Have you heard of Bitcoin or Litecoin? These are all examples of what are called “Proof-of-Work” (PoW) cryptocurrencies. They’re the most well-known and popular type of crypto coins, but there’s another kind that’s starting to gain traction: Proof of Stake (PoS).

Whereas PoW coins like Bitcoin and Litecoin rely on miners to verify and add transactions to the blockchain, PoS coins use “validators.” Validators lock up their coins in a wallet and are rewarded for doing so with transaction fees.

Let’s take a look at the updated list of Proof-of-Stake coins and determine if these coins are better for the environment, as well as for investment.

Also Read:

Proof of Stake vs Proof of Work

Proof-of-stake is a different way of reaching consensus in a decentralized network. In proof-of-work, the next valid block is chosen based on how much work the miner has done. In proof-of-stake, the next valid block is chosen based on the validator’s number of coins.

The idea behind proof-of-stake is that it’s more energy efficient than proof-of-work. With PoW, miners are constantly competing against each other to solve complex math problems in order to add new blocks to the blockchain. This requires a lot of energy, which can be costly.

Proof of Stake Explained

PoS is a type of network consensus in which transaction validation is based on proof of stake (PoS). Transactions are verified in decentralized databases known as blockchains since cryptocurrencies aim to create decentralized networks. Each block consists of a new transaction that has been validated on the network.

With PoS, there is no mining competition. Validators are simply chosen based on the number of coins they have staked. This means that anyone with a computer and an internet connection can become a validator.

The Proof of Stake consensus allows coin holders to verify transactions by staking their own token holdings. By staking their tokens, they are assigned the responsibility of validating transactions on the network.

Each coin’s owner or “validator” is chosen at random, with each cryptocurrency network having its own criteria for becoming a validator. For example, before standing a chance to be a network validator on Ethereum, the coins of owners must stake at least 32 ETH ($51,000 as of Sept 2022).

In 2022, if you are looking for the best cryptocurrencies to stake, you should look for those that have a high market capitalization, trading volume, and cryptocurrencies that are well established.

Top Proof-of-Stake Coins in 2022

1. Cardano (ADA)

Cardano was founded by Charles Hoskinson in 2017. It is a smart contract platform that is built on a proof of stake consensus algorithm. Cardano is often considered to be the most advanced and well-built blockchain platform.

Cardano has a very active development team and a large community. It is one of the most popular proofs of stake coins. Cardano has a market capitalization of $16.13B billion and a trading volume of $1.18B billion.

The Cardano network’s major selling point is its ability to handle hundreds of transactions per second. Cardano made the cut as one of the best staking coins because users are free to withdraw any of their staked assets at any time. This is a highly user-friendly platform for those unfamiliar with the staking process. Cardano’s staking rewards, in particular, are of interest since they decrease in value over time if too many people put their money into a single pool. As a result, diversification is critical to achieving the best results. ADA has two official wallets: Yoroi and Daedalus. The average yearly return for ADA is 5–9%.

2. Ethereum 2.0 (ETH)

Ethereum 2.0 is the long-awaited upgrade to the Ethereum network. It is a smart contract platform that uses a proof of stake consensus algorithm. Ethereum 2.0 is often considered to be the most advanced and well-built blockchain platform.

To stake this crypto, you’ll need at least 32 ETH to get started. The previously utilized PoW consensus mechanism was used by Ethereum. However, it has now changed over to PoS and has attracted more than $12 billion in ETH staked.

Ethereum merges the ghost protocol with a proof-of-stake system validator

Ethereum has merged a proof of stake (PoS) algorithm with a proof of work (PoW) algorithm to try to address the issue of mining centralization. Ethereum network is now using the proof of stake (POS) algorithm, which means that you can earn a reward for holding Ethereum in your wallet. The amount of the reward depends on the amount of Ethereum you hold and how long you hold it.

There are a few different ways you can stake your Ethereum. You can run a full node, contribute to an existing full node, or participate in a proof of stake pool.

The coins you stake will remain in the network. Ethereum 2.0 debuted on 15th September 2022. By staking your ETH, you can earn rewards based on the number of validators and transactions. The more ETH you stake, the more block rewards you will get. Ethereum 2.0 has a market capitalization of $193.45 billion and a trading volume of $24.9 billion.

3. BNB – Massively Popular Smart Contract Crypto

BNB rose to fame in May 2021 when it reached its all-time high of $681. After a slight dip, it has now recovered and is trading at $274.12.Operating on the Binance Smart Chain (BSC), BNB follows the BEP standard to integrate smart contracts.

BNB is the native token of the Binance smart contract platform. The BNB token can be used to pay fees on the Binance exchange. BNB has a market capitalization of $54.5 billion and a trading volume of $1,044,855,484.

BNB abides by the Proof of Stake Authority consensus, which permits a validator to bet a fixed There are various methods you can use to stake Binance Coin (BNB) in order to earn up to 30% or more from staking alone. The most common method is through the BNB Vault, available on the Binance exchange site. If you want to go directly to the staking page.

You can use the Trust wallet to stake your BNB if you understand the risks and rewards that come with mobile wallets. Mobile wallets aren’t as secure as hardware wallets, but if you’re willing to take on the risk, Trust is a popular option.

Binance customers may benefit from BNB, which is the exchange’s major cryptocurrency. Customers may receive a 25% discount on spot trading crypto transactions on the platform, which usually costs 0.1 percent per transaction. Investors who hold BNB can save 10% on futures trading fees.

Not only is the popular token used as a means of investment, but it can also be swapped out for other BEP-based cryptocurrencies. For example, to purchase Battle Infinity tokens (which are some of the best new cryptocurrency assets), you must first buy BNB tokens.

4. Solana

Solana is one of the best-performing staking coins. Solana is a fast and secure smart contract blockchain that can process more than 65,000 transactions per second without needing Sharding. In contrast, Ethereum processes an average of 17 TPS. The increased scalability makes Solana more advantageous for decentralized applications (DApps), as developers can achieve high levels of scalability with Solana.

As Ethereum struggled to keep up with the demand during the 2021 bull run, Solana came onto the market at just the right time. With its unique proof of history consensus mechanism, Solana offered a massive throughput, near-instant settlement time, and much higher energy efficiency than Ethereum. As a result, SOL token prices shot up from just a few dollars to over $250 at their peak.

To stake SOL on Solana, you must first purchase the token from an exchange like Binance. Then, you can use SOL staking pool like StakeSol to earn rewards. Solana is a decentralized, open-source blockchain with a Proof of History (PoH) consensus mechanism that allows the network to handle transactions as they arrive.

Despite recent blunders on centralization and security, Solana is still a relatively young project. Although it is not particularly old, the Solana ecosystem is one of the most significant, especially for NFTs. Given this fact, it’s reasonable to assume that Solana is one of the best proof-of-stake cryptos available to investors today.

Solana currently has a trading volume of $1,114,626,588 and a market capitalization of $11,669,381,930.

5. Avalanche

Avalanche (AVAX) is a layer-1 network that functions as a hub for decentralized applications and custom blockchain networks. It uses the Proof of Stake consensus algorithm and can support up to 6,500 TPS.

The way Avalanche verifies transactions sets it apart from other smart contract cryptocurrencies. Rather than requiring every node to validate each transaction, as is the case in Bitcoin, Avalanche has three sub-blockchains: one for payments and two more for data transfers.

The Avalanche network has three sub-blockchains that handle different types of transactions–The Exchange Chain (X-Chain) for sending and receiving funds, the Contract Chain (C-Chain) for smart contracts or dApps, and the Platform Chain (P-Chain) for staking/validator transactions. The Primary Network validates these sub-blockchains and requires stakers to own at least 2,000 AVAX.

The main reason for this popularity is Avalanche’s unique features. Firstly, its high TPS makes it one of the fastest blockchains available. Secondly, its three-layer structure allows it to be highly adaptable and versatile. And finally, its support for smart contracts makes it a great platform for developers.

AVAX currently has a trading volume of $524,965,347 and a market capitalization of $5,419,008,948 .

6. Polkadot

Polkadot (DOT) is a layer-1 network that enables the creation of custom blockchain networks. It uses the Proof of Stake consensus algorithm and can support up to 1,000 TPS.

Polkadot’s multi-chain staking system is one of the most scalable available, allowing users to earn rewards with a minimum stake of only 40 DOT. (If you want to create a validator node on Polkadot, however, your contribution will have to be at least 350 DOT.)

Polkadot’s unique features make it a great platform for developers. For one, its support for multiple blockchains allows developers to easily create and connect custom blockchain networks. Additionally, Polkadot’s governance system gives users a say in the direction of the project, making it more decentralized than many other cryptocurrencies.

DOT currently has a trading volume of $382,493,848 and a market capitalization of $7,768,416,980.7.

7. Algorand-Sustainable and reliable network

Algorand (ALGO) is a self-sustaining blockchain-based network built on the Pure Proof of Stake (PPoS) consensus, which differs from PoS in several respects. PPoS is a network platform where users validate blocks and vote on proposals. Users are chosen randomly, with the amount of ALGO they stake determining how likely they are to be selected.

Algorand’s unique features include its support for smart contracts, scalability, and security. Algorand’s energy efficiency is due to its PPoS consensus system. With the growing concern over high energy usage by cryptocurrencies (particularly proof of work projects), Algorand has become a favorite among investors and could be the next cryptocurrency to explode.

ALGO currently has a trading volume of $75,018,348 and a market capitalization of $2,023,889,085.

In 2022, Algorand introduced the London Bridge, a trustless bridge that allows for interoperability with the Ethereum blockchain. In the long term, Algorand wants to build its DeFi ecosystem. ALGO is presently trading at $$0.2924 per token.

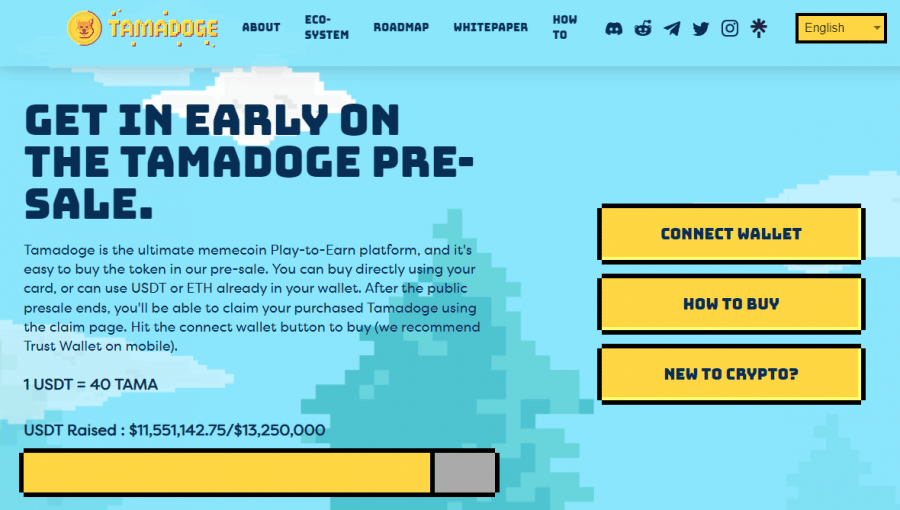

8. Tamadoge-Latest innovation in blockchain

Tamadoge (TAMA) is a new cryptocurrency token that takes advantage of the decentralized GameFi (Gaming Finance) industry by providing its platform members with a play-to-earn ecosystem. TAMA is the native currency in the Tamaverse, which is a metaverse-style ecosystem that draws players by hosting Tradable NFT competitions. The Tamaverse is a virtual world where players can explore and raise 3D-animated, tokenized pets to earn rewards. Players level up their pet by using items from the in-game store, which also helps them rank higher on the leaderboard and be entitled to a greater share of the rewards pool.

That is, however, not all. The Tamadoge developers will later release a series of tradable arcade-style games that may be tokenized (Q3 2023). Furthermore, in 2023, support for virtual reality headsets and augmented reality software allowing players to bring their pets into the real world are both expected to debut. As a result, it’s an excellent moment to get involved before demand rises due to all of these upgrades.

The Tamadoge project uses the ERC standard. As a result, while the project is without a doubt one of the greatest new cryptocurrencies available, it does not yet employ proof of stake (PoS). Because Ethereum has switched to PoS, Tamadoge will transition to one of the finest proof of stake coins sooner rather than later, putting it on our list of top proof of stake cryptocurrencies.

Should you Invest in Proof of Stake coins?

Proof-of-Stake consensus mechanism also has the potential to be more secure than Proof-of-Work. With PoW, 51% of attacks are a real threat. This is when a group of miners controls more than 50% of the network’s mining power. They can then use this power to manipulate the blockchain and double-spend coins.

With PoS, 51% of attacks are much harder to carry out. This is because a group would need to control more than 50% of the coins in order to have a majority stake. This is much harder to do than controlling a majority of the mining power.

Proof-of-stake also has the advantage of being more decentralized than proof-of-work. With PoW, the biggest and most powerful miners are usually the ones who find new blocks. This can lead to centralization, as a small group of miners controls the network.

With PoS, anyone with coins can validate transactions. This means that the network is less likely to be controlled by a small group of people.

Proof-of-stake is a new and exciting way of reaching consensus mechanisms in a decentralized network. It’s more energy efficient than proof-of-work and has the potential to be more secure and decentralized. If you’re looking for an alternative to PoW coins like Bitcoin and Litecoin, then PoS coins are worth considering.

Conclusion

Staking POS currencies is undoubtedly one of the most common and effective methods to make passive income. In many cases, the barrier to entry is quite low. You can often start earning rewards with just a few dollars worth of cryptocurrency.

With that said, there are a few risks to consider before you start staking your coins. First, you need to make sure that you’re comfortable with the risks associated with holding cryptocurrency. Second, you need to research the specific coin that you want to stake tokens in and make sure that it’s a good investment.

If you’re willing to take on these risks, then staking could be a great way to earn some passive income. Just remember to do your research and only invest what you can afford to lose.