Let’s talk about Curve Finance, one of the most popular stablecoin-centric DEXs on the market. Read on as we give answers to all your questions.

Executive Summary

- Curve Finance is an AMM decentralized exchange (DEX) created primarily for exchanging stablecoins.

- The key use cases are governance, LP rewards, increasing yields, and token burns.

- A pricing formula is used to determine the price of assets rather than an order book. A pricing formula is used to determine the price of assets rather than an order book.

- It was designed to give all CRV owners a voice in how decisions are made, from how Curve users are compensated to more advanced technological advancements.

- The Curve model is incredibly conservative compared to other AMM platforms because it favors stability over volatility and speculation.

What is Curve Finance?

Curve Finance is an automated market maker (AMM) decentralized exchange protocol that swaps stablecoins with low trading fees. Anyone can contribute their assets to various liquidity pools through this decentralized liquidity aggregator while earning a profit from fees in the process.

Curve is a blockchain-based system that aims to make trading easier without using a central order book. Users can lock stablecoins into lending pools and receive CRV tokens in exchange for doing so and also get a share of the trading fees.

Although it has many similar features to Uniswap and Balancer, this AMM platform distinguishes itself by only allowing liquidity pools of similar assets like stablecoins or wrapped versions of related assets like wBTC and tBTC. This approach enables Curve to employ more effective algorithms and offer low fees and low slippage.

AMMs operate without an order book. This can be beneficial for switching between tokens that stay in a similar price range due to the way Curve’s pricing mechanism functions.

This implies that it’s perfect for swapping stablecoins and various tokenized coin forms. As a result, Curve is one of the most acceptable ways to exchange between various tokenized forms of Bitcoin, such as WBTC, renBTC, and sBTC.

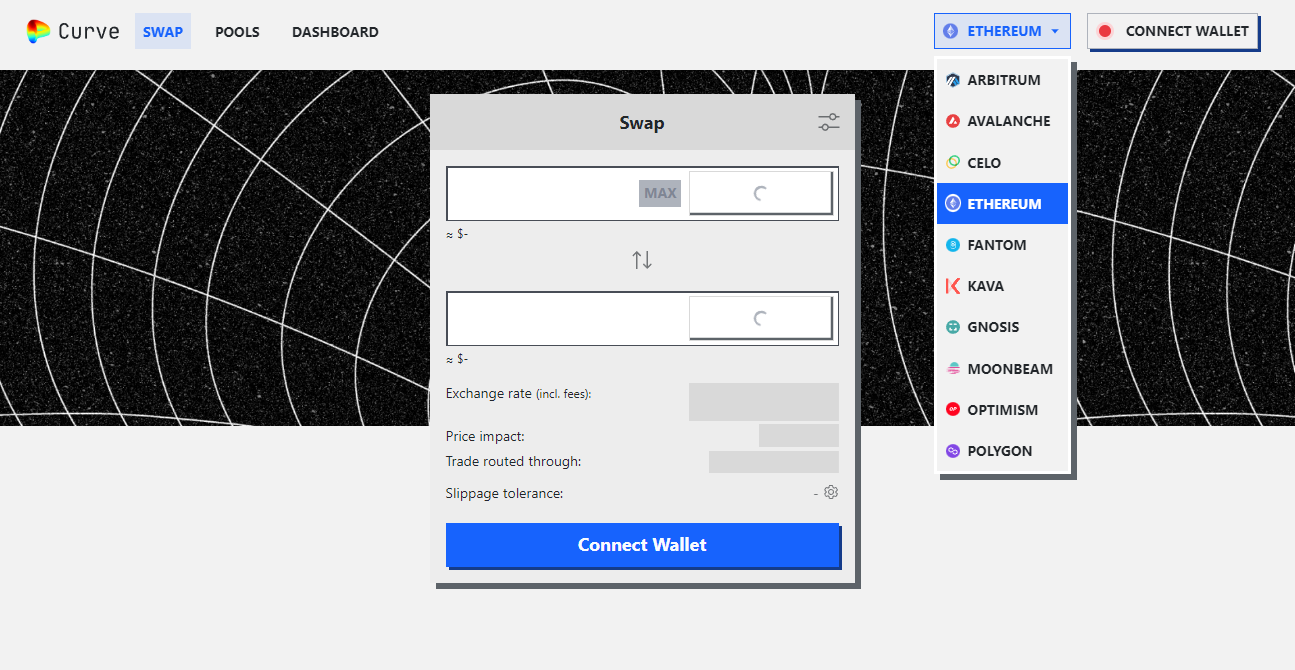

Curve Finance supports 10 blockchain networks, including:

- Ethereum

- Polygon

- Fantom

- Celo

- Arbitrum

- Avalanche

- Kava

- Glosis

- Moonbeam

- Optimism

Let’s have a quick review of how AMMs operate before concentrating on how Curve outperforms other AMMs in the DeFi ecosystem regarding risk and efficiency.

What Is an Automated Market Maker (AMM)?

By leveraging liquidity pools rather than trading directly between buyers and sellers, automated market makers (AMMs) enable the permissionless and automatic trading of digital assets.

A liquidity pool is essentially a shared pool of tokens. Tokens are added to liquidity pools by crypto users, and a formula determines the pricing of the tokens in the pool. By changing the formula, liquidity pools can be more effective for various goals.

Anyone with access to the internet and a few ERC-20 tokens can become a liquidity provider all you have to do is add or deposit liquidity tokens to the pool of an AMM. However, traders who use the liquidity pool pay a fee to the liquidity providers in exchange for their provision of tokens to the pool.

Founders of Curve Finance

Michael Egorov is the founder and CEO of Curve. Michael Egorov is a Russian scientist who has experience with various cryptocurrency-related businesses.

He co-founded NuCypher, a cryptocurrency company that develops infrastructure and protocols that protect user privacy. In 2015 he was appointed CTO of the company.

Egorov also founded the decentralized lending and banking platform LoanCoin.

As part of the initial launch strategy, Curve’s regular team, which is a member of the Curve CRV allocation structure, will be given tokens on a two-year vesting schedule.

In August 2020, Egorov claimed that he “overreacted” in response to Yearn.Finance’s voting power by locking up a significant amount of CRV tokens, giving himself 71% of governance in the process.

What Is the CRV Token?

The native utility token of the Curve protocol is called CRV. Its key use cases include governance, LP rewards, increasing yields (as veCRV), and token burns.

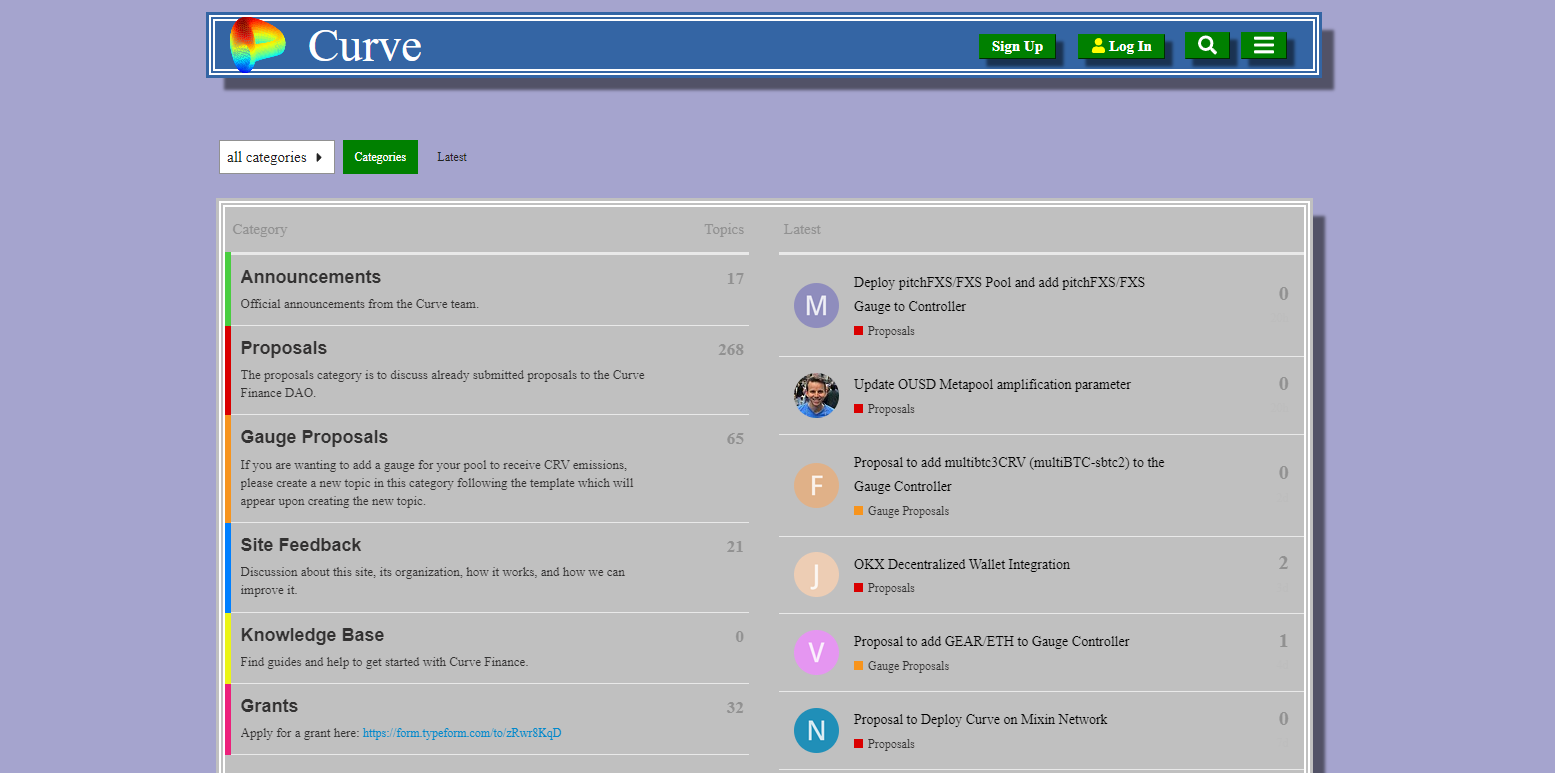

The Curve protocol established a decentralized autonomous organization (DAO) in August 2020 to oversee protocol modifications as it began its path toward decentralized governance. Most DAOs are governed by governance tokens, which grant voting privileges to their holders. The CRV token, in this instance, governs the Curve DAO.

The CRV token can be bought or earned through yield farming—which is depositing assets into a liquidity pool in exchange for token rewards. You obtain the CRV token in addition to fees and interest by supplying DAI to a Curve liquidity pool. Gaining assets and ownership of a strong DeFi protocol are two benefits of yield farming the CRV token, which also boosts the incentives to work as a Curve liquidity provider.

Furthermore, an update to the Curve protocol may be suggested by any party holding a sufficient amount of vote-locked CRV tokens (meaning CRV crypto holders automatically get to participate in the decision-making process of the protocol ). A few examples of updates include shifting fees or where they go, setting up new liquidity pools, and adjusting yield farming rewards.

What Gives Curve (CRV) Tokens Value?

Curve focuses mainly on using AMM for stablecoin trading. Following this mandate, Curve has attracted a lot of interest.

Given that CRV is a governance token and that users are allocated the token based on their commitment to liquidity and length of ownership, the launch of the Curve DAO and its native token resulted in increased profitability.

Curve’s durability has been secured by the rise of DeFi trading, which has resulted in AMMs turning over enormous sums of liquidity and corresponding user gains.

Curve serves people engaged in DeFi activities like yield farming and liquidity mining, as well as those trying to maximize returns and incentivize liquidity providers without taking risks by holding non-volatile stablecoins.

How Many Curve (CRV) Tokens Are in Circulation?

In August 2020, Curve (CRV) and the Curve DAO went live. It serves as a tool for governance, an incentive system, a way to pay fees, and a way for liquidity providers to earn money over the long run.

3.03 billion tokens comprise the whole CRV supply, 62% of which are given to liquidity providers. The remaining money is distributed as follows: Shareholders receive 30%, employees get 3%, and a communal reserve gets 5%. The vesting period for the shareholder and employee allocations is two years.

Since there was no pre-mine for CRV, 750 million tokens should be in circulation a year after launching, thanks to the tokens’ steady unblocking.

According to CoinMarketCap, the current price of the Curve DAO Token is $0.919572 USD. It has a market cap of $488,829,013 USD, a maximum supply of 3,303,030,299 CRV coins, and a circulating supply of 531,583,334 CRV coins.

How Does Curve Finance Work?

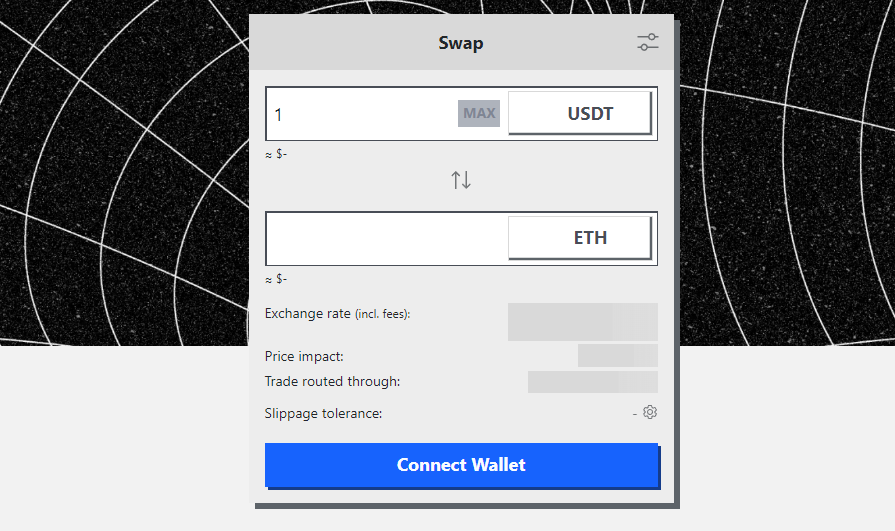

Curve facilitates trading by utilizing the AMM protocol. Automated market makers, or AMMs, use algorithms to price tradable assets in a liquidity pool effectively.

A pricing formula is used to determine the price of assets rather than an order book. Curve’s formula is created primarily to make swaps that take place in a substantially close range easier.

For instance, 1 USDT ought to be equivalent to 1 USDC, which ought to be close to 1 BUSD, and so on. However, there would be some slippage if you want to convert 100 million dollars of USDT to USDC and convert it to BUSD. The formula for Curve is created to reduce this slippage as much as possible.

One thing to remember is that Curve’s formula wouldn’t function properly anymore if they weren’t in the same pricing range. But that’s not something the system has to take into account.

For instance, a price difference between a token and the asset to which it was pinned something outside of Curve would be seriously off. As the system has no power to change circumstances beyond its control, the algorithm works admirably as long as the tokens stay pinned.

Due to this, even huge sizes experience incredibly low slippage. Curve’s spread can effectively compete with some of the best-liquid OTC desks and centralized exchanges.

There are four essential parts to the Curve AMM model:

- Liquidity Providers, which deposit tokens into the Curve liquidity pools

- Liquidity Pool, where tokens from liquidity providers are stored in the LP to generate exchange liquidity.

- Traders that exchange tokens with the liquidity pool to create pressure to buy and sell, influencing token values.

- AMM Algorithms, which are used to efficiently price tokens in the liquidity pool according to numerous criteria, including the buy and sell pressures exerted by traders.

If you want to track your DeFi investments alongside your crypto and NFTs, check out CoinStats portfolio management app.

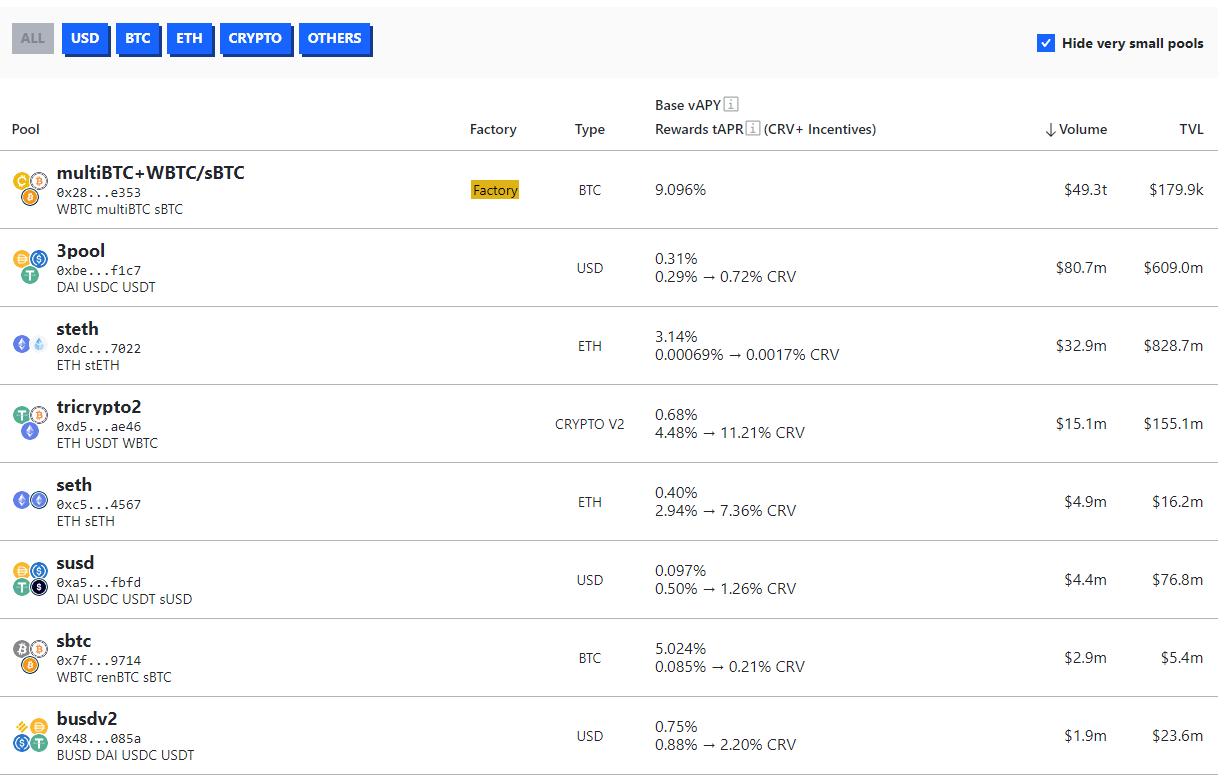

Stable Liquidity Pools

In 2020, Curve was introduced as a low-fee AMM decentralized exchange for traders. Curve lets investors avoid more volatile crypto assets while still earning high-interest rates via lending protocols by concentrating on stablecoins. The Curve model is highly conservative compared to other AMM platforms because it steers clear of volatility and speculation in favor of stability.

Liquidity pools on AMMs like Curve always attempt to “buy cheap” and “sell high.” Here’s a reminder of how that rebalancing works, this time with the USD Coin (USDC) and DAI stablecoins tethered to the US dollar. If you were to sell DAI on Curve, the following set of things would happen:

- The pool is expanded with more DAI.

- Because there are now more DAI than USDC, the pool is no longer balanced.

- To encourage equilibrium, the pool offers DAI at a little discount to USDC.

- The pool rebalances its DAI to USDC ratio.

The pool then tries to return to how it was by offering DAI at a discount.

Compared to other AMM liquidity pools, the Curve pool’s trading between its assets creates the least volatility because their prices are steady relative to one another. Volatility is significant on AMMs like Uniswap or Balancer when liquidity pools might contain any token. By restricting the pools and the types of assets in each pool, the Curve reduces impermanent losses—an AMM situation whereby liquidity providers experience a loss in token value in relation to the market value of that token due to volatility in a liquidity pool

However, impermanent loss isn’t always a bad thing. Users that try to make money by entering and leaving a liquidity pool at the proper time can benefit from volatility and low slippage. Through a strategy known as decentralized finance (DeFi) composability, Curve attracts liquidity providers by trading off the high-risk—and occasionally great reward—aspect of volatility. As a result, you can utilize the money you invested on the Curve platform to get rewards from other DeFi ecosystem platforms.

The values maintained in various assets are not necessarily equal or proportional to one another, as Uniswap or Balancer attempt to do. As a result, Curve can concentrate liquidity close to the ideal price for comparable-priced assets (in a 1:1 ratio) to have liquidity where it is most needed. With those assets, Curve can utilize liquidity considerably more effectively than otherwise.

The like-asset strategy for AMMs is not just applicable to stablecoins. wBTC and renBTC, two tokenized variations of bitcoin (BTC), are also included in Curve’s liquidity pools. Bitcoin is very volatile compared to stablecoins, but the Curve technique still works since tokens in Curve pools need to be stable to other tokens in the same pool. In contrast to wBTC and USDC, which are incompatible, wBTC and renBTC can be included in the same Curve liquidity pool.

Curve Finance Governance

The CRV native token for the Curve platform was released in 2020. 3 billion CRV tokens were produced at this time.

30% of the CRV tokens were set aside for the Curve team and investors, while about 60% were distributed to users who had locked coins on the site. The remaining money was allocated for the project’s personnel and a reserve for charitable causes.

Currently, 2 million CRV tokens are released daily, for a total of 750 million annually. Voting for ideas that establish the Curve system’s regulations will be done with the tokens.

DeFi Composability: Incentivizing Liquidity Providers

Every time a trade is executed on an AMM exchange like Uniswap, fees are earned. Trading fees on Curve are cheaper than Uniswap, but interoperable tokens also let you receive rewards from sources outside of Curve.

For instance, on the Compound platform, DAI is converted into the liquidity token cDAI when it is lent out, and cDAI automatically accrues interest for the holder. A right to withdraw DAI from Compound with interest is conferred upon holders of cDAI. With the ability to deploy cDAI in Curve’s liquidity pools, consumers can get a second layer of utility and potential profit from a given investment.

The advantages of composability in the decentralized finance (DeFi) ecosystem are best demonstrated by using Compound’s cTokens on Curve. Additionally, Curve interfaces with several external DeFi protocols, Compound being just one example. To maximize incentives for liquidity providers, the protocol also interfaces with Yearn Finance and Synthetix.

The Challenges of Curve Finance

Now that the project has undergone an audit, it must be safe to use, right? No matter how many audits smart contracts have, there are always risks associated with using them. Don’t put more money down than you’re willing to lose.

You must consider impermanent loss, just like with any other AMM protocol, before adding liquidity to Curve.

To increase the profits for the liquidity providers, the liquidity pool may be given to Compound or Yearn Finance. Additionally, users can trade on other smart contracts in addition to Curve because of the wonders of composability. Several of these DeFi protocols become dependent on one another, creating new hazards. If one of them fails, the entire DeFi ecosystem can experience adverse side effects as a result.

Is Curve Finance Safe?

With a wholly non-custodial platform, Curve Finance strives to give consumers the control that cryptocurrency should be about. This implies that your coins are always in your possession and that the platform never assumes custody of them.

Many cryptocurrency users are drawn to earning tokens by using liquidity pools, especially those who prefer to keep their tokens rather than trade them. Users can choose this, and Curve Finance offers a variety of liquidity pools to select the one that best suits their cryptocurrency strategy.

Curve is an excellent choice if you’re a cryptocurrency trader who wants to dive deep into using liquidity pools. Although it has a steeper learning curve, spending the time to go through the documentation reveals an ecosystem that is really about balancing many cryptocurrencies together.

Curve Finance is safe. With complete cost transparency, various liquidity pools to pick from, and a DAO that enables users to participate in the exchange’s future actively, Curve is a DeFi go-to that merits more investigation.

Bottom Line

Although it is a more recent entry into the cryptocurrency world, the Curve Finance platform offers a wealth of advantages for users by allowing for deeper DeFi yield farming, staking, and stablecoin movement.

Due to its preference for consistency and composability above volatility and speculation, Curve is one of the most often-used platforms in DeFi. With the CRV token serving as the governance mechanism and its composable components, making it an interconnected center of the DeFi ecosystem, it is an incredibly decentralized organization that belongs to its people.