With the Bitcoin price stuck in the mid-$90,000s and the market bracing for a flood of economic updates, Wall Street is already celebrating.

The S&P 500 and Dow Jones broke new ground, ignoring the usual anxiety traps of trade disputes and faltering economies. Not to be outdone, the Nasdaq 100 rallied on tech and consumer wins, while utilities—the market’s dark horse—silently overshot forecasts and left analysts blinking.

Key Economic Events to Watch As Bitcoin Price Crabs

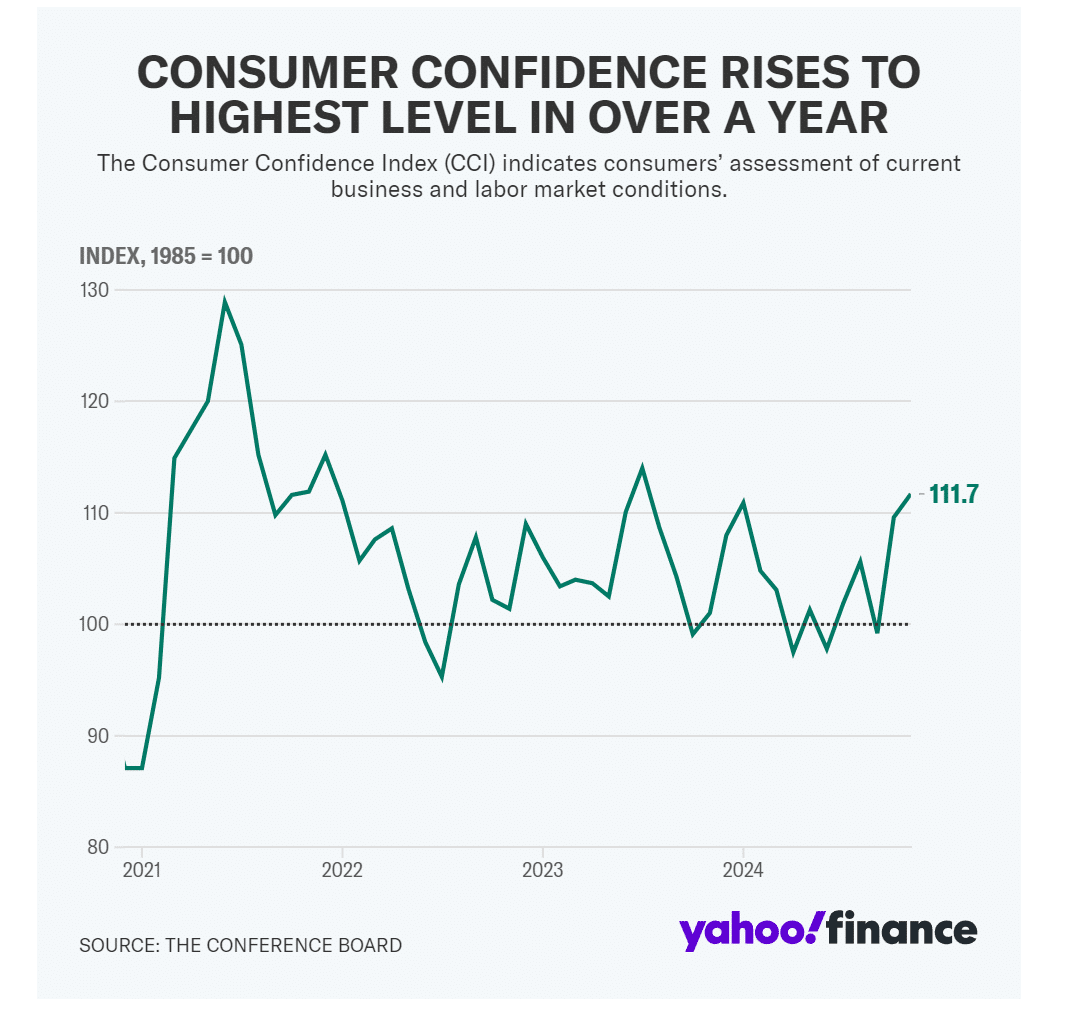

The U.S. economic calendar is stacked this week, and it’s all about the numbers that could twist market sentiment. U.S. consumer data kicked off the action with Tuesday bringing updates on consumer confidence, new home sales, and the Richmond Manufacturing Index—a quick pulse check on spending habits and economic momentum.

By midweek, the focus shifts abroad with Australia’s inflation stats and the RBNZ’s policy move.

Back in the U.S., a torrent of reports will drop—GDP projections, durable goods data, and the coveted core PCE price index—all capped with the FOMC meeting minutes.

The recent FOMC indicated that the Federal Reserve could pause interest rate cuts if inflation doesn’t slow down.

EXPLORE: 20 Next Cryptocurrencies to Explode in 2024

Record Highs Amid Mixed Global Signals

Even though US stocks are pumping the rest of the world is hurting. This week, New Zealand’s central bank takes the spotlight with a 50-basis-point rate cut on deck, bringing policy rates to 4.25%.

Inflation might be losing steam there, but unemployment’s tick up to 4.8% signals an economy softening at the edges. Across the map, Japan’s inflation story unfolds Friday with a predicted 2% pop in Tokyo’s Core CPI, setting the tone for further shifts nationally.

India to overtake Japan and become the world’s 4th largest economy next year. pic.twitter.com/VzLdPThLAo

— Globe Eye News (@GlobeEyeNews) November 18, 2024

Over in the eurozone, inflation data shows a projected 2.8% for core rates, keeping traders locked onto ECB signals.

BTC ETFs Are Seeing Massive Outflows

Boomers will always Boomer, and they are taking out their 1.2X on the Bitcoin ETFs.

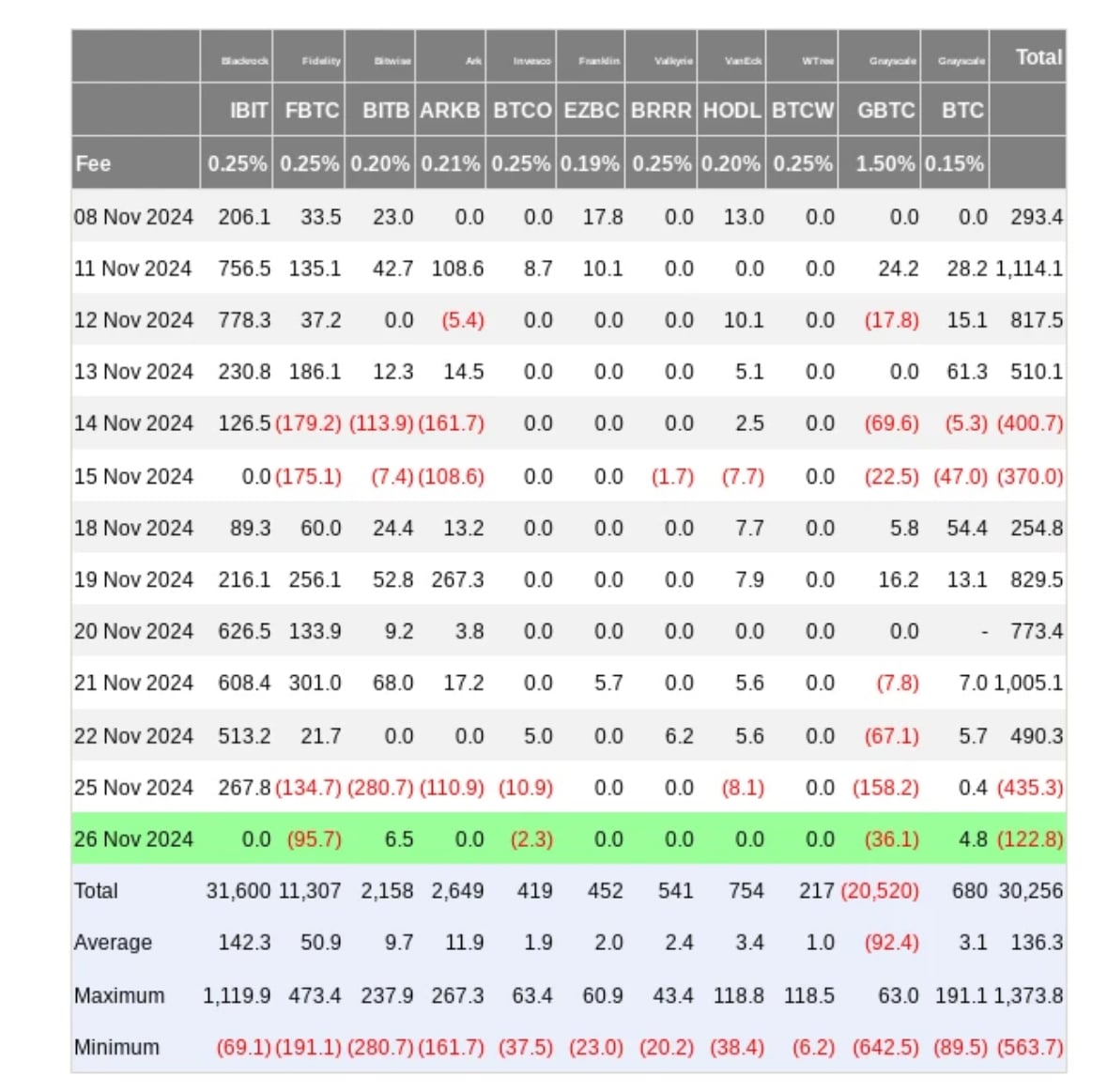

Although Bitcoin ETFs have become the best-performing ETFs in history, Monday hit the Bitcoin ETF market like a gut punch, with $438 million bleeding out. This ended a five-day streak that funneled in $3.4 billion. Bitcoin’s brief dalliance with $100,000 crumbled as its price slid to $94,515, a 3.55% loss in just 24 hours.

It’s over. The top is in. Bitwise’s BITB felt the brunt of it, dumping $280 million, followed by Grayscale’s GBTC shedding $158.2 million. Fidelity’s FBTC dropped $134.7 million, and Ark’s ARKB bled out another $110.9 million. Still, BlackRock’s IBIT stood tall, raking in a cool $267.8 million, keeping some optimism afloat.

99Bitcoins analysts believe these ETF investors are rebalancing, as we saw a similar outflow around Nov. 14-15 after a new ATH.

EXPLORE: Crypto Crash Sends Shockwaves Through Market: Why Is Bitcoin Down and Is the Bull Run Over?

Lastly, Could Michael Saylor Crash the Bitcoin Price?

One last event making its way around the horn is Michael Saylor is looking like this season’s main character, and you know what happens to main characters in crypto.

The MicroStrategy founder is drastically increasing his average in Bitcoin. Some speculate that if the BTC price collapses, this will be the next FTX.

Saylor is betting the farm on Bitcoin, and history doesn’t repeat, but it sometimes rhymes.

Here’s how the story goes: In 2000, MicroStrategy was a rising star in data analytics. The stock went parabolic, and CEO Michael Saylor became a billionaire overnight. Then… reality check. They announced revenue restatements. Investors saw the scam, and the stock crashed over 99%.

It’s one of the biggest busts of the dot-com era.

Fast forward 20 years. MicroStrategy’s still around, but low-key. Then Saylor gets a new obsession: Bitcoin. He starts stacking BTC like his life depends on it. Corporate treasury? Converts it to Bitcoin. Takes out loans? Buys Bitcoin. Does it sell more stock? You guessed it: Bitcoin.

BTC hits $69K, and he’s hailed as a genius.

We’ll pause for a second here because Saylor is an important figure in the Bitcoin community. He supported it when others called it a scam.

But MacroStrategy’s stock price doesn’t track the business; it tracks Bitcoin. Their balance sheet is now basically a leveraged BTC ETF. If BTC drops below its average buy price, margin calls start knocking.

Thankfully, and by a wide margin, this goofy data analytics company is running circles around the competition with its BTC investing strategy. Institutions like MicroStrategy buy Bitcoin over the counter. The thing is, the OTC reserves are running out of Bitcoin, and miners are not producing enough.

If things continue this way, the squeeze past $100k Bitcoin is going to be epic.

We’ll continue to monitor whether global macroeconomic events will support Bitcoin or keep it in price limbo.

EXPLORE: 20 New Crypto Coins to Invest in 2024

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Could US Preliminary GDP Data Trigger Reversal in Bitcoin Price? appeared first on .