Animoca Brands Corp., a Hong Kong-based blockchain game maker and venture capitalist, has scaled down the target amount for its Web 3.0 and metaverse investment fund to US$1 billion from the initial goal of up to US$2 billion, according to Bloomberg.

See related article: Silvergate cuts 40% of staff after covering US$8.1B withdrawals in FTX collapse

Fast facts

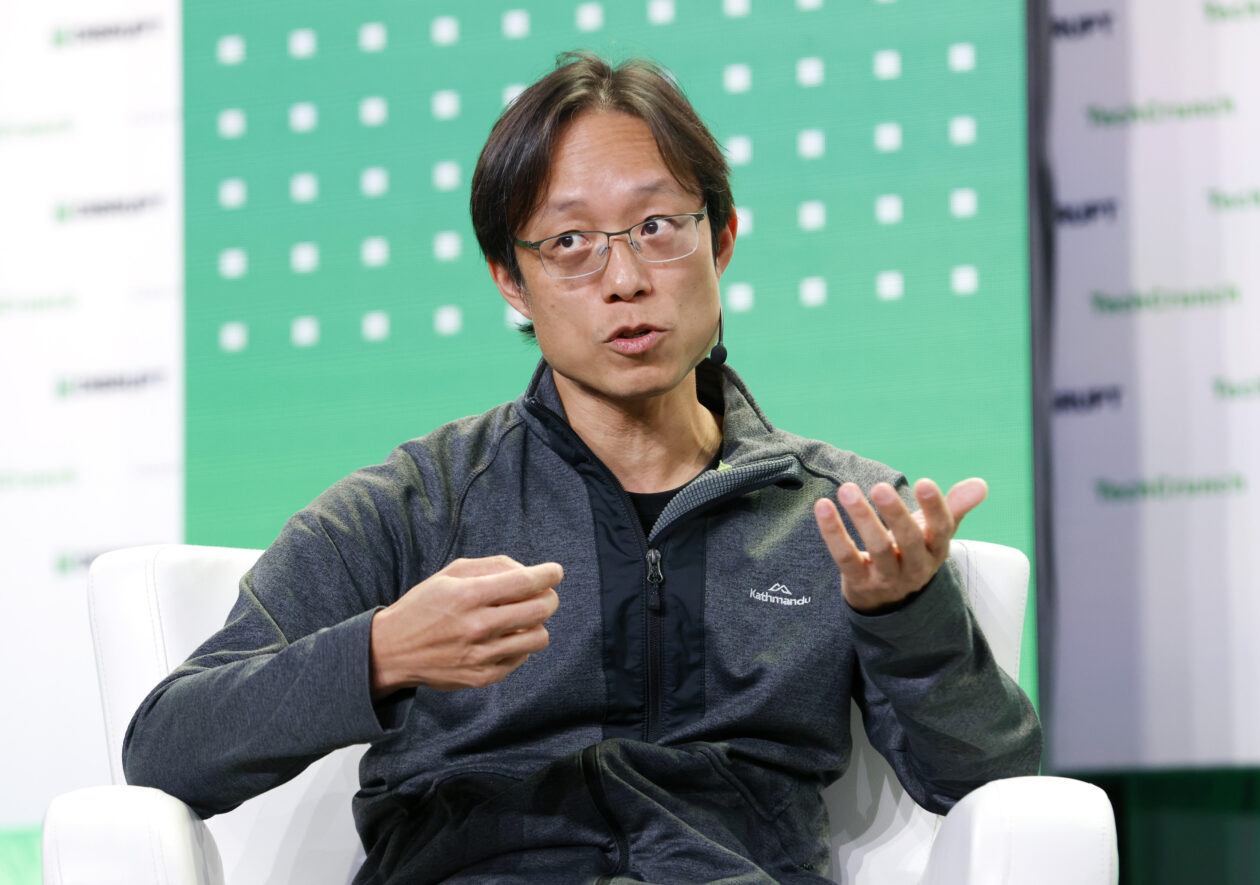

- The company is raising around US$1 billion for its new Web3 fund within Q1 of this year, Animoca Chairman Yat Siu said during a Twitter Spaces chat hosted by Bloomberg.

- The fund, Animoca Capital, aims to support the growth of startups in Web3, or the next generation of internet technology focused on decentralization, often through blockchain.

- The collapse of the Bahamas-based bankrupt cryptocurrency exchange, FTX.com, severely hit about a dozen of Animoca’s investments, including the long-awaited non-fungible token (NFT) game, Star Atlas, Siu said, according to Bloomberg.

- Despite the shock from FTX, Siu said several Animoca subsidiaries have raised capital, and the interest in crypto still exists.

- “The biggest damage with FTX was not so much financial … it was more of a reputational damage and an institutional damage, and in particular, an institutional American damage,” Siu said in a December interview with Forkast.

- FTX, once the world’s second-largest exchange, filed for bankruptcy in November after revelations of misappropriation and poor disclosure of company assets, affecting other major crypto players such as Genesis and Gemini.

See related article: Biggest blockchain trends for 2023 and beyond