Are you in search of a cryptocurrency exchange that offers a secure, centralized environment? If so, you may have already come across Bilaxy. But is it the right choice for your digital currency needs?

In this Bilaxy Review article, we’ll take a look at all the pros and cons of using Bilaxy, including its main features, supported cryptocurrencies, fees, and more. By the end, you’ll be able to determine if this exchange is the perfect fit for you!

Overview

Many centralized cryptocurrency exchanges offer a wide range of features and benefits. As an overview in this Bilaxy exchange review, we’ll give you a glimpse of what this platform is about through the table below.

| Official Website | https://bilaxy.com/ |

| Year Founded | 2018 |

| Company Stage | Seed |

| Deposit Method | Cryptocurrencies and Tokens |

| Crypto Supported | 600+ stablecoins and cryptocurrencies including Ethereum, Bitcoin, and Solana |

| Security Biggest Investors | ZMT Capital, Origin Capital, LD Capital, and BTC12 Capital |

| Liquidity | ±2% |

| Fees | 0.2% flat fee |

| Bilaxy App | iOS and Android |

| Trading Volume | $18,561,493.84 |

| Bilaxy KYC Requirement | Yes |

Pros & Cons

Pros

There are a number of reasons why Bilaxy may be the suitable centralized cryptocurrency exchange for you. Some of the pros include:

- Supports over 600 trading pairs

- Both the app and the website include a user-friendly trading terminal

- Has its native token known as the BIA coin

- No minimum deposits and withdrawal limits

- 24/7 support through email and Telegram

- Offers referral programs

Cons

Users should be aware of a few potential drawbacks to using Bilaxy before trading on the platform. These are the following:

- Is an anonymous team

- No passive earning opportunities

- No margin trading

- No training guides or demonstration

- Does not support fiat transactions

What is Bilaxy?

Bilaxy is a centralized cryptocurrency exchange that was launched in April 2018. The platform is owned and operated by an anonymous company and offers trading pairs with major cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and XRP.

Little is known about the history of the exchange, such as its founder and actual country of origin. Some believe that its headquarters is probably in Hong Kong as the language in the exchange is offered in both English and Chinese.

However, what we know about the Bilaxy itself is that it:

- Has announced moving its funds to cold wallets after a hacking incident

- Accepts many cryptocurrencies but has no access to fiat accounts

- Uses of coin trade history for analytics

- Can be used via mobile app for both iOS and Android devices

- Is a centralized exchange

With nearly 800 coins and trading pairs on the exchange, Bilaxy remains a choice for its users because it continuously updates to improve its system. It has basic functionalities, which could allow new users to quickly understand how to navigate the platform in under twenty minutes.

Centralized and Decentralized Exchange: Differentiated

In this Bilaxy exchange review, we’ll distinguish between centralized exchanges from decentralized ones. To learn more, refer to the table below.

| Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

|---|---|

| Centralized intermediary | Peer-to-peer (P2P) basis |

| Helps you control your funds | Gives you exclusive control and responsibility over your funds |

| Highly regulated | Minimal to no KYC and/or AML standards |

| High Liquidity | Low liquidity |

| Susceptible to hacker attacks | Backed by blockchain |

| Examples: Bilaxy, Binance, and Coinbase | Examples: Kine Protocol, Uniswap, and PancakeSwap |

Main features

Order Execution

The Bilaxy exchange offers limit orders to their users. In this case, it enables users to purchase or sell a stock while limiting the highest price spent or the minimum price received, also known as the “limit price.” If somehow the order has been filled, it will only be at or above the given limit price. The purpose of this order type is to allow users to purchase or sell securities at a predetermined price.

One reason why people may be invested with limit orders in Bilaxy is that it allows them to choose their own price. The order will most likely be filled if the stock hits that level. It may be helpful when traders believe they can purchase at a cheaper (or sell at a higher) price than the current quote.

Unfortunately, there may be instances when trades or orders cannot be executed. Issues may be in line with the price and volume of the orders, among other factors. When this happens, the platform recommends checking the selling market orders–presented in red–or the buying market–shown in green–to ensure that the trades match.

Trading Performance

Bilaxy prioritizes liquidity for new coins for global crypto dealers. The cryptocurrency exchange has no minimum deposit requirement. This implies that you simply need to register and validate your account to begin trading. Furthermore, you have the capacity to determine your economic policies and may make deposits through any accessible channel.

Its goal is to become a significant worldwide trading platform that offers global traders a wide variety of trading goods and services. With more than $18 million in 24-hour spot trading volume, it demonstrates how serious it is about transparency, dependability, and excellent execution.

According to Forbes, the platform serves as a global blockchain asset exchange that offers real-time, secure trading. With over 150 trading pairs, including BIA/USDT, BTC/USDT, and ETH/USDT, it provides so many trading possibilities for users.

Some other salient pointers to remember about the platform are as follows:

- There is no leverage available. You can only trade with your assets.

- Margins (borrowed funds) are not allowed.

Referral Bonus

The referral bonus feature of Bilaxy is intended for users who can encourage people to exchange. Users just have to copy their invite code and send them to people who might be interested.

The fee commission will be given to your Bilaxy account in real-time as the person who accepted your invitation completes each trade. The compensation will be paid to you in the token in which the initial fee was paid.

Bilaxy KYC

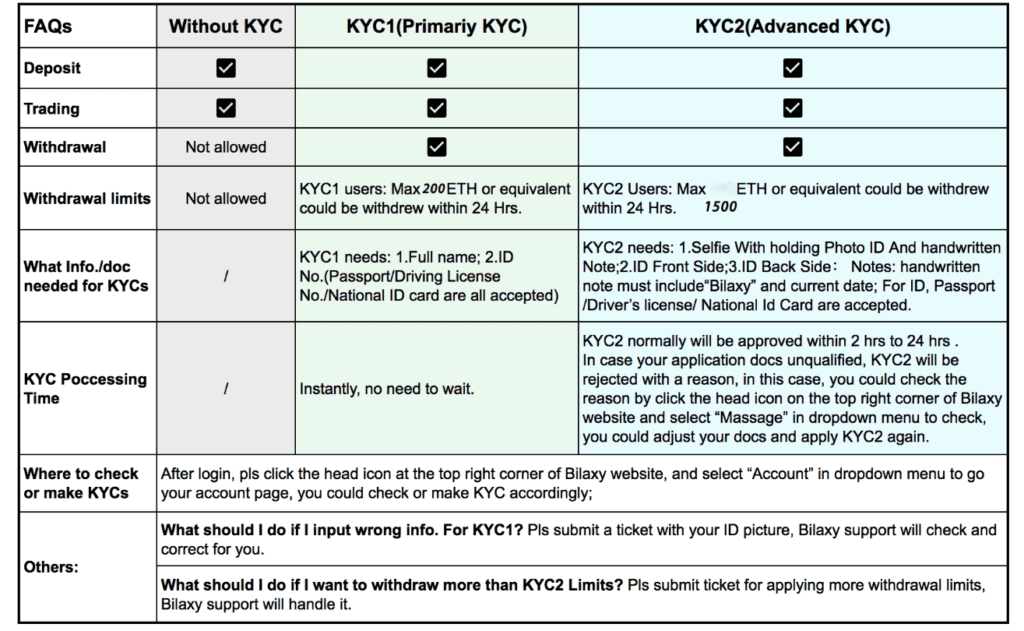

Bilaxy’s support noted that there are functions that users can and cannot access without KYC (Know Your Customers). As discussed in many of the articles on our website, KYC is intended to safeguard institutions and their users from being victims of money laundering by criminal groups.

In summary, here’s what you need to remember about the platform’s KYC policy:

Customer Support

As provided earlier, the platform has a 24/7 customer service unit that answers questions made by its users or potential clients. However, all of this assistance is in written form. As of writing, Bilaxy does not have a call center for efficient connection with technical assistance.

Supported Cryptocurrencies

In this Bilaxy review, we’ve already mentioned how the exchange offers hundreds of cryptocurrencies, stablecoins, and tokens. However, fiats are not yet accepted on the platform.

Among the myriad of tokens in the market, some of the most popular in Bilaxy are:

- Bilaxy Token (BIA)

- Binance Coin (BNB)

- Bitcoin (BTC)

- Yearn.Finance (YFI)

- Litecoin (LTC)

- BADGER

- MATIC (MATIC – Mainnet)

Because Bilaxy does not accept fiat currency deposits, inexperienced cryptocurrency investors, particularly those with no prior cryptocurrency holdings, are unable to trade here. You’ll need to use an entry-level, user-friendly exchange that accepts deposits in fiat money to acquire your first cryptocurrencies.

Bilaxy Fees

The exchange allows you to trade that comes at various costs. Please take a look at the table below to learn more about their fee system.

| Type | Cost |

|---|---|

| Deposit Fees | No charge |

| Withdrawal Fees | 0.02 ETH (from the previous 0.01 ETH) |

| Trading Fees | 0.1% for BIA token holders 0.2% flat fee for other cryptocurrencies and coins |

Security

Bilaxy Hacking Incident

Most traders are wary of decentralized finance and exchange scams due to the lack of compensation provided by the organization. However, it is equally crucial for traders to be mindful of their resources that are in centralized exchanges.

For one, they are more prone to phishing and victimizing vulnerable currency holders. Second, many examples of hacking incidents have compromised many CEX.

Unfortunately, in August 2021, Bilaxy was the victim of a breach that breached a hot wallet on its network, resulting in the distribution of 295 ERC-20 tokens to a single wallet. Its then-value was equivalent to worth more than $21 million.

How Bilaxy Improved Their Security System

After the Bilaxy hack, the team studied their regulatory gaps and the result of lax security measures. The 2-factor authentication (2FA) feature didn’t really help much when the incident happened.

Currently, the platform uses three security features, namely:

- Two-factor authentication;

- Phone number verification; and

- Password

They also provided users with some security tips to avoid phishing, fraud, and hacking issues. Although we can’t say for sure that it will never happen again, proper precaution always keeps us from being victims of online crimes.

Final Verdict

Bilaxy is a popular cryptocurrency exchange that offers a wide variety of coins and tokens to trade. However, it is essential to note that Bilaxy is a centralized exchange, which means that your funds are not as secure as they would be on a decentralized exchange. We advise that you use caution when trading on Bilaxy, as in any exchange, and only do so with amounts that you can afford to lose.

FAQs

Is Bilaxy safe to use?

Generally, Bilaxy offers excellent conditions and easy trade executions. However, since its major hacking that took place in 2021, a lot of traders have been thinking twice about this exchange. But then again, it has since improved its system and begun offering better features.

Do you need KYC Bilaxy?

Yes, KYC is required in many of its important features. For instance, you cannot withdraw from the platform without KYC.

Is Bilaxy US available?

Yes, Bilaxy US customers enjoy the platform’s services. In fact, they’re believed to be one of the largest–in demographics–in the distribution of Bilaxy Trading users.