Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin has surged past $66,000, and Altcoin Buzz has analyzed the potential drivers for a push toward reclaiming the $70,000 mark. Experts point to the Federal Reserve’s recent interest rate cuts as a key influence, as lower rates tend to encourage investment in riskier assets like Bitcoin.

According to Into The Cryptoverse (ITC), Solana is steadily recovering from a severe bear market that led to sharp declines in price and market capitalization. A chart from ITC shows that SOL’s dominance peaked near 4% during the 2021 bull run before dropping significantly in the months following. Other altcoins are also experiencing positive price movements. For those looking to capitalize on the current market optimism, here are the five best altcoins to watch today.

6 Best Altcoins To Watch Today

Stellar (XLM) is a decentralized peer-to-peer network. THORChain has played a key role in helping various platforms generate significant passive income. Chainlink serves as a blockchain abstraction layer, allowing smart contracts to interact with external data sources.

Pepe Unchained (PEPU) is gaining momentum in the crypto market thanks to its successful presale and innovative strategy for attracting developers. Binance founder Changpeng Zhao is set for release after four months.

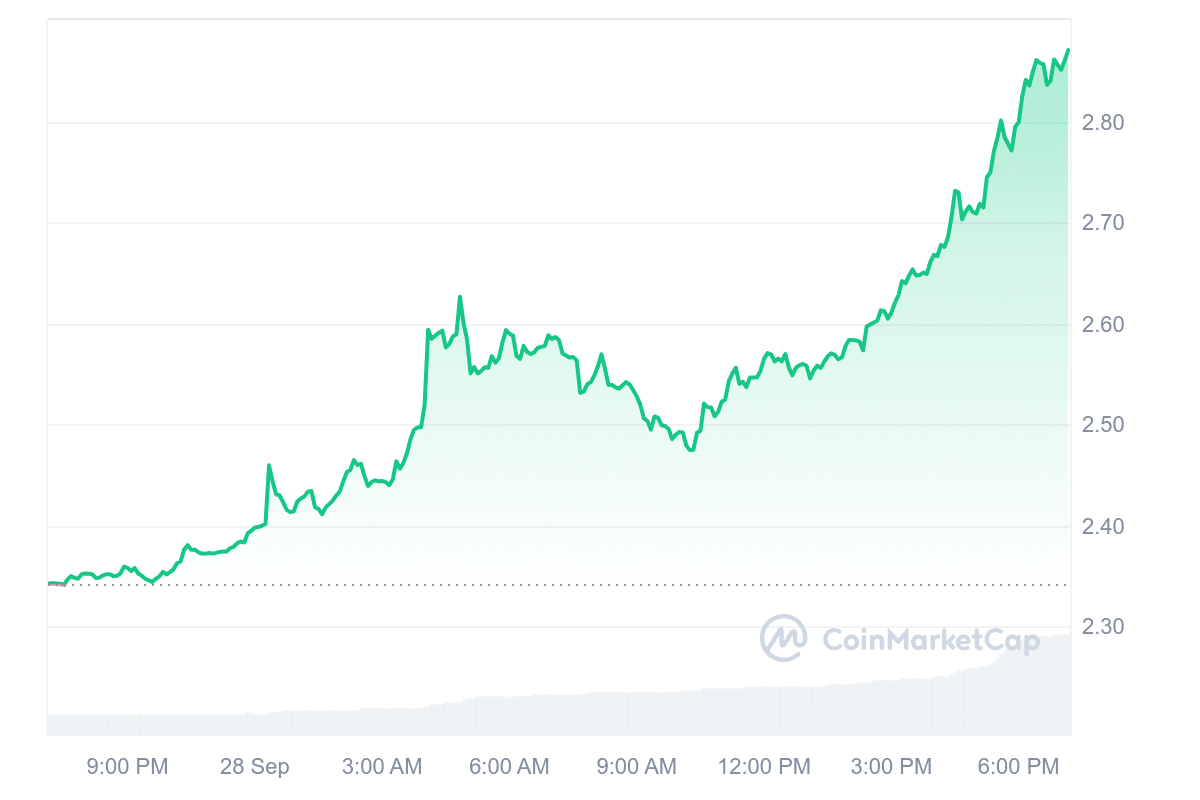

1. ETHW (Ethereum PoW)

ETHW trades at $2.86, marking a notable 21.77% increase over the past 24 hours. Year-to-date, the asset has gained 113%, surpassing 57% of the top 100 cryptocurrencies in terms of performance.

Currently, ETHW is trading 28.74% above its 200-day Simple Moving Average (SMA) of $2.23, indicating a positive long-term trend. Additionally, the token has seen 18 out of 30 green days in the last month, representing 60% of the time with a relatively moderate volatility of 11.00%.

Market sentiment around EthereumPoW is bullish, with the Fear & Greed Index showing a reading of 64, indicating greed. Meanwhile, predictions suggest a potential price rise of 231.95%, which could bring ETHW to $8.65 by October 28. Given the technical indicators, current market conditions may present a favorable entry point for potential investors.

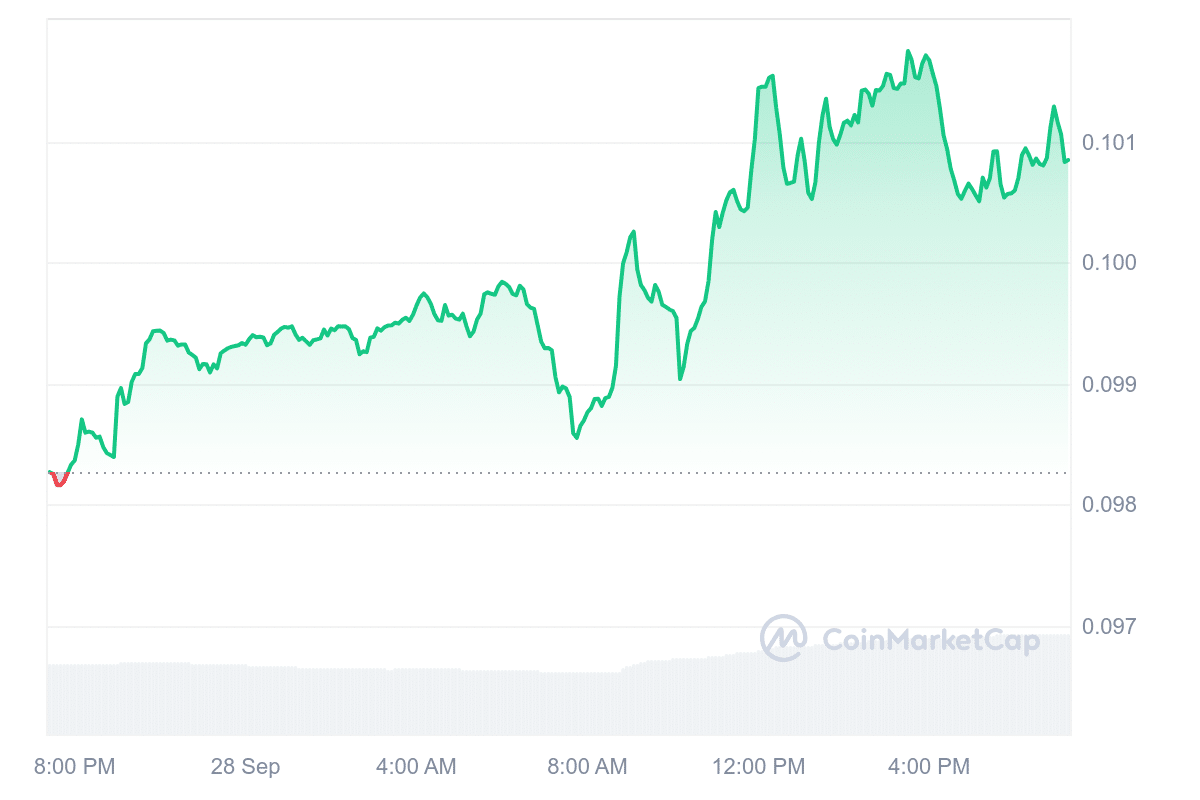

2. Stellar (XLM)

Stellar (XLM) is a decentralized, peer-to-peer network developed by the Stellar Development Foundation and launched in 2015. Its primary aim is to connect global financial systems by providing a reliable and low-cost protocol for payment providers and financial institutions. Stellar facilitates fast and secure transactions, enabling users to create, send, and trade various cryptocurrencies.

Stellar’s price stands at $0.100796, reflecting a 2.41% increase in the last 24 hours. The platform has shown strong liquidity relative to its market capitalization, indicating ease in trading. Over the past month, Stellar experienced 19 green days (63% of the time), where the closing price was higher than the opening.

This week, we’re shining a spotlight on our Policy team’s recent work on public blockchains. Stay tuned for insights on stablecoins, digital assets, and the future of finance.

Kicking it off with our contribution to @StablecoinStnd, exploring how public blockchains like Stellar…

— Stellar (@StellarOrg) September 23, 2024

At present, market sentiment toward Stellar remains neutral, with 21 technical indicators showing bullish tendencies. Despite this, the network continues to be viewed as a promising solution for financial transactions, though its future performance will depend on broader market conditions.

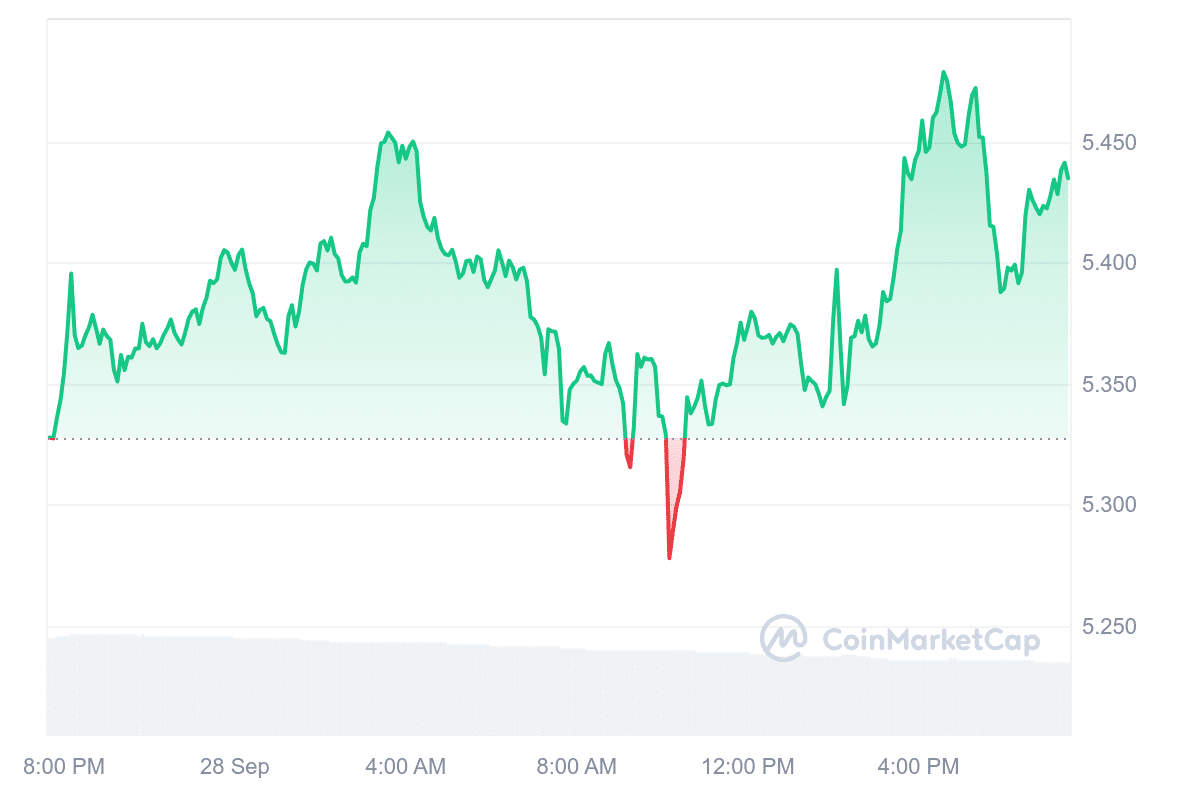

3. THORChain (RUNE)

THORChain has played a significant role in enabling various platforms to generate substantial passive income. To date, these platforms have earned over 3.69 million $RUNE in affiliate fees, valued at approximately $19 million. Currently, the price of THORChain stands at $5.43, marking a 1.91% increase in the last 24 hours.

Over the past year, the price of RUNE has surged by 179%, outperforming 70% of the top 100 crypto assets, including Bitcoin and Ethereum. It is also trading well above its 200-day simple moving average (SMA), currently 85.23% higher than the $2.93 mark. In addition, the token has shown 15 green days in the past 30 days, reflecting a 50% success rate.

THORChain Q3 2024 Overview by @reflexivityres https://t.co/OV24JdhmfB

— THORChain (@THORChain) September 28, 2024

Technical indicators suggest a bullish sentiment, with the Fear & Greed Index at 64, signaling greed in the market. Volatility has been moderate at 11.65% over the last month. Based on current forecasts, the price of THORChain could increase by 27.05%, potentially reaching $6.79 by October 28, 2024. Consequently, now may be considered a favorable time to buy.

4. Ethena (ENA)

Ethena Labs, known for its synthetic USDe dollar, has introduced a new stablecoin, UStb, which will invest its reserves into Blackrock’s USD Institutional Digital Liquidity Fund (BUIDL). This follows the launch of the synthetic USDe, a stablecoin pegged to the dollar through a cash-and-carry arbitrage strategy.

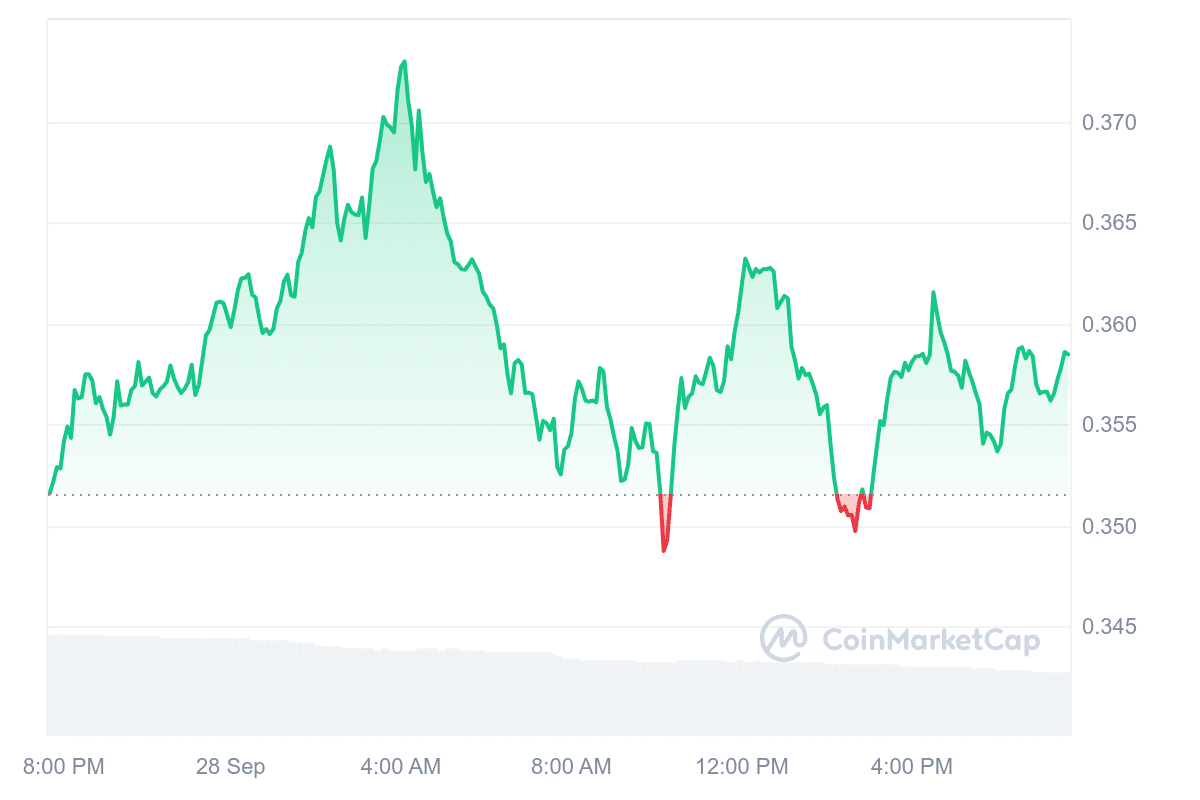

The introduction of UStb aims to provide users and exchange partners with more choices. This announcement resulted in a 14% increase in the value of Ethena’s ENA governance token, pushing it from $0.307 to $0.378 overnight.

We are excited to announce Ethena’s newest product offering: UStb

UStb will be fully backed by @Blackrock BUIDL in partnership with @Securitize, enabling a separate fiat stablecoin product alongside USDe

Details below on why this is important: pic.twitter.com/jOIoMef7W3

— Ethena Labs (@ethena_labs) September 26, 2024

The ENA token is priced at $0.358544, showing a 1.83% rise in the last 24 hours. The token has seen positive price movement on 17 out of the last 30 days, reflecting a 57% rate of days closing higher than they opened. With strong liquidity relative to its market cap and trading near a cycle high, market sentiment appears bullish. Sixteen technical indicators currently support this optimistic outlook.

5. Chainlink (LINK)

Chainlink is a blockchain abstraction layer that enables smart contracts to connect with external data sources. Using a decentralized Oracle network allows blockchains to access off-chain data, events, and payment systems securely. This is essential for smart contracts that require external information to operate effectively.

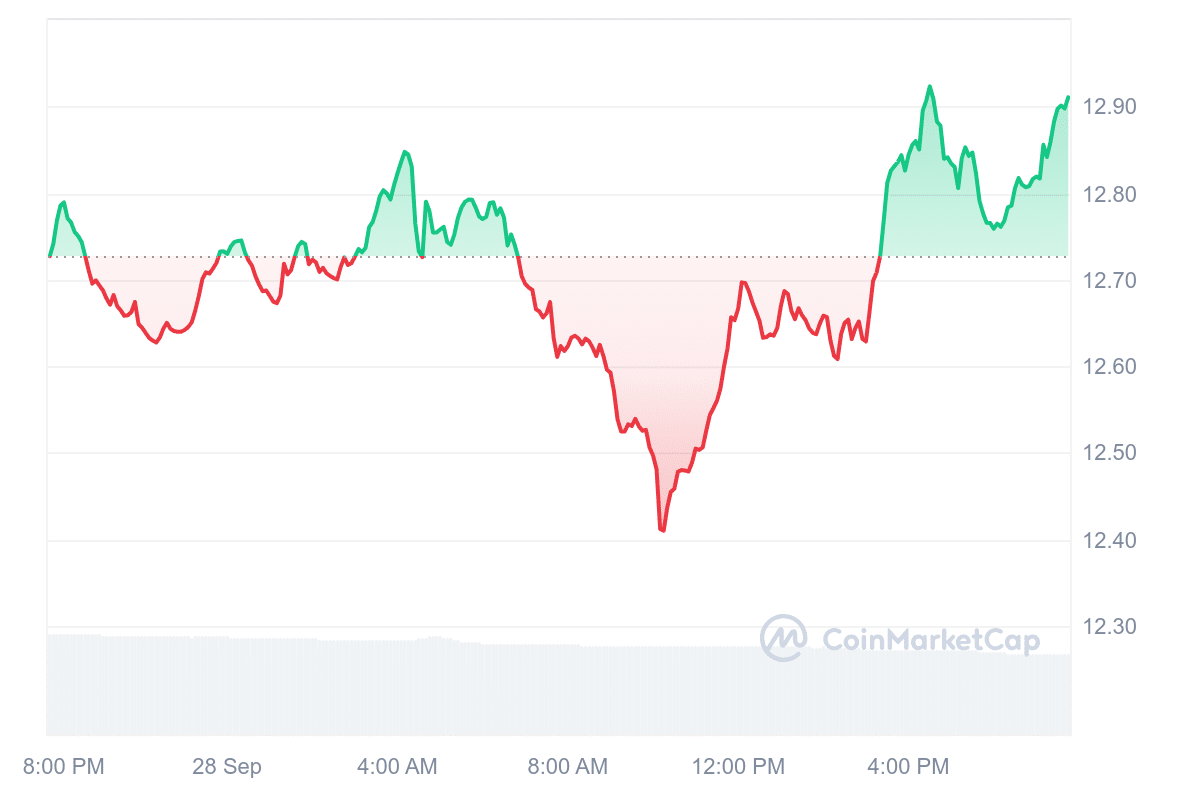

Chainlink is changing hands at $12.90 after a 0.97% intraday rally. Over the last year, its price has risen by 66%, showing strong growth. The token has also performed well compared to its initial sale price. In the past 30 days, Chainlink experienced 17 days (57%) where the closing price was higher than the opening, indicating a favorable market sentiment. It also displays strong liquidity, given its market capitalization.

The quality of data inputs and the security of oracle mechanisms delivering them onchain are integral to the security of dApps.

Find out the five security risks to look out for when choosing a blockchain oracle and how Chainlink mitigates them: https://t.co/hvlMTANId6

— Chainlink (@chainlink) September 28, 2024

Meanwhile, forecasts suggest that Chainlink’s price could rise by 8.93%, potentially reaching $13.92 by October 28, 2024. Although technical indicators currently suggest a neutral market sentiment, the Fear & Greed Index shows a rating of 64, indicating greed in the market. With 17 out of the last 30 days being positive and 6.11% price volatility, some consider this a reasonable time to buy Chainlink, though caution may still be warranted.

6. Pepe Unchained (PEPU)

Pepe Unchained (PEPU) is gaining traction in the crypto space, largely due to its successful presale and unique approach to attracting developers. With over $16 million already raised, the project aims to stand out by creating a Layer-2 network tailored for meme coins. This network promises faster transactions and reduced fees compared to Ethereum, with a strong focus on maintaining security.

A key component of Pepe Unchained’s strategy is its developer grant initiative, known as “Pepe Frens with Benefits.” Through this program, the project is encouraging the creation of decentralized apps (dApps), NFTs, and DeFi tools. By offering these grants, the team aims to ensure the platform is well-equipped with practical applications once it officially launches. This focus on developers during the presale phase could position Pepe Unchained to compete effectively in the expanding Layer-2 market.

For investors, Pepe Unchained is drawing increasing attention with its APY of 133%. Tokens are currently priced at $0.00988, and speculation around possible listings on major exchanges is driving momentum. Although the project has not provided specific details, hints of “Tier-1” exchange listings are generating anticipation.

Boom! $16M raised!

Pepe Unchained keeps smashing records, and we’re not slowing down! 🌊 pic.twitter.com/Qtkw0w0n85

— Pepe Unchained (@pepe_unchained) September 28, 2024

Additionally, interest from larger investors, or “crypto whales,” adds credibility to the project. Recent purchases of 23 ETH and 10 ETH reflect growing confidence, which is often considered a positive indicator of a project’s potential.

Visit Pepe Unchained Presale

Learn More

Most Searched Crypto Launch – Pepe Unchained

- Layer 2 Meme Coin Ecosystem

- Featured in Cointelegraph

- SolidProof & Coinsult Audited

- Staking Rewards – pepeunchained.com

- $10+ Million Raised at ICO – Ends Soon

Join Our Telegram channel to stay up to date on breaking news coverage