It’s clear that Ethereum has become too diffuse with its layer 2s, especially when held against the lean, mean “Eth Killer” Solana. But is this a sign Ethereum will lag in this cycle, or will it rise as a top contender when the dust settles?

Ethereum has faced a storm of skepticism lately, with everyone from Bitcoin Maxis to Memecoin traders taking shots, while Solana is riding a fresh wave of momentum. Here’s what you should know of which will be the better hodl this cycle.

The Ethereum Struggle Vs. Solana

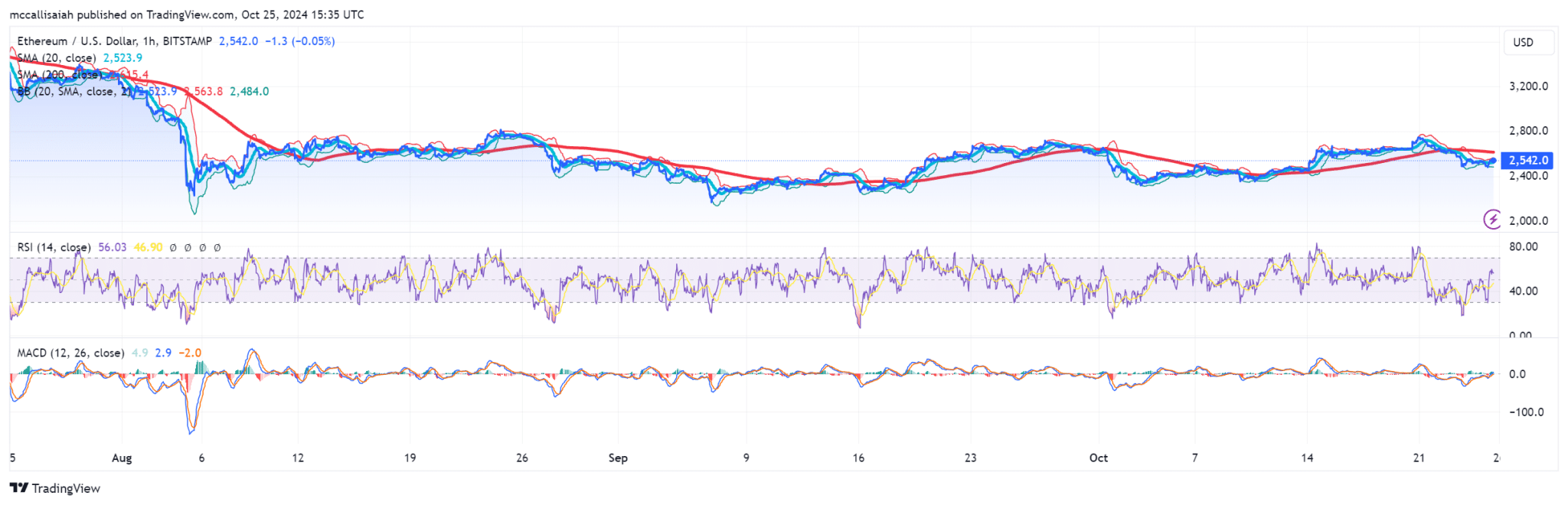

Still the heavyweight champ in the smart contract arena, Ethereum finds itself in troubled waters. Its value against Bitcoin has sunk to a point last seen over three years ago, reigniting investor anxiety. The blame is liquidity pouring Ethereum into other smart contract platforms like Solana.

“Ethereum remains the leading smart contract platform committed to true decentralization, with significant institutional adoption and developer activity,” emphasized Eric Connor, one of Ethereum’s core developers, as he defended the blockchain from its critics.

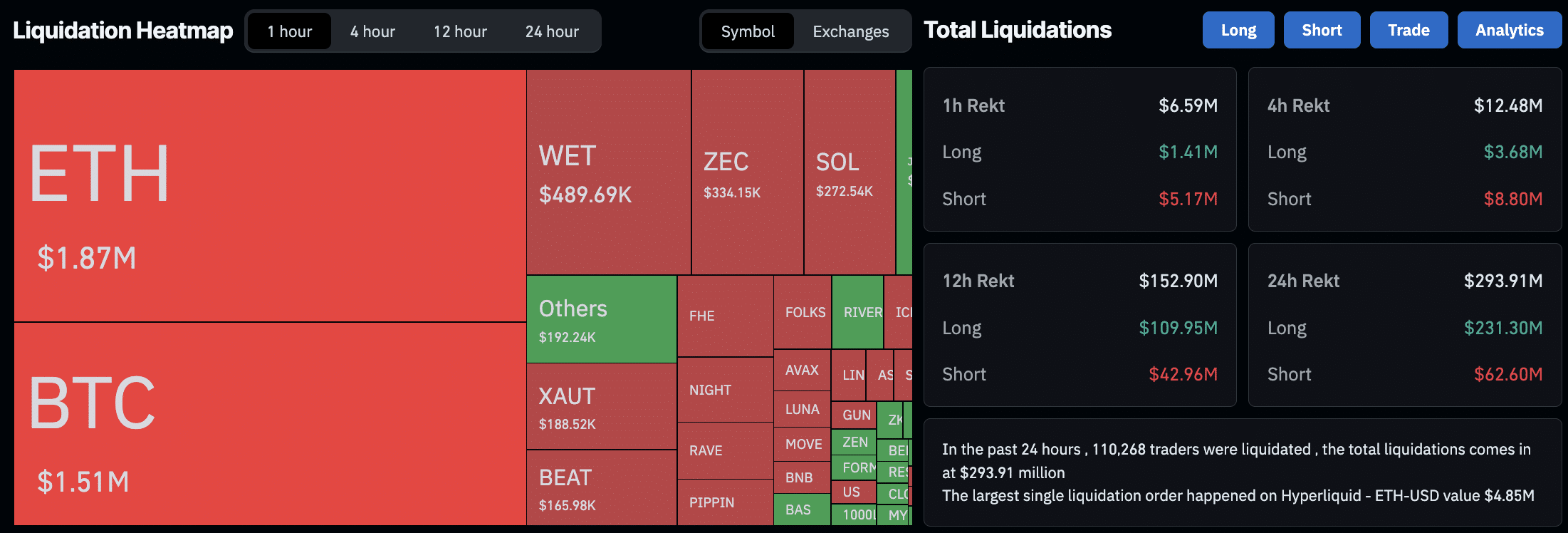

Ethereum finds itself in a bind, thanks to the emergence of layer-2 solutions and rival platforms draining its liquidity and users. This has stalled ETH’s momentum, dragging its price below the $2,500 mark while Bitcoin strides ahead in recovery. So is Ethereum screwed? Yes and no.

In this cycle, DO NOT expect Ethereum to outperform Bitcoin or any trending altcoins like Solana, Sui, and Kaspa.

However, Vitalik Buterin and company have made a bet with the proliferation of L2s that will take years to pay off; it won’t be immediate.

Ethereum is in deep trouble

UNI moving off-chain is only the final nail in the coffin, all apps are moving to competing L1s & L2s instead

Collapsing ETH revenue, UNI was ETH's biggest fee-paying customer!

Now ETH is being left behind, irrelevant & broken; Ethereum is cooked

… pic.twitter.com/AY55IShcoD

— Justin Bons (@Justin_Bons) October 14, 2024

Ethereum is the backbone of what is eventually going to be a fully digital commercial infrastructure. I get it. It is also the most boring hold in crypto. It’s not going to the moon; the ETFs only slow it down, and as far as solid layer ones go, there is maybe average interest in it. It’s like mining iron while everybody else is mining gold or diamonds.

You keep thinking about all the things that need iron, and yet you will never be as excited as the fools who get up every morning, thinking it might be the day that changes everything.

DISCOVER: These 100X Cryptocurrencies Could Change Everything for Your Portfolio This Run

The Road Ahead For SOL & ETH

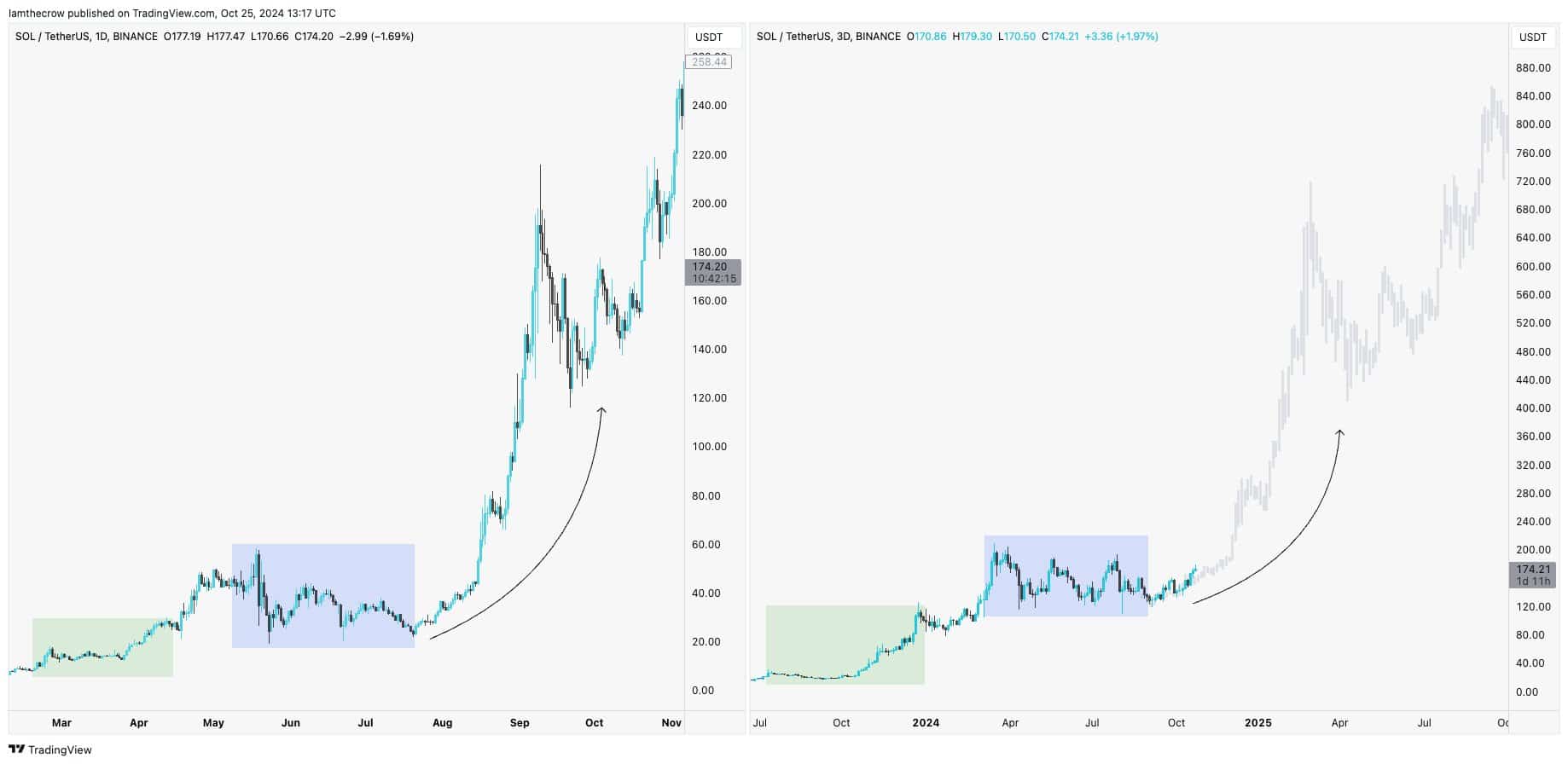

In stark contrast, Solana’s been blazing its own trail, rocketing up 17% this week alone. 99Bitcoin’s analysts point to a lure from Solana’s vibrant ecosystem and dirt-cheap transaction fees. The meme coin frenzy on Solana only adds fuel to the fire, stealing Ethereum’s thunder.

The journey for Solana isn’t without hurdles—recent sell-offs by big players like Pump Fun, which sold 40,000 SOL this week, have put pressure on its price. Still, analysts are betting on Solana’s resilience, noting its knack for soaking up new supply and keeping traders hooked, hinting at a robust future ahead.

In closing, the Tl;dr is that the FUD against Ethereum is warranted.

But this is also a bottom signal for anyone longing for Ethereum. At 99Bitcoins, we sometimes find it helpful to counter trade sentiment, and a barrage of negativity can often be a tell for bottom signals.

As both Ethereum and Solana fight for supremacy and innovation, those holding the purse strings and the code must stay vigilant as the scene evolves.

DISCOVER: Would a Kamala Presidency Really Kill Crypto? You Might Be Surprised

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Why is Capital Rotating From ETH to Solana? Pump.Fun Sell Pressure Knocks ETH Foundation Selling Out The Park appeared first on .