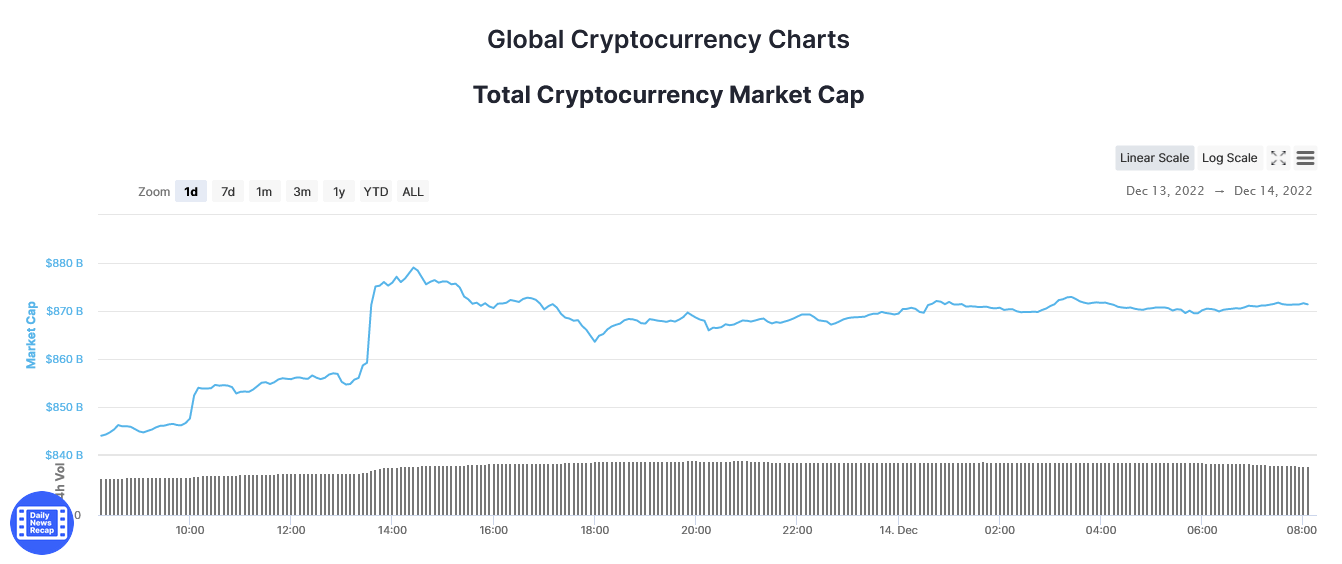

The total crypto market cap recorded inflows of $27.2 billion in the last 24 hours to post a four-week high of $871.4 billion.

This suggests investors’ confidence is returning following the FTX scandal and wider, ongoing macro factors.

Total crypto market cap

The previous market cap local top of $1,064.4 billion was achieved on Nov. 5.

Shortly after that date, as rumors of FTX’s insolvency and dodgy dealings spread, peak-to-trough outflows totaled $284.1 billion, reaching a bottom of $780.3 billion on Nov. 22.

Since bottoming, signs of returning confidence have presented with a slow trickle upwards. This sentiment was boosted on Dec. 13 following better-than-expected U.S. Consumer Price Index (CPI) data, showing a 7.1% year-on-year increase. Economists’ expectations were for a 7.3% increase.

Although the debate rages around the fact that U.S. consumers were still paying 7.1% more in November than a year ago, markets interpreted the news positively.

Market leader Bitcoin saw a spike to just below $18,000, and capital inflows jumped at 13:30 (UTC,) the time of the CPI announcement.

In addition, former FTX CEO Sam Bankman-Fried (SBF) was arrested in the Bahamas at the behest of the U.S. government on Dec.12.

A statement by the Bahamas Attorney General revealed that U.S. authorities had filed criminal indictments against SBF, and extradition to the U.S. to face the charges is likely.

The event caps a tumultuous period in which observers expressed disbelief over the lack of criminal proceedings against SBF. The saga was all the more outlandish given the mainstream media support he drew.

Top 100 winners and losers

The biggest top 100 gainers of the last 24 hours were Toncoin (TON,) Lido DAO (LDO,) and Fantom, up 13.0%, 9.4%, and 8.8%, respectively.

Meanwhile, over the same period, the biggest losers were Stacks (STX,) GMX (GMX,) and Bitcoin SV (BSV,) down 7.7%, 7.3%, and 2.7%, respectively.

Solana (SOL) led the top 10 (excluding stablecoins) with 6.7% gains, and Cardano (ADA) brought up the rear, posting 2.0% gains.

All eyes are on the up-and-coming FOMC meeting, scheduled for Dec. 14.

Markets are expecting the Fed to ease its pace of rate hikes with a 50 basis point increase.