Bitcoin price analysis is not showing much volatility since yesterday. Today, the price touched a 24-hour high of $16984 and then dipped back. It marked a low of $16526. Nevertheless, it is currently closing slightly lower than yesterday. At the same time, it is consolidating sideways without much volatility. This has resulted in a lot of uncertainty.

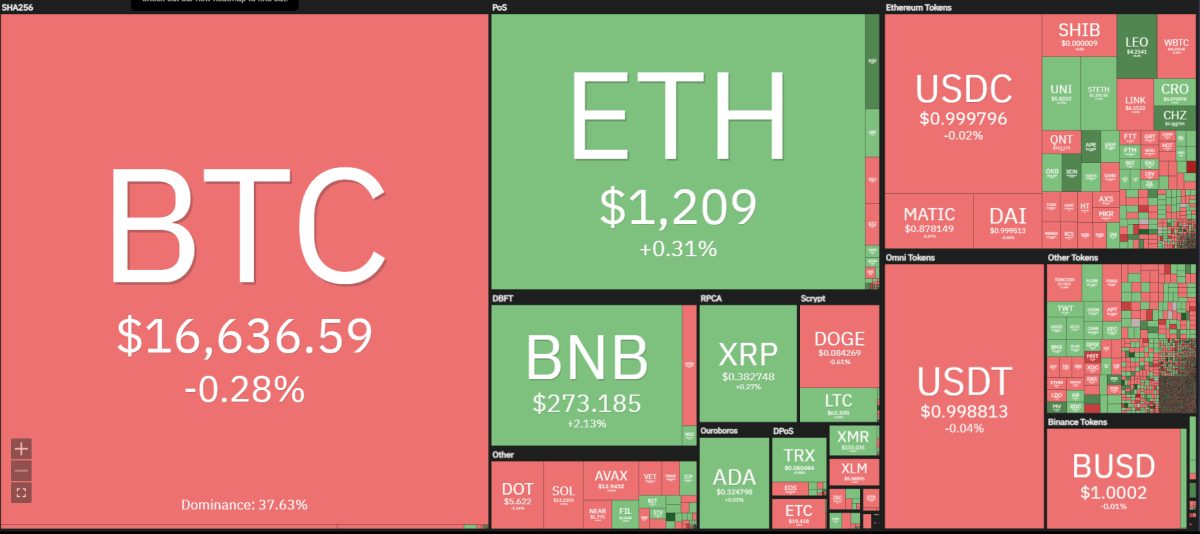

The cryptocurrency market is again showing a lot of uncertainty just like yesterday. Ethereum is slightly in the green while Bitcoin, along with some major altcoins such as DOGE and AVAX are trading in the red.

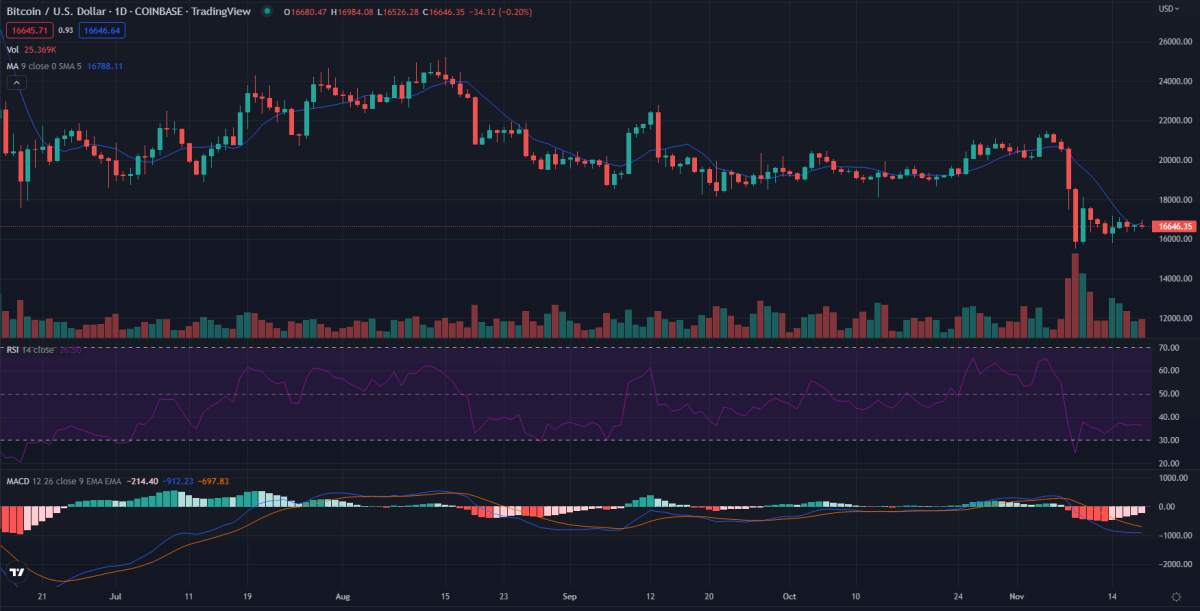

The 1-day Bitcoin price analysis gives us the bigger picture of Bitcoin’s market. The MACD shows us that the bears are slowly giving up. Eventually, Bitcoin might retrace the fall from earlier. However, it is going to face significant resistance at $17000 followed by $18000.

Bitcoin 24-hour price movement

In the last 24 hours, Bitcoin’s market cap reduced by 0.28 percent. The trading volume also went down by 5.44 percent, leaving its 24-hour volume-to-market cap ratio at 0.0848.

At the same time, Bitcoin formed a 24-hour high of $16984 with a low of $16526. It is still consolidating sideways for the most part and is expected to continue this pattern in the next 24 hours. After that, the bears might finally give up and we shall see some increase in the price.

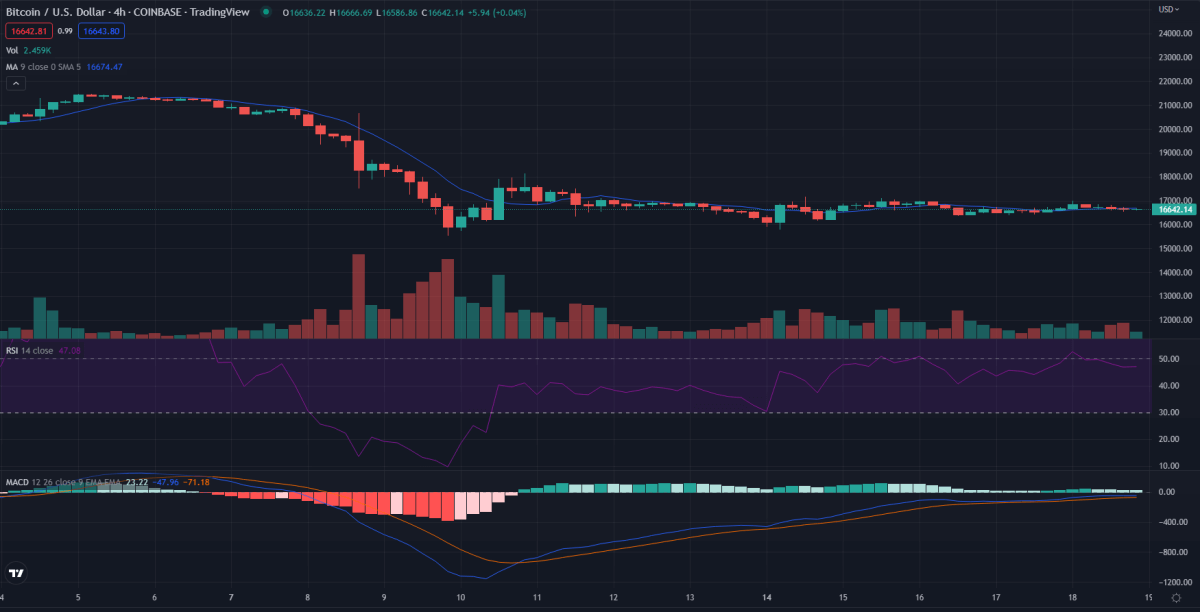

4-hour Bitcoin price analysis: BTC is continuing to consolidate sideways

The 4-hour Bitcoin price analysis shows that it is still consolidating sideways. Its local resistance is set at $17000 while the local support is at $16400. The market simply lacks enough momentum to cause significant volatility. Based on the current scenario, it is expected that Bitcoin will continue consolidating in the next 24 hours, at least. This means that the market is going to remain just as uncertain.

Bitcoin price analysis: Conclusion

Currently, Bitcoin price analysis has a lot of uncertainty. Bitcoin continues to consolidate, while the RSI is somewhat balanced on both the 1-day and 4-hour charts. The market is lacking volatility, and there’s a tug-of-war going on between the bulls and the bears. Due to the uncertainty, it is not a good time to invest for short-term gains. Although, it is likely that once this tug-of-war is over, Bitcoin will try to test the resistance at $17000 followed by $18000.

While the Bitcoin price analysis determines its course, consider reading our latest price predictions for Uniswap and Avalanche.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.