Celo proce has been in a strong bullish trend in the past few weeks in sync with other digital coins. It surged to a high of $0.7950, the highest point in months. This price is about 76% above the lowest level in 2022. Its market cap has surged to more than $348 million, making it the 93rd biggest crypto in the world.

What is Celo and why is it soaring?

Celo is a blockchain project that was created with mobile users in mind. It is a carbon-negative, mobile-compatible blockchain network that developers use to build quality applications. Most of their apps are focused on mobile, the biggest ecosystem in the world. There are now over 5 billion smartphone users internationally.

Celo has other important features. For example, it has an average block time of 5 seconds and a negligible gas fee of $0.0005. This makes it one of the most affordable blockchains in the industry. For example, Ethereum charges over $20 per transaction.

Celo developers can build all types of applications including decentralized payments, mobile decentralized finance (DeFi), and other types of dApps. According to its website, there are now over 1,000 projects created in Celo.

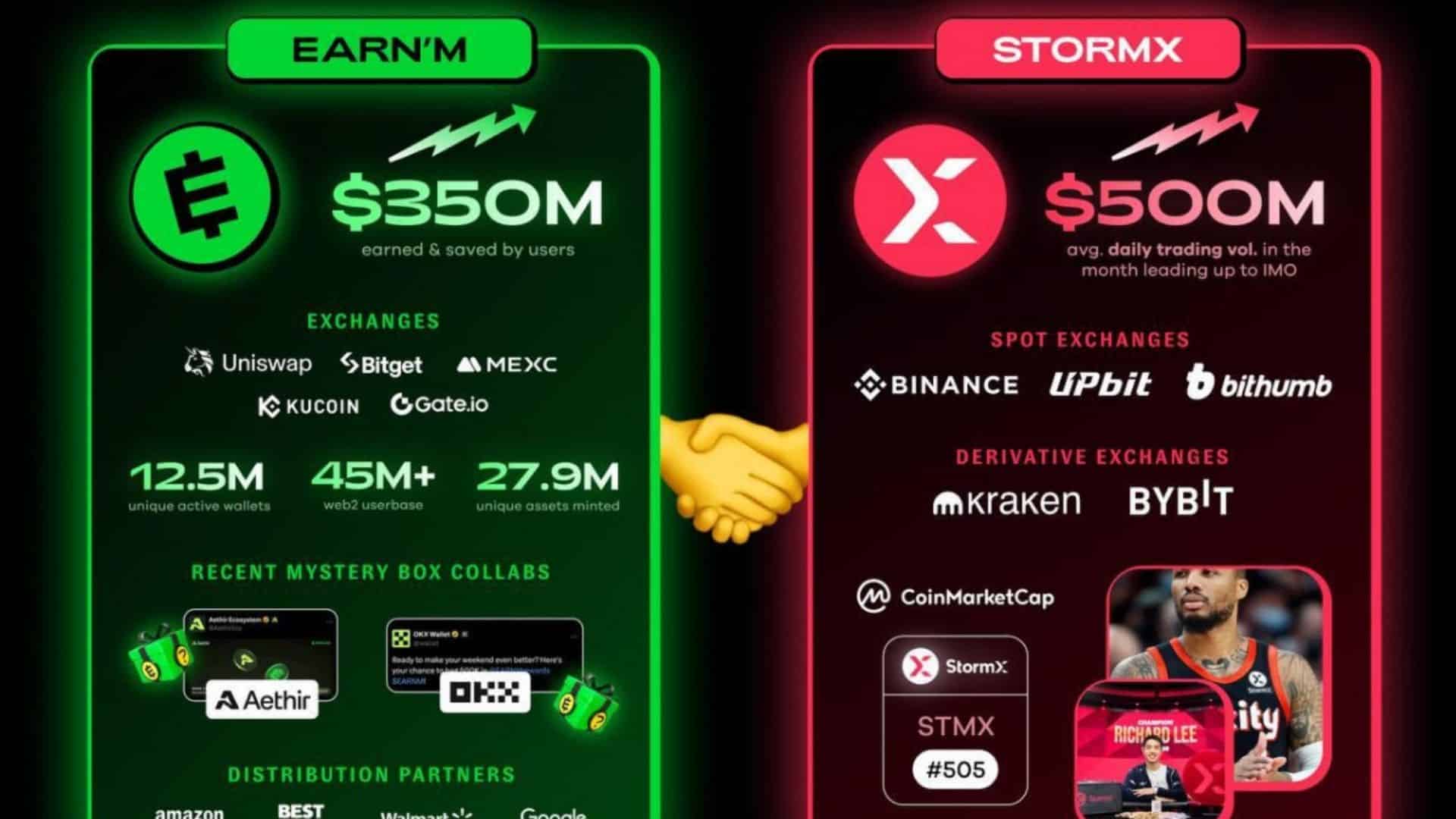

Some of the top projects that have been created using Celo are Uniswap, Mento, Curve, Tatum, Plastiks, and GoodDollar among others. According to DeFi Llama, Celo has a total value locked (TVL) of more than $139.2 million. At its peak, its TVL was more than $1.2 billion. Some of the biggest dApps in the platform are Mento, Curve, and Moola Market among others.

Celo price has rallied as investors cheer the network’s growth. In the past few months, the developers have worked hard to make Celo more popular, especially in the emerging market. One way they are doing this is by holding Celo Block parties, which are events in countries like Nigeria and Uganda.

Celo price prediction

The four-hour chart shows that the CELO price has been in a strong bullish trend in the past few weeks. As it rose, the coin has moved above the key resistance level at $0.5640, the highest point on December 24. It has moved above all moving averages while the Relative Strength Index (RSI) has moved above the overbought level. Therefore, the coin will likely retreat to a low of $0.60, which is about 20% below the current level.