Solana is a highly scalable blockchain network released in 2020. The project’s founder Anatoly Yakovenko published the initial Solana whitepaper in November 2017. The native coin of the blockchain, SOL, entered the market in April 2020 at a price of roughly $0.79. Considering that it’s priced at $13.50 at the time of writing, SOL is still 17 times more valuable than it was at launch.

However, this doesn’t mean that it’s all sunshine and rainbows in the Solana markets. SOL lost approximately two-thirds of its value in just 4 days (November 6 – November 10) following the collapse of the FTX cryptocurrency exchange.

The reason why the collapse of FTX was so devastating for the price of SOL is that FTX was one of the biggest supporter of the Solana project and the ecosystem of projects building on Solana. The negative price action has led many crypto investors to wonder if Solana is dead or not.

Why is Solana down?

Solana entered a strong uptrend in 2021 when it caught intense hype and reached the fourth place in the crypto market cap rankings. This rally was especially impressive given that Solana was only the 112th largest crypto by market cap at the beginning of 2021.

A big driver of Solana’s popularity was the massive increase in transaction fees on the Ethereum network, which made Solana’s cheap and fast transactions that much more appealing. Solana is known as one of the most scalable blockchains available today.

The strong bull season spanning 11 months of 2021 also helped other smart contract platforms such as BNB, Cardano, Polkadot, Solana, and Avalanche, which are sometimes called “Ethereum killers”.

Like all other cryptocurrencies, Solana lost value when the entire cryptocurrency market went into a downtrend and turned into a bear market. In the roughly three months before FTX’s bankruptcy, SOL was priced between $28 and $37.

When it comes to external factors, the bear market in cryptocurrencies was triggered by rising interest rates, uncertain macroeconomic conditions, and the war in Ukraine. There was also a series of negative events inside the crypto sector itself, most notably the collapse of Terra, several cryptocurrency lending firms, and FTX.

However, it’s entirely possible that the crypto market would have slowed down significantly even without these negative events. The crypto markets have historically followed a pattern of strong rallies followed by sharp price corrections of 80% or even more.

Crypto-specific reasons for Solana’s crash

Solana supports the Proof-of-Stake consensus mechanism with its unique Proof-of-History algorithm. This algorithm greatly increases the scalability of the network and the speed at which transactions are validated.

Solana is a great blockchain when it comes to transaction speeds and costs. The two major problems of the network, which hosts hundreds of successful projects in the NFT and DeFi ecosystems, are network outages and concerns about insufficient decentralization. The Solana blockchain has suffered multiple-hour outages dozens of times since its launch. During these outages, users were unable to perform any operations on the network.

Solana has far fewer validators and nodes than its main competitor, Ethereum. Moreover, while the nodes of most major blockchains are spread homogeneously in different regions around the world, the nodes in Solana are concentrated in certain regions. Solana’s top 30 validators hold more than 35% of the total SOL supply. At the same time, Solana developers and VCs have millions of dollars of SOL in their wallets.

While these two issues have somewhat diminished confidence in Solana, the bankruptcy of FTX was arguably the biggest blow to Solana. Sam Bankman-Fried, the former CEO of FTX, is one of Solana Labs’ early investors and has expressed his support for Solana on multiple occasions. Bankman-Fried and FTX are now permanently associated in the public eye with billion-dollar losses and potentially even fraud, which could unfortunately also have a negative impact on how the public perceives the Solana ecosystem.

Serum, one of the largest DeFi platforms on the Solana blockchain, is an FTX-backed startup. Binance, OKX, and Bybit have even decided to suspend USDT and USDC deposits on the Solana network. With this decision, many began wondering whether SOL is dead.

Macroeconomic reasons for Solana’s crash

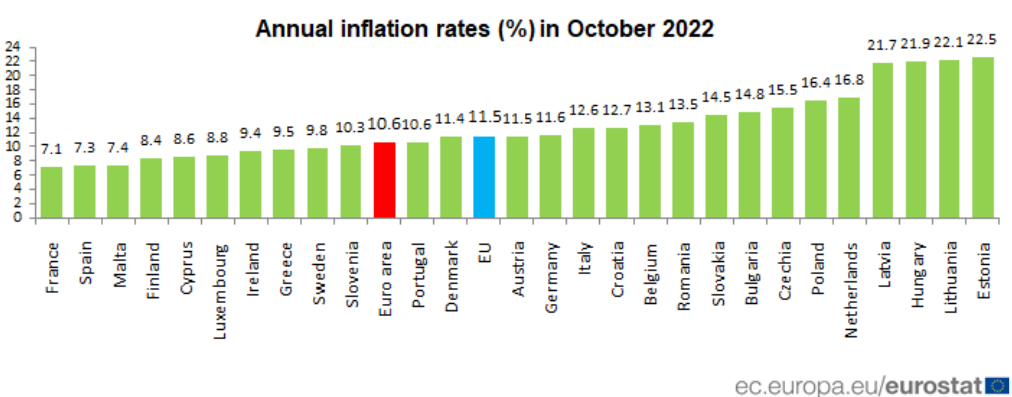

The macroeconomic situation is negatively affecting the cryptocurrency markets, including Solana. The global inflation crisis has caused product and service prices to rise at an unprecedented rate in the last 40 years, leading to central banks increasing their interest rates.

For example, the U.S. Federal reserve did not hesitate to increase its interest rate by 75 basis points four times in a row. In such an environment, investors tend to shy away from riskier assets such as tech stocks and cryptocurrencies.

Another crisis affecting all world markets is the Russian invasion of Ukraine. This ongoing war is affecting the supply of key products such as grain, natural gas and oil. The expectation that energy and gas prices will continue to increase in the winter months is creating a lot of economic uncertainty.

Solana’s historical market performance: Is SOL dead?

Launched as the native coin of an innovative and scalable smart contract platform, SOL gained nearly 5 times its value from April 2020 to September 2020 with the help of the general conditions of the market.

December 2020 marked another bull run for Solana. Having hit a local low of $1.21 on December 24, 2020, SOL reached a price of $259 on November 6, 2021, about 11 months later. The biggest jump in this process was the price of $188 on September 10, from $44 on August 15, 2021. SOL traders made 4.25x gains in just 26 days.

The process after November 2021 was painful in Solana, as in most other cryptos. The price has fallen towards $13.50 as of November 30, 2022 down from an all-time high of almost $260 in November 2021.

Here is how Bitcoin has performed this year so far in comparison to other top cryptocurrencies:

*Price data collected on November 30, 2022 at 13:00 UTC.

Does Solana have a future?

The Solana project can certainly have a bright future. The Solana blockchain is highly advanced in terms of scalability, with the ability to handle thousands of transactions per second.

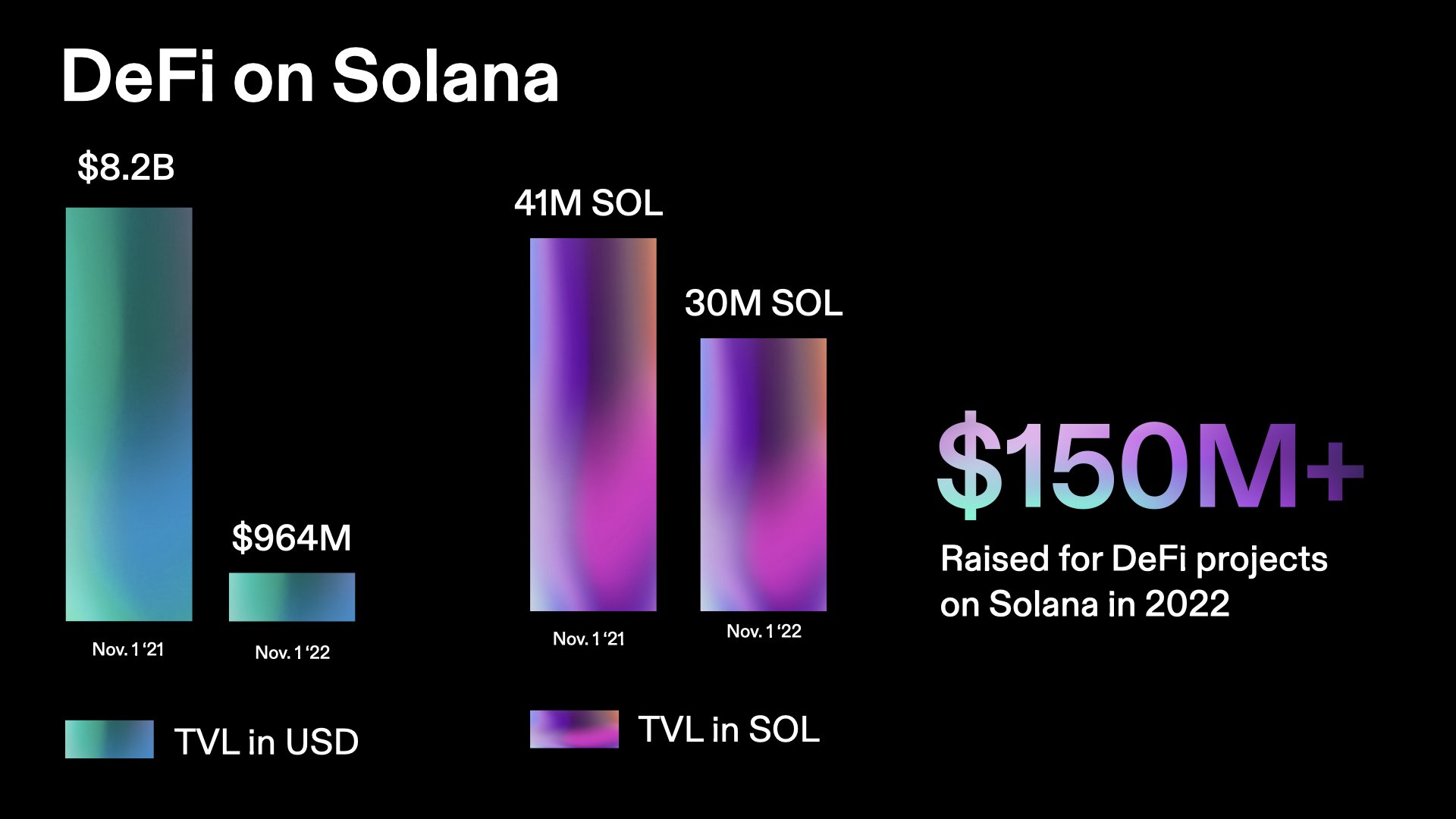

This could make Solana a suitable platform for mainstream-oriented use cases, such as web3 gaming and NFTs. For example, platforms such as Magic Eden have already gained a lot of traction and created a vibrant ecosystem for Solana-based NFTs. Due to its low transaction costs, Solana can also be an attractive destination for decentralized finance (DeFi) protocols.

In addition, the Solana project is working on expanding its presence on mobile platforms with the Solana Mobile project. This will also include a blockchain-friendly flagship smartphone called Saga.

However, Solana will need to address its reliability issues and improve the decentralization of its network before it will be fully embraced by crypto community.

What will the Solana price be at the end of 2022?

Solana, which entered 2022 with a price of $172.50, has lost more than 90% of its value in this crypto winter. As we enter the last month of 2022, we see on Solana’s daily chart that the RSI is at 34, near the lower border of the oversold zone. The MACD line and the signal line are also broken from the bottom to the top of the chart.

CoinCodex’s algorithmic SOL price prediction tool shows that the SOL price may fluctuate between $10 and $16.70 for about 2 months. As we approach the new year, we can expect sudden fluctuations in the SOL price.

What’s Solana price prediction for 2023?

Investors expect 2023 to be a bull season. With the final bottom in the market and the approach of Bitcoin halving, cryptocurrencies can now prepare for bull rallies. According to CoinCodex’s Solana price prediction, the SOL coin could see gains of up to 5x within a year. In April 2024, which corresponds to the Bitcoin halving period, the Solana price may exceed $500.

So, is Solana dead?

If you’re wondering if Solana is dead in 2022, the short answer is no. Solana is a successful blockchain network that hosts a large number of DApps and has a vibrant community of users. Its unique proposition of offering smart contracts with blazingly fast transaction speeds and low costs can certainly lead to widespread adoption in the future.

However, the collapse of FTX and the series of network outages are real setbacks that the Solana project will have to overcome.