One Ethereum (ETH)-based altcoin is surging by nearly 30% this week as it outpaces both the king crypto and the overall digital assets market.

Interoperable blockchain network Quant (QNT) has sparked a rally over the last seven days, going from $103.14 on September 14th to $133.34 at time of writing, a nearly 30% gain.

QNT has risen significantly compared to top crypto asset Bitcoin (BTC) and the total market cap of all crypto assets, as they have gone up 3% and 4% respectively during the same time frame.

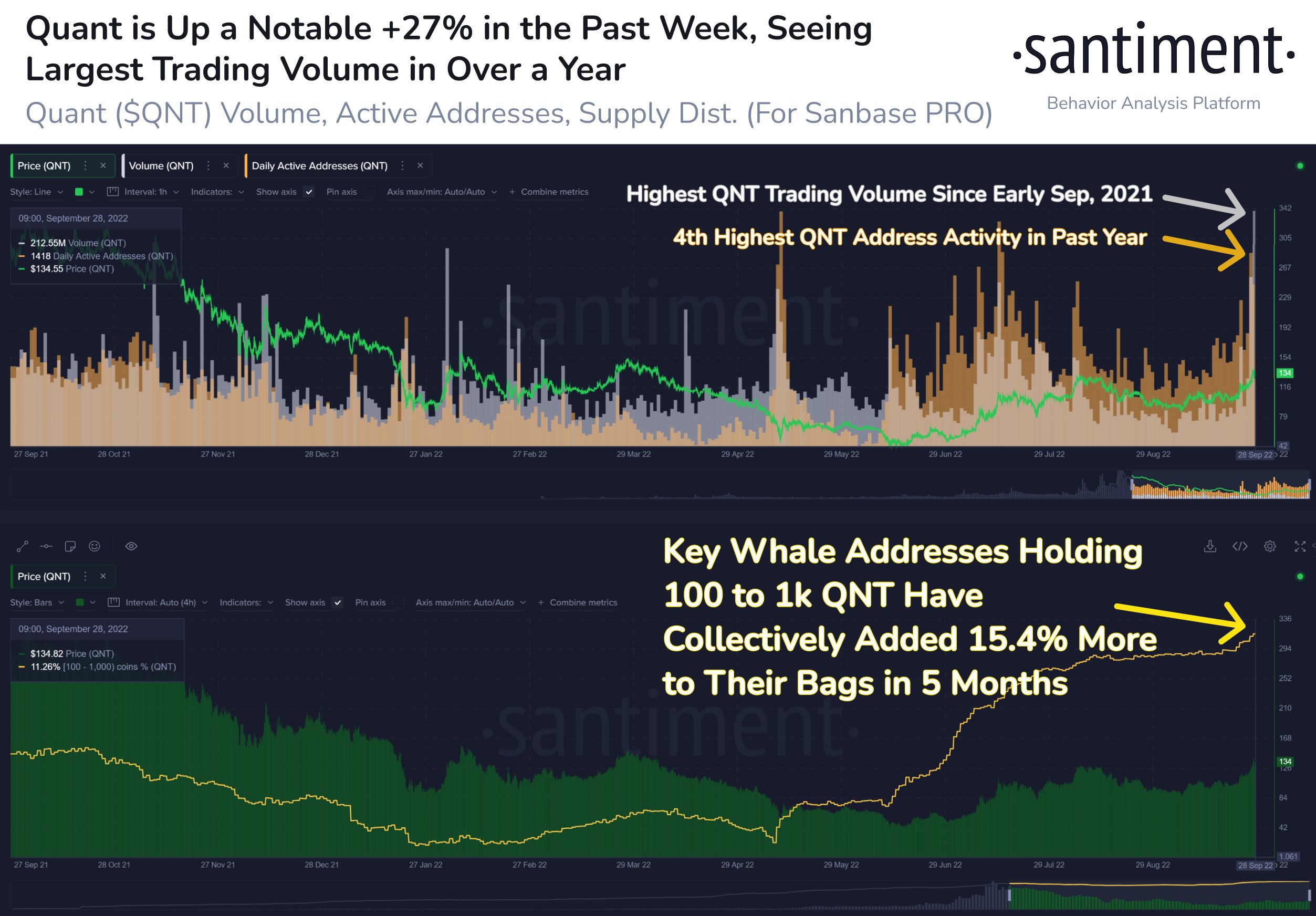

According to market intelligence firm Santiment, trading activity centered around Quant has risen significantly during the last month and week, supporting the crypto asset’s rise.

“Quant has been climbing the market cap ranks as of late. Among the top 100 assets in crypto, it has the second-best returns in the past month, and best in the past week. Volume, daily active addresses, and whale accumulation have all supported QNT’s rise.”

Santiment further finds that traders currently purchasing QNT are retail investors rather than those holding at least $1 million worth of the digital asset, who are doing the opposite and selling their tokens.

“If we look at holders’ distribution, we might notice that retail holders seem to be the ones buying QNT. A larger group of holders, QNT millionaires, holding from up to $1M worth of Quant, doing [the] opposite, they are offloading.”

Though Quant has seen a massive rise during the last week, it’s still much lower than its all-time high of $311.72 set in September of last year.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Papapig