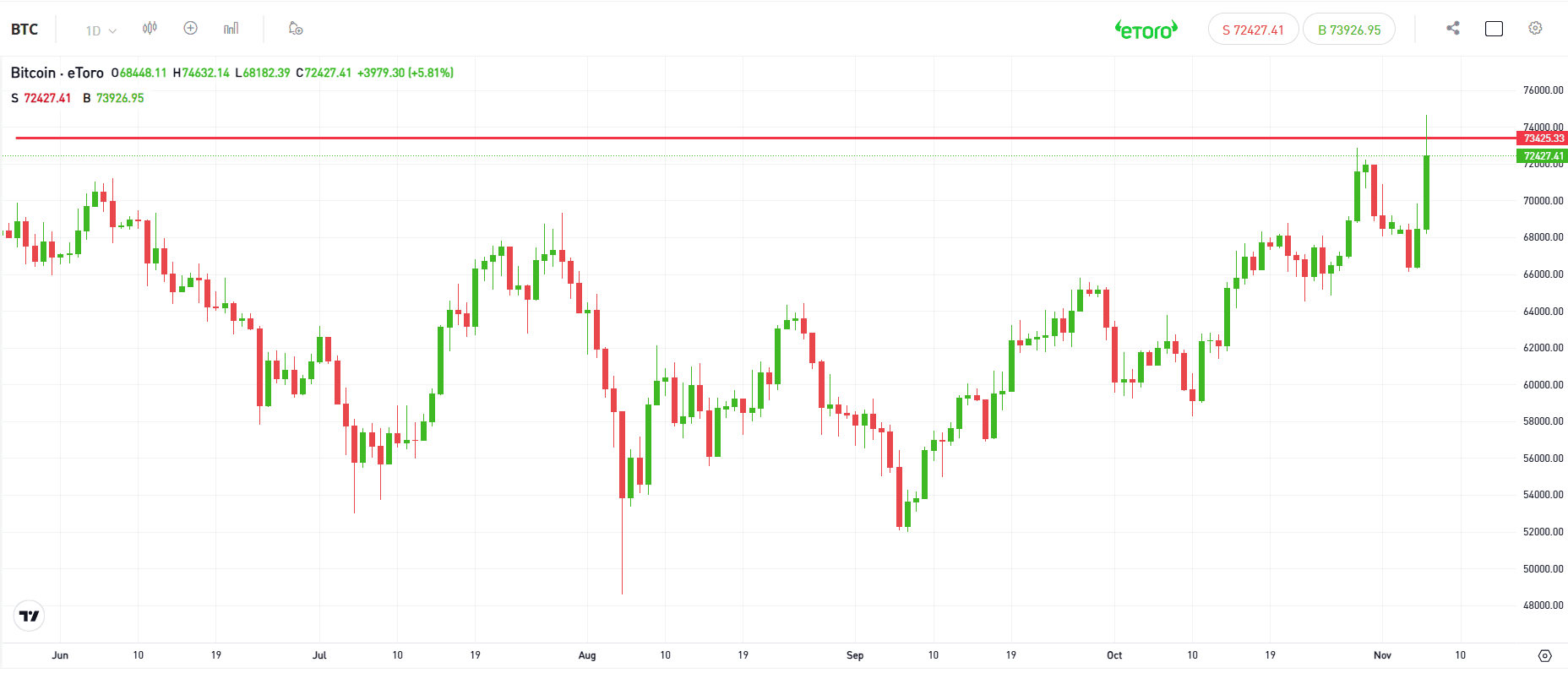

Despite the promises, few cryptocurrencies have been able to beat Bitcoin’s price performance in the long run. Bitcoin increased by 50,000%, 60,000%, 10,000%, and 2,000% respectively from cycle bottom to top during the four historical cryptocurrency bull runs.

All-time Bitcoin/U.S. Dollar chart with the four growth cycles.

During the first bull run from 2010 to 2011, there was only Bitcoin. The second cryptocurrency, Litecoin launched at the onset of the second bull market in late 2011. Not a single cryptocurrency that was present in the second bull run, including Litecoin, has performed better than Bitcoin to date.

Tides started to turn with the launch of Ethereum in the third growth cycle (September 2015). Since its launch, Ethereum has managed to outperform Bitcoin by around 30x (see the Ethereum/Bitcoin trading pair chart below).

All-time Ethereum/Bitcoin parity chart.

Besides Ethereum, eight other cryptocurrencies have outrun Bitcoin over the last eight years – BNB Coin, Dogecoin, Cardano, Aave, Decentraland, Shiba Inu, Axie Infinity, and The Sandbox.

BNB Coin/Bitcoin parity chart. BNB Coin has been the top performer against Bitcoin with a 350X increase.

Dogecoin/Bitcoin parity chart. Since its launch, Dogecoin outperformed Bitcoin by 450%.

Aave/Bitcoin parity chart. Aave has outperformed Bitcoin by approximately 230x.

Some coins launched during the last 2020/21 bull run and have performed much better than Bitcoin since their debut. Solana, Avalanche, Polygon, and Fantom, to name a few, as well as Axie Infinity and The Sandbox (these two have consistently returned more gains than Bitcoin since 2015).

Hyping new coins for superior returns is common practice during every bull cycle. However, what matters going forward is whether these coins will be able to preserve their price performance over the next cycle.

What is required for long-term survival?

For sustained, long-term performance, a coin or token needs to preserve trading volume. In other words, people in the market need to keep trading that asset.

Unlike stocks, cryptocurrencies do not have to generate cash flow to survive. Rather, a cryptocurrency goes out of business when people stop trading it. In that sense, cryptos are more like commodities. Commodities do not generate cash flow either but instead possess a use case whose value fluctuates on the whims of market speculation.

So a cryptocurrency is unlikely to disappear entirely unless it faces a black swan event like Terra’s collapse due to hyperinflating, or the hack of the EasyFi ecosystem back in 2021. During such incidents, the value of a cryptocurrency’s native token crashes dramatically as its holders panic and try to liquidate their holdings at whatever price they can.

Terra’s sudden collapse caused the price to go to almost zero.

Which cryptos collapsed in the past?

Historically speaking, cryptocurrency projects that offered unrealistically high yields for holding their tokens have usually been the ones that collapsed to zero after losing their liquidity. This typically happens during extreme market conditions, where liquidity providers remove their funds under panic and uncertainty.

The Terra ecosystem offered over 20% annual yield for its algorithmic stablecoin, UST, while you could only get around 1% interest for a U.S. Dollar at a traditional bank.

Some lending platforms that were offering similar returns for stablecoins suffered the same fate as Terra. For example, Celsius, once a huge player in the crypto lending industry filed for bankruptcy in May 2022 after UST’s collapse dried the liquidity on its platform. This caused the value of its native token, CEL, to crater by over 80% in less than a month.

Community factor

If the collapsing crypto in question has a wide enough user base and holds together as a community, it could still come back to life with various remedies, like forking the original currency.

This was the case in Terra’s situation. Terra was one of the five largest cryptocurrencies and held $30 billion worth of funds before it collapsed. It was deemed as “too big to fail” and developers responded by forking the original chain (now the Terra Classic) to a new chain (Terra or Terra 2.0). Many of the apps and protocols that existed on the original chain carried over to Terra 2.0.

However, even though the Terra ecosystem was saved, the new network has failed to gain traction so far. Currently, there is only $22.5 million worth of value locked on Terra 2.0, while the value locked on the original chain was a whopping $20 billion before the collapse.

Trading volumes on exchanges

long run, collapsed projects run the risk of their trading volumes eventually dropping to such low levels that exchanges may choose to delist them. Unless their network actively recovers, this could lower their chances of returning to previous high prices, and promising relatively dismal returns for holding these tokens in return.

By that logic, cryptocurrencies that keep being traded on major exchanges throughout bear markets could have a higher chance of seeing another bull cycle.

If you are looking for a top exchange that has survived multiple bear markets, CEX.IO has been leading the cryptocurrency space since 2013. CEX.IO was named in the Top 20 Best Global Crypto Exchanges by Forbes and provides sufficient liquidity for all digital assets listed on its platform.

You can conveniently buy over 100 different cryptocurrencies on CEX.IO by using its spot exchange or buy directly with your credit/debit card using the Instant Buy function. The spot exchange is available on the browser website, while the Instant Buy function is available on both the website and on the mobile CEX.IO App.

View of the CEX.IO spot exchange

View of the Instant Buy function.

Cryptocurrencies listed on CEX.IO include major players like Bitcoin, Ethereum, Tether, and BNB Coin as well as the recently popular coins like Solana, Polygon, Shiba Inu, and the Sandbox.

Factors that impact trading volume

Exchange liquidity

The liquidity of a cryptocurrency can be thought of as the number of outstanding buy and sell orders on an exchange. Major exchanges usually have more liquidity for each listed asset which typically results in a higher trading volume.

During a bear market, both liquidity and trading volume drop for almost all cryptocurrencies. However, if the exchange liquidity of your cryptocurrency drops significantly more than the market average (in percentage terms) while being traded on fewer exchanges, it could be a point of concern for its future growth potential.

A good example from the past is Bytecoin. Bytecoin is the first privacy coin that was created in 2014. During the 2017 bull market, which marked the third bull cycle in crypto history, there was so much hype around Bytecoin that all major exchanges of the day rushed to list it.

Subsequently, Bytecoin generated one of the largest trading volumes in the market. This resulted in one of the most unbelievable price advances in history, where the price of Bytecoin increased by approximately 40,000% in only 300 days.

Although a major correction is natural after such a price spike, Bytecoin failed to gain traction even after the following bear market. As the narrative for privacy coins generally lost ground, dramatically reduced trade volumes ended with Bytecoin getting delisted from most major exchanges. This caused Bytecoin to lose its liquidity and eventually its entire price advance from 2017.

Bytecoin/U.S. Dollar price chart.

As the project did not need to deliver anything to survive, Bytecoin remained in the market, albeit with very small trading volumes, and enjoyed few listings. Not surprisingly, Bytecoin was far from reaching its previous all-time high price during the 2021 bull run. Today, it is back at its launch price in 2014 with a daily trading volume of only $8,000, down from the tens of millions it saw in 2017.

Product category

The popularity of a crypto’s product category and its relevance within the overall ecosystem is critical to factor in when determining that currency’s long-term price performance.

In the past, there have been many novel products with unique use cases that became instantly popular only to fizzle out in the next bear market like a flash in the pan.

Activity coins, loyalty program coins for shopping, social platform coins, and supply chain solution coins are only a few examples. None of these narratives were able to maintain their popularity over the following bull cycles and the values of related cryptocurrencies were practically wiped out.

During the last bull run in 2020/21, DeFi and NFT/metaverse were the two predominant cryptocurrency product categories. We cannot know what the future will bring, but the ongoing dominance of these two categories in the crypto ecosystem could be a sign of lasting popularity.

Another important angle to consider is that not all products under the same category perform the same function. There have been a lot of Bitcoin alternatives in the past, such as payment coins, which offered faster and cheaper transactions. But almost none of them could compete with Bitcoin in terms of popularity, adoption, and subsequently price performance.

Dogecoin is the only exception here but that recorded the bulk of its gains only in 2021 after Elon Musk publicized it.

The same applies to Ethereum. The crypto ecosystem saw dozens of “Ethereum killers” in the 2017 bull cycle, but none of them ended up performing better than Ethereum in the long run. Most of these coins failed to make a new all-time high price in the last bull cycle (2020/21) while Ethereum surpassed its previous high by almost 300%.

Regarding the new competitors from the last bull run, like Solana, Avalanche, and Fantom, time will show whether they will end up as viable “Ethereum killers”.

Regardless of how things play out, we are constantly keeping watch at CEX.IO, and remain committed to guiding you through any changes in the cryptocurrency tides.

On-chain factors to monitor

Network activity

If a cryptocurrency’s blockchain is used actively during a bear market, it could be followed by a significant price surge once the downtrend comes to an end. In other words, the anticipated price action could arrive with a lag.

For example, Polygon, already an actively used network during the current bear market, had an unusual increase in its network activity following Terra’s collapse in May. This was due to the migration of dApps on the Terra platform to Polygon.

Initially, this did not transform into a price surge in Polygon’s native token, MATIC, as Bitcoin was on the verge of capitulating. However, as soon as Bitcoin capitulated and made a bottom in June, the price of MATIC exploded. It increased by 200% (3x) in only one month, from $0.32 per token on June 18 up to $0.97 on July 18.

Decentralized exchange Uniswap followed a similar path to Polygon. The Uniswap ecosystem had many important developments in early June but the price of its native token, UNI, started moving after Bitcoin capitulated. UNI increased by 200% in the next 40 days.

Among the largest-volume cryptocurrencies, Ethereum has had more activity on its network since the start of the current bear market, compared to Bitcoin. This was a consequence of the number of ETH coins staked on Ethereum’s new network continuing to break daily records. Around 8 million ETH was staked on the network at the beginning of 2022, but now that figure has grown to surpass 13 million ETH. This has resulted in Ethereum outperforming Bitcoin by around 60% since the Bitcoin capitulation in June.

All of these examples suggest that a robust network activity during a bear market could be essential for a cryptocurrency to outperform its competitors.

Sustained project development

Another fundamental factor that could determine a cryptocurrency’s survival is whether project development is sustained and if the project team delivers the milestones outlined in their whitepaper.

The widespread optimism during bull markets typically bestows cryptocurrency projects with a ton of resources to develop their ideas. Many of them receive funding from multiple backers such as venture capital and crypto hedge funds.

However, tides turn once the bear market sets in. Funding quickly dries up and many projects fall into a cash shortage as the value of held tokens drops dramatically. This could in return stall the development of those projects unless they secure new external funding.

A common practice by project teams is dumping their project tokens into the market to raise funds. Although this could ensure the continuity of development and its deliverables, it could also create a substantially more severe price depreciation compared to the competition.

When the bulk of a cryptocurrency’s supply is unloaded by its project team, it could later have difficulties sustaining an uptrend (once the bull market sets in) due to the highly abundant supply in circulation.

As long as a cryptocurrency project delivers its promises, it could have a chance of survival and growth potential even with too much supply in circulation. During bear markets, some project teams just sell their entire token supply, not to develop the project, but to perform a classic “exit scam.”

Number of long-term holders

Monitoring the progress of long-term holders and active wallet addresses could be a helpful way to understand whether a cryptocurrency project is alive or not. You can access this data via on-chain activity data services like Glassnode or Santiment.

If the number of holders of a cryptocurrency is increasing while the price drops, it could suggest that the project’s development still progressing and the ecosystem is growing.

Not that easy to beat major cryptos

Despite all the glamor during crypto bull markets where thousands of digital assets explode “to the moon,” there have been only a handful of cryptocurrencies in the long run that has managed to perform better than Bitcoin.

To survive crypto bear markets and possibly outperform the competition during the next bull run, monitoring a few indicators could give you a head start in testing the reliability of different cryptocurrencies.

These indicators include:

- Trading volume relative to other cryptos

- Exchange liquidity

- Product category

- Community size

- Network activity

- Continuity in project development

- The number of long-term holders

If you’re looking for an exchange that has survived multiple bear markets, CEX.IO empowers users to explore and buy over 100 major digital assets on a convenient, hassle-free platform.

Keep your eyes out for further updates and analysis from CEX.IO as the crypto ecosystem continues to evolve. To always stay informed, follow us on social media, or sign up for our mailing list to never miss a beat.