Innovation is the lifeblood of any industry or company. The DeFi ecosystem constantly witnesses brilliant innovations aimed at solving the excesses of traditional finance and other projects within the space.

Today’s article focuses on one stellar innovation that bridges two worlds (centralized and decentralized exchanges) to create an optimized user experience for interested parties. Let’s take a deep dive into IDEX Exchange.

Executive Summary

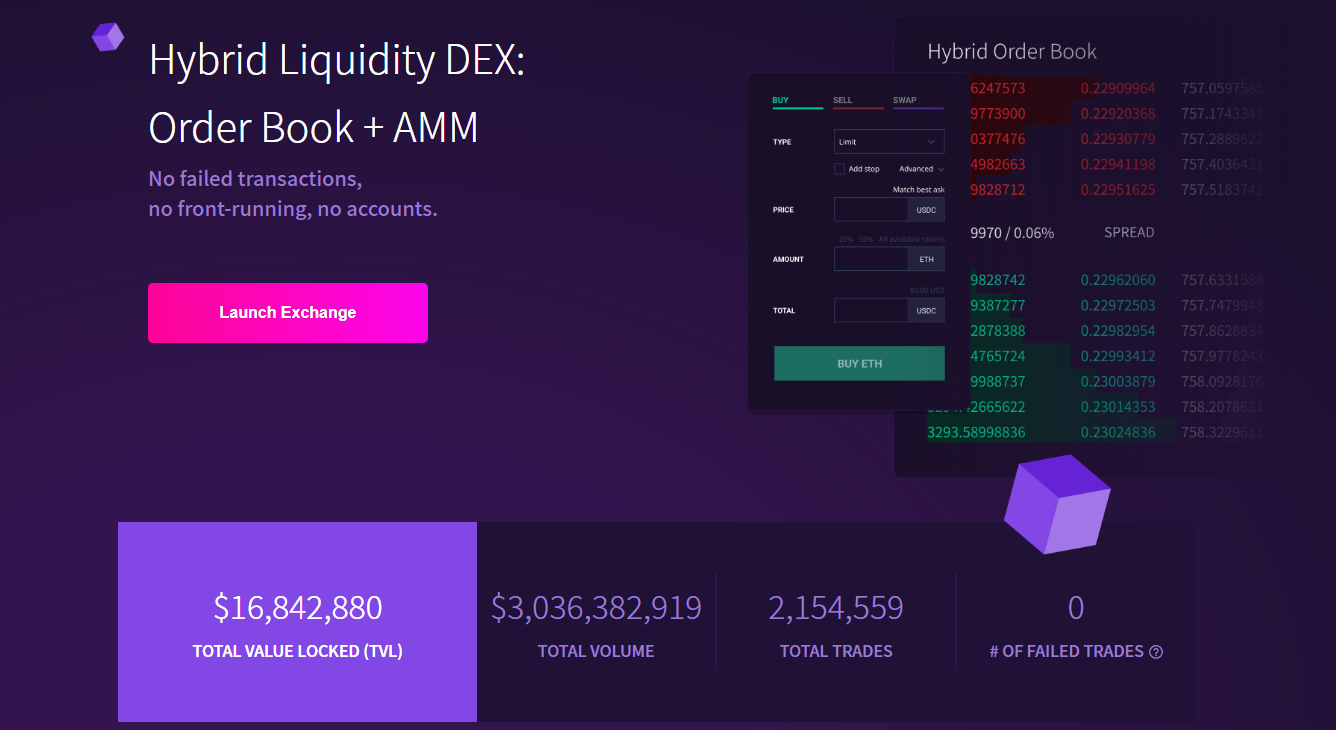

- IDEX is a decentralized exchange with centralized exchange components that speed up the network while preserving its decentralized nature

- IDEX is supported by Ethereum, Binance Smart Chain (BSC), and Polkadot

- IDEX combines the order book model and Automated Market Maker (AMM)

- IDEX is the utility token of the IDEX exchange. It serves as the fuel for all operational activities within the Exchange.

- Other tokens supported by the IDEX exchange include Chainlink, Celsius, Everex, Quant, Etherbase Coin, Flexacoin, and Fantom, to mention a few.

What Is IDEX?

IDEX is a decentralized exchange with centralized exchange components that speed up the network while preserving its decentralized nature. Both Ethereum and Binance Smart Chain are used to host the platform. Similar initiatives employ the automated market maker methodology to carry out trades on a DEX, whereas IDEX takes a different track.

The order book model and an automated market maker are combined in IDEX, which bills itself as the first hybrid liquidity DEX. It combines the functionality and traits of a conventional order book model with the safety and liquidity of an AMM. By combining an off-chain trading engine with an on-chain deal settlement, IDEX adopts a novel approach to decentralized exchange. This has various advantages for users.

This strategy eliminates unsuccessful trades and lost money on gas expenses, improving the trading experience overall. Due to the fast trade execution, users can trade immediately without waiting for previous trades to finalize, making front-running or sandwich assaults impossible. Limit order capability enables executing more sophisticated order types and trading techniques, creating the potential for arbitrage with other exchanges.

The stop-loss mechanism is one of the functions IDEX on BSC offers, typically seen on centralized exchanges. As a recent addition to the IDEX Multichain project, IDEX is now accessible on Polkadot.

Users can swap tokens supported by Ethereum, Polkadot, and Binance Smart Chain. The project’s major objective is to make it possible to perform and process thousands of transactions in a matter of seconds. The utility token for the exchange is called IDEX, and nodes can stake it to ratify transactions on the off-chain ledger.

Who Are the Founders of IDEX?

In 2017, Aurora was the name given to the company that would later become IDEX. Alex Wearn and Philip Wearn co-founded the project. Aurora’s 2019 rebranding as IDEX aimed to establish and grow the first real-time non-custodial exchange that blends decentralization and a centralized system for matching orders.

Alex Wearn, the CEO and co-founder, and Phil Wearn, the COO, both have invaluable experience in the tech business. Alex Wearn is a Kellogg School of Management graduate and has previously worked for prominent corporations like Amazon, IBM, and Adobe. Phil Wearn is an entrepreneur with a background in accounting who also holds a degree in astronautical engineering.

The project aims to give users access to banking and financial tools and services for real-time crypto exchanges on various platforms, including Ethereum, Binance Smart Chain, Polkadot, and others that will be included in the future.

What Makes IDEX Unique?

An order book model and an automated market maker are combined in IDEX to create a distinctive strategy. IDEX uses an off-chain trading engine for deal execution that matches the performance of centralized exchanges and ensures sequencing. Trades are processed in an off-chain order book and do not appear on-chain until it is matched and executed.

By doing this, users can avoid additional network fees for placing and canceling orders. Additionally, as placements are executed in real-time, more sophisticated market-making and trading methods, including stop-loss, post-only, and fill-or-kill, are possible.

To show AMM liquidity in the order book model, the automated market maker displays both virtual and actual limit orders in the order book to ensure liquidity. Orders are typically settled using either automated market makers or a mix of automated market makers and limit order liquidity.

To decentralize fund custody and trade settlement, IDEX leverages smart contracts. The smart contract executes trades off-chain but settles them on-chain after a delay in order to support the order book concept. The smart contract serves as an escrow until the settlement is complete and prohibits funds transfer.

Additionally, trades are sequential, and a unique smart contract feature ensures that funds cannot be restricted forever. Because the smart contract enforces ownership and authorization, users maintain custody and can conduct transactions without needing extra infrastructure.

What Is IDEX Token?

IDEX is the utility token of the IDEX exchange. It serves as the fuel for all operational activities within the Exchange. Its utility and frequency of usage by users on the IDEX protocol also help to secure IDEX Exchange.

How Many IDEX Tokens Are in Circulation?

There are 1,000,000,000 IDEX in existence, however, only 674,482,177 are in use right now. The token supply is constrained, just like Bitcoin and many other cryptocurrencies. Since there is a limited quantity, IDEX coins cannot lose value due to inflation, and once the supply is depleted, no more IDEX coins should be produced.

IDEX token distribution is as follows:

- 40% – market maker rewards, marketing campaigns, and airdrops

- 25% – core team members

- 10% – IDEX members

- 10% – future employee token pool

- 10% – future use

- 5% – operational expenses

If a user has 10,000 IDEX or more, they can additionally run a lightweight node and stake their IDEX.

What Gives IDEX Token Value?

The number of users actively using IDEX, how often they use it, and the technology, features, tools, and scalability of IDEX all contribute to its intrinsic value. Since IDEX is subject to rapid adjustments, much like other cryptocurrencies, the intrinsic value frequently differs from the market price. Due to the volatility and market speculation surrounding cryptocurrencies, IDEX is sometimes overbought or underbought.

IDEX’s use case—exchanging different cryptocurrencies—and the system’s capacity to provide customers with expected services determine how lucrative the platform is.

The platform also derives value from its technological prowess and utility. IDEX, a project that blends centralized and decentralized characteristics while maintaining its integrity as a DEX, is a useful addition to the DEX market.

IDEX Features

Below are some of the key characteristics of IDEX Exchange:

- Sophisticated security and transparency.

- Crypto-based financial services and tools

- Ethereum, Polkadot, and Binance Smart Chain (BSC) support.

- Peer-to-peer trading.

- Dependable customer service.

- Numerous trading options

- Super fast trading using cryptocurrencies for investors.

- Layer-2 solution.

- A centralized exchange that offers customers the security of the decentralized exchange.

- Multichain functionality

- High returns for stakers on IDEX products

- User-friendly interface

Other tokens supported by the IDEX exchange include Chainlink, Celsius, Everex, Quant, Etherbase Coin, Flexacoin, and Fantom, to mention a few. Additionally, this cryptocurrency trading platform offers Aura tokens, which give account holders the option to stake and support the IDEXD trading network.

Users who utilize IDEX exchange have total control over their money, which can only be accessed with the owner’s consent.

How Does IDEX Work?

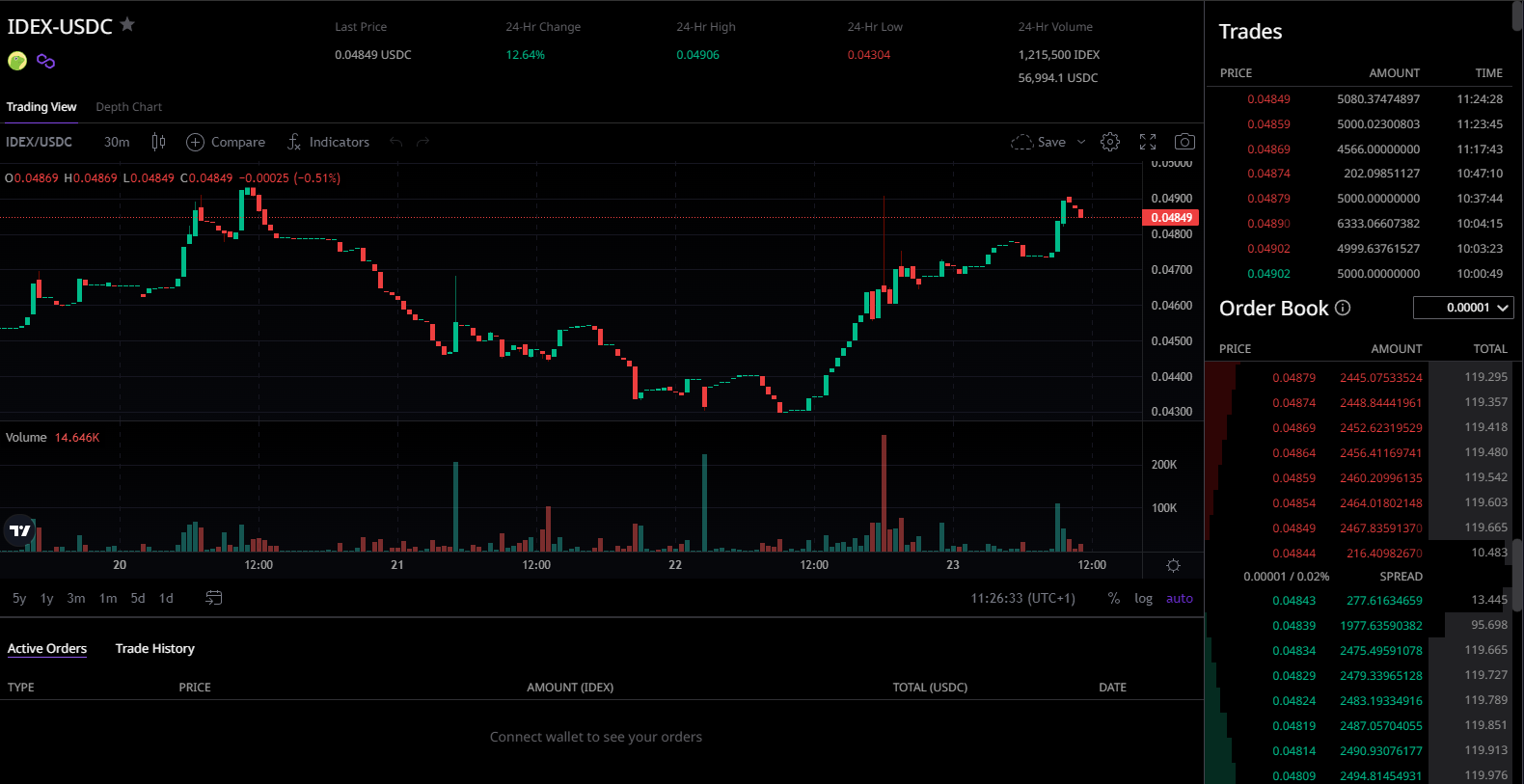

To enable instant execution, IDEX works as an order book exchange while the project mixes components of centralized and decentralized exchanges. While IDEX employs order books and centralizes the method for matching orders on the network, the bulk of DEX platforms on the market are AMMs.

IDEX employs Layer-2 Optimistic Rollups to provide the greatest functionality and speed on Ethereum. The Optimistic Rollup is a scaling technique that employs faster off-chain transaction processing while maintaining the decentralized nature of the main network, IDEX, in this case.

Ethereum users were prone to experiencing network congestion, failed transactions, and increased gas fees under the proof-of-work model. But Ethereum’s transition to proof-of-stake will greatly help reduce hassle and costs. Although, IDEX still uses Layer 2 solutions and Merkle trees to reduce congestion and maintain reasonable gas fees. On BSC, off-chain infrastructures and matching engines, such as the Ethereum Virtual Machine (EVM), are used to scale and allow quick transaction execution.

IDEX and Proof-of-Stake

IDEX uses the proof-of-stake consensus mechanism to protect the network and verify transactions with staking and Node operators.

Since proof-of-stake uses less power, is more scalable, and can avoid network congestion, it outshines Proof of Work as a consensus process. IDEX mixes the decentralized proof-of-stake protocol with centralized components to match orders from order books and process transactions in batches.

IDEX and Staking

To maintain the platform’s financial stability, IDEX launched its IDEX staking program and built a trustworthy network that allowed stakers to earn 25% in ETH. Stakers can buy tokens and make contributions to the IDEX staking program, which aids in keeping the IDEX exchange infrastructure operational.

Is IDEX Safe?

In contrast to centralized exchanges, which rely on the dubious security of centralized companies, the IDEX network secures users’ crypto assets with smart contracts. The network also uses external data to interact; for example, IDEX connects to networks like Ethereum and Binance Smart Chain, which require oracles as an extra security measure.

The network rewards Node operators through automation. Node operators are compensated as essential network members for validating transactions and other network functions. The utility token IDEX, which node operators must stake to run the network, is also used to secure the protocol.

IDEX 2.0

The original iteration of IDEX Exchange, launched in 2019, featured centralized management and the advantages of decentralized exchanges. IDEX 2.0 was introduced in the final trimester of 2020, having two key enhancements added to its catalog:

- High-performance offline infrastructure with centralized exchange experience for dealers.

- Off-chain smart contracts that improve the user experience for scalability and cost-effectiveness.

Replicators and Validators

Replicators and validators are staking nodes; however, validators audit transactions while replicators distribute API data. In contrast to validators, whose minimum stake has not yet been determined and which must be deposited in the staking contract, replicators require a minimum stake of 10,000 IDEX to be deposited in the IDEX network or wallet are immune from slashing. Both kinds of nodes generate IDEX trading fees. However, validators also have the opportunity to generate fraud rewards.

IDEX Trade Fees and Limits

0.2% for takers and 0.1% for makers. The minimum withdrawal is 0.2 ETH, while the minimum trading orders are 1 ETH for takers and 0.5 ETH for makers.

Bottom Line

A non-custodial DEX is now available to users everywhere, thanks to IDEX, a special exchange that blends centralization and decentralization. Instant trade execution and quick transactions are also made possible by IDEX, the first DEX of its kind that lets users preserve complete ownership over their digital currency while protecting the security of balances on the network.

IDEX Exchange is one of the safest places to trade in today’s rapidly evolving world of technology and digital currency. For investors wishing to increase the return on their money by trading and staking cryptocurrency, IDEX offers a secure platform and affordable option.