Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

Strong jobs report, oil, China, and an eventful week ahead

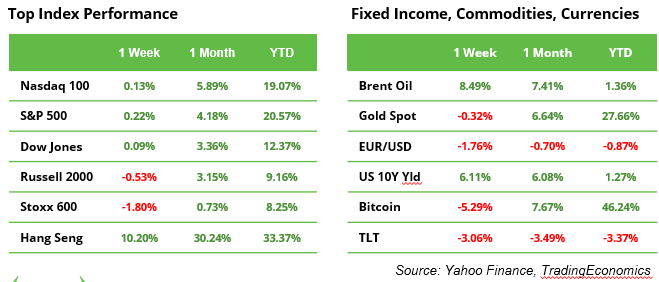

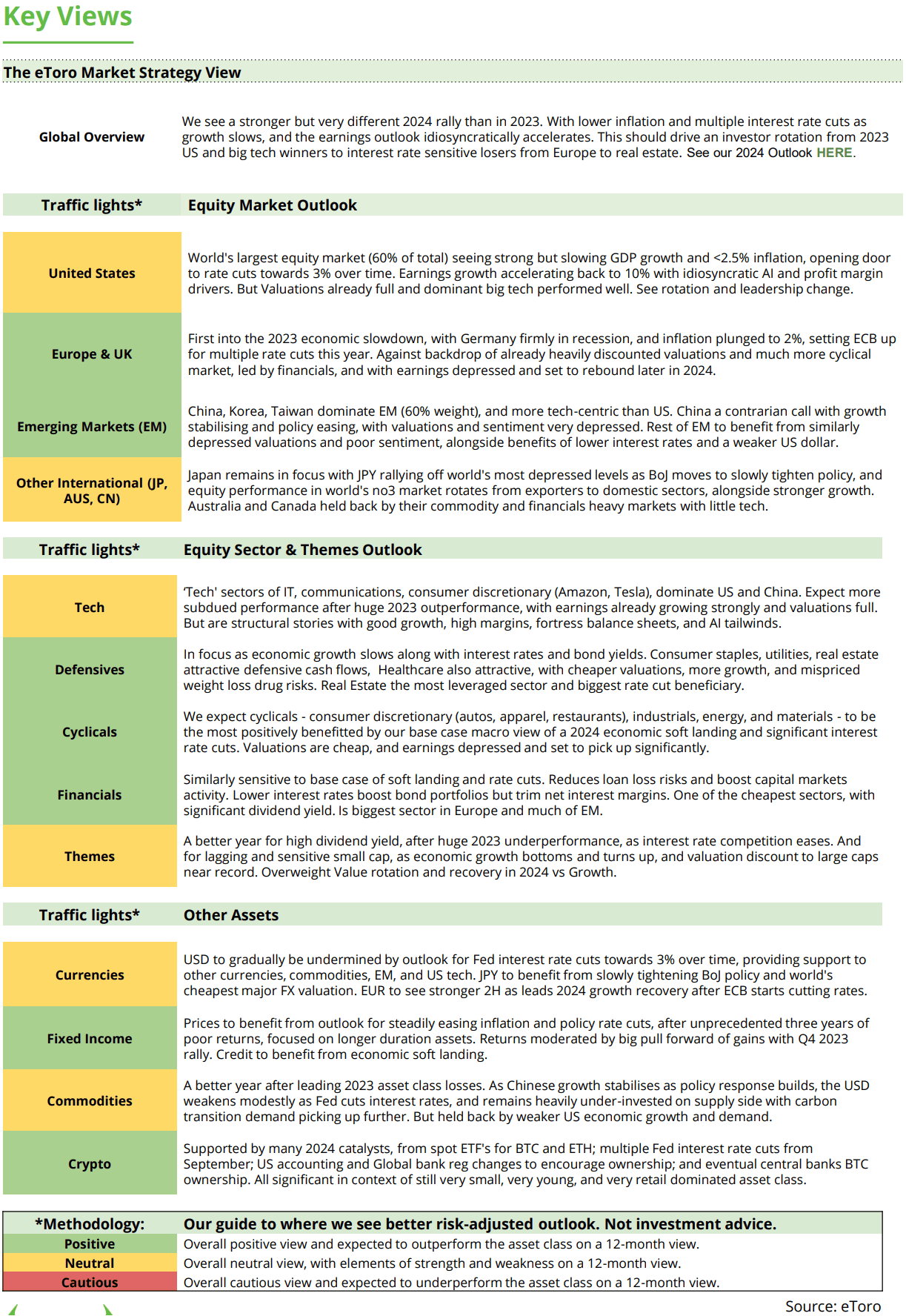

Last week ended with a bang as a new jobs report showed that US companies and the government collectively added 254K payrolls in September, significantly higher than the 150K expected, keeping unemployment down at 4.1%. This supports the Fed’s “goldilocks” scenario and keeps the prospect of a soft landing for the economy firmly on the table. Following the news, the US dollar strengthened to its highest level since mid-August, and the US 10-year interest rate rose by 13 basis points to 3.98%, moderating future rate cut expectations.

The most discussed topic, however, was the oil price, which rose 8.5% over the week due to fears that oil production sites may be drawn into the expanding conflict in the Middle East.

The biggest gainer last week was the Hang Seng Index, marking its second consecutive week at the top. The China-focused equity index added another 10%, bringing the total to +30% over the last thirty days. Investors are anticipating further increases in the Chinese government’s support package aimed at reviving the local economy.

This week is particularly eventful, with “Champions League” companies Amazon, TSMC, AMD, Tesla, and JP Morgan making headlines. JP Morgan will unofficially kick off the Q3 earnings season on Friday.

Oil prices rise most in one week since January 2023

The oil price has firmly reversed course. The price of a barrel of Brent rose to $78 from a recent low of $70 on Tuesday, while North American crude (WTI) climbed from $66 to $74 (see chart).

Overall, oil prices have been trending downward on speculation that Saudi Arabia, the world’s largest oil producer, may abandon its $100 per barrel price target in order to capture a greater market share—a move expected to materialise with an official increase in production levels at the upcoming OPEC+ meeting on 1 December. Additionally, lacklustre demand for oil was highlighted in an update from ExxonMobil, which stated that pressure on refining margins would significantly impact its Q3 earnings, due to be published on 1 November. However, higher-than-anticipated economic growth in key markets may reverse this trend.

Q3 earnings, what to expect?

Pepsico, Delta Airlines, JP Morgan, Wells Fargo, and Blackrock are amongst the first companies to report their financial results for the third quarter. As an average for the S&P 500, the market expects 4.7% revenue growth and 4.2% earnings growth, making Q3 stand out as the weakest quarter of the year. With earnings growth projected to bounce back to 14.6% in Q4 and moreover 14.9% for 2025, investors will be specifically focused on forward guidance to judge whether these high expectations can be maintained. Should the numbers fall short, the current P/E ratio of 21.4 may turn out to be too demanding. Risk is clearly on the downside. Another focus in the coming weeks is on rate-sensitive stocks in real estate, utilities, and healthcare, that have performed well recently.

Upcoming IPOs

Sentiment for new stock exchange listings appears to be cautiously improving. Cerebras, a competitor to NVIDIA, is aiming for a valuation of $7 to $8 billion through a Nasdaq listing. Online fashion retailer Shein is targeting a $60 billion valuation via a London listing. Meanwhile, Hyundai plans to raise $19 billion by listing shares of Hyundai Motor India in what would be the first car IPO in India since Maruti Suzuki’s in 2003. All three have filed their regulatory documents and may start trading in October.

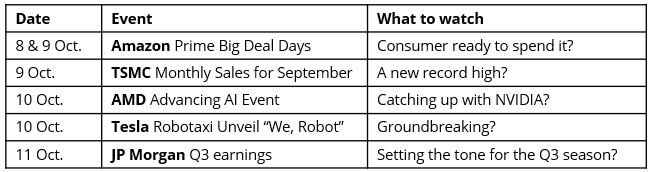

Earnings and events

Major macro release include Germany’s trade balance and US CPI and PPI.

This week is particularly eventful, with Amazon, TSMC, AMD, Tesla, and JP Morgan in focus.