Argo Blockchain, one of the largest public Bitcoin mining companies on the market, is facing a cash shortage that could force it to shut down in the near future.

According to an October 31 press release, the company failed to secure a $27 million strategic investment that was supposed to improve its liquidity position. The company agreed to issue 87 million shares to a sole investor, which equates to around 15% of the business.

However, Argo noted that it no longer believes it will be able to raise the funds “under the previously announced terms” and said it was continuing to explore other financing opportunities.

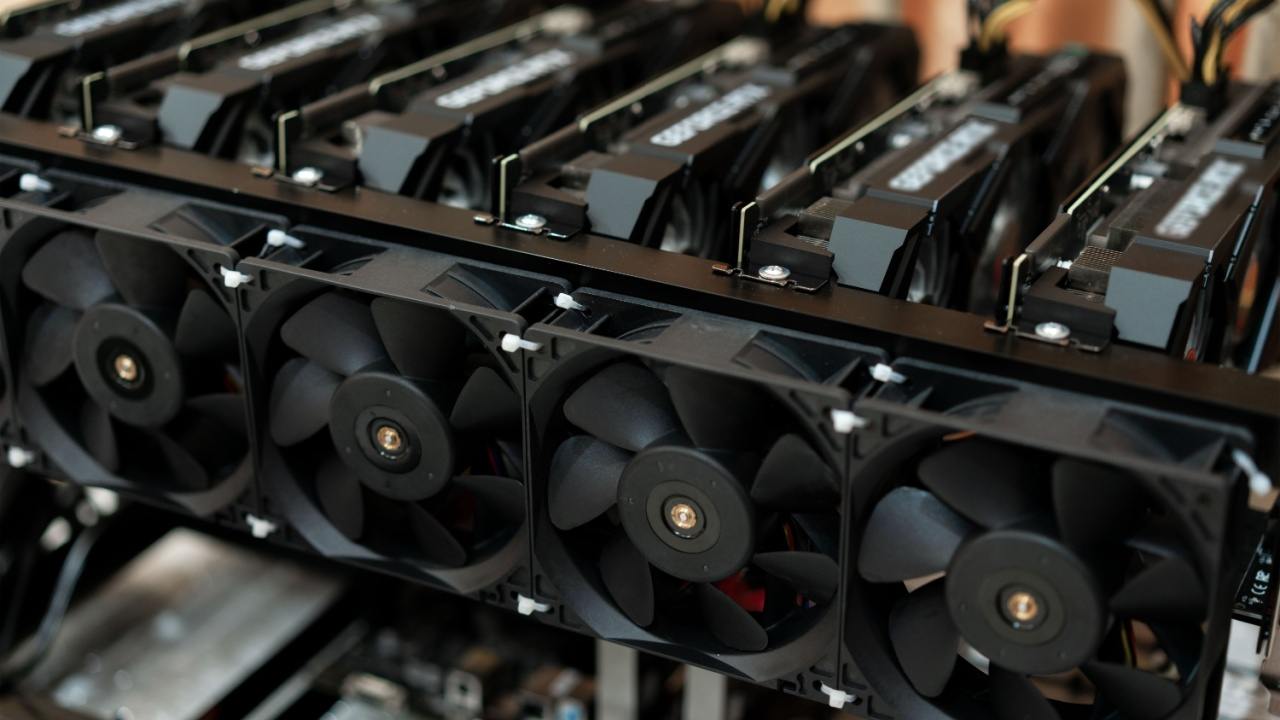

As part of its effort to preserve cash, the company sold 3,842 new Bitmain S19J Pro Bitcoin miners for around $5.6 million. The sold machines represent around 384 PH/s of its total hash rate capacity, which now stands at 2.5 EH/s.

And while the company is actively looking for a solution to its cash problems, it noted that there’s no assurance it will be able to resolve its issues. The company said in the press release:

“Should Argo be unsuccessful in completing any further financing, Argo would become cash flow negative in the near term and would need to curtail or cease operations.”

Earlier in October, the company’s CEO Peter Wall took to YouTube to explain the steps Argo was taking to improve its position. Wall said that Argo’s profitability has been “squeezed from both sides,” with high energy prices and Bitcoin’s depreciating value wiping out almost all of its profits.

The $27 million investment was supposed to provide Argo with enough liquidity to get through the next 12 months. Without an equally high financial injection, it’s likely that the company won’t make it until the next quarter.

Argo’s shares listed on NASDAQ lost almost 89% of their value in the past year, while its LSE stock crumbled 95% since October 2021.