Following Donald Trump’s re-election, markets responded with remarkable enthusiasm, particularly within the cryptocurrency and financial sectors, where significant gains were recorded. Bitcoin soared to a new high of over $75,000, marking an 8% increase. Other digital assets, such as Ethereum and Dogecoin, also experienced notable boosts, with Dogecoin jumping up to 18%.

Trump’s shift from crypto skepticism to a pro-crypto stance has invigorated market sentiment, and his re-election brings fresh optimism for regulatory changes in favor of digital currencies. He has voiced intentions to make the United States the “crypto capital of the planet,” establishing a national Bitcoin reserve and proposing light regulatory oversight. Trump also plans to oust current SEC Chair Gary Gensler, whom he considers a hurdle to crypto innovation.

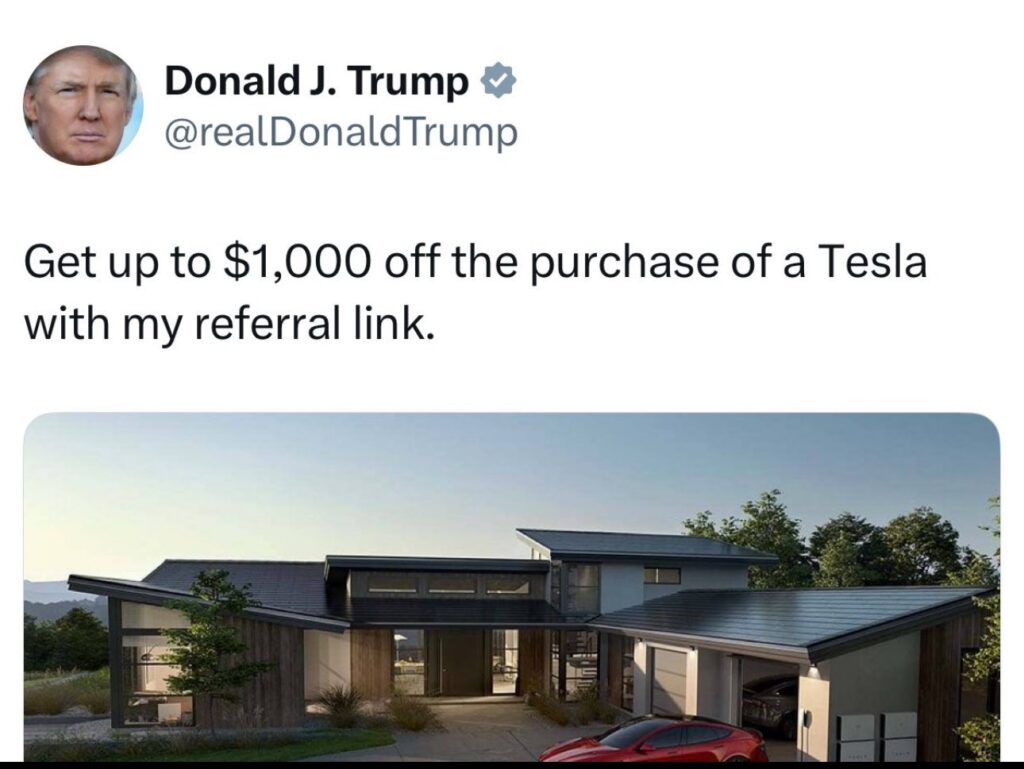

Crypto-related stocks followed the upward trend. Coinbase jumped by 22.7%, and MicroStrategy, a major corporate Bitcoin holder, saw a rise of around 10%. Shares in Tesla, a company whose CEO Elon Musk is one of Trump’s most prominent supporters, surged by 15%, contributing to CEO Musk’s increase in net worth by roughly $14 billion.

Financial stocks also benefitted, with notable gains across major banks like JPMorgan, Wells Fargo, and Goldman Sachs. Trump’s plans for deregulation and corporate tax cuts are anticipated to promote growth in the financial sector, potentially easing restrictions that could spur mergers and acquisitions.

While the cryptocurrency and banking sectors thrived, clean energy stocks took a hit. Companies focused on renewable energy, such as First Solar and Enphase Energy, faced double-digit declines, as Trump’s energy policies lean heavily toward fossil fuels, possibly reversing recent renewable energy incentives.

The broader U.S. stock market indices followed suit with notable gains; the S&P 500, Dow Jones Industrial Average, and Nasdaq all rose. Nonetheless, concerns about inflation persist, fueled by Trump’s stance on increasing tariffs on imports, a move that could push consumer prices higher.

Trump’s re-election is shaping a new era in the cryptocurrency and financial sectors. The market’s response underscores widespread anticipation for a regulatory shift, potentially positioning the U.S. as a leading crypto-friendly nation.