Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

Risk appetite continues amid market gains

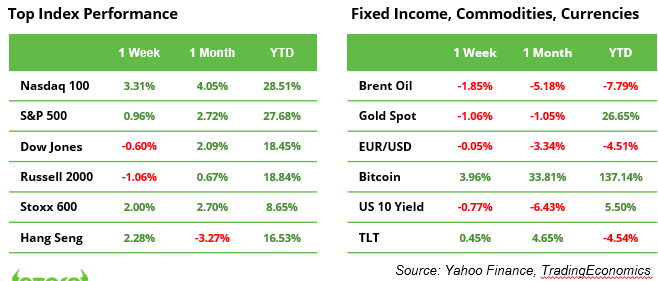

Last week saw a continued appetite for risk, with the Nasdaq 100 rising 3.3%, the S&P 500 hitting a record high of 6,090, and Bitcoin finally surpassing the $100,000 mark. Investor sentiment was bolstered by a strong November jobs report, which showed the U.S. added 227K jobs (October: 36K) and unemployment fell to 4.2%. The market’s primary focus this week will be the ECB rate decision on Thursday. Analysts are divided between a 25 or 50 basis point cut. Meanwhile, in the U.S., the inflation report (CPI) will provide the final data point before the Fed’s meeting next week, where markets are pricing in an 83% chance of a 25 basis point cut.

Despite elevated equity valuations and soaring cryptocurrency prices, selling pressure in the current market appears limited. Many anticipated risks have not materialised, including chaos around the U.S. elections, escalating geopolitical tensions, major cybersecurity breaches, significant climate disasters, or a consumer spending slowdown. However, risks remain. The most immediate concern appears to be the potential for another European debt crisis.

Santa rally: investors feel validated

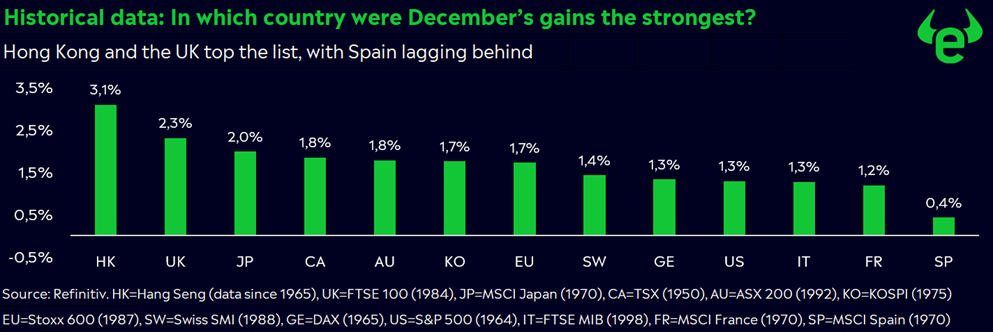

December is traditionally a strong month for stock markets, with the so-called “Santa rally“, a seasonal rise in prices, becoming a globally recognised phenomenon. According to our analysis, Hong Kong and the UK (see chart) present the best opportunities for above-average gains.

Notably, December accounts for a significant portion of annual returns in some regions. Italy leads the pack, with the month contributing an impressive 39% of yearly gains. The UK follows closely at 36%, while Japan records 32%. Europe also performs well, averaging 29%, though the US lags behind, with December adding just 16% to annual returns.

Although past performance is no guarantee of future results, the data suggests that investing during December can be rewarding. Investors who maintain their positions during the holiday season may benefit from these seasonal trends, even as each year brings unique challenges.

Current uncertainties include Trump’s unpredictable trade policies, sluggish economic growth in Europe and China, and political turmoil in countries like France and Germany. Yet, the rally continues despite these risks. Investor confidence remains high: the S&P 500 volatility index dropped to nearly 13, while the DAX climbed an impressive 4% last week.

ECB rate decision: Trump adds uncertainty to the mix

So the year-end rally is gaining momentum, with the DAX posting its strongest gains since September. This week, the European Central Bank (ECB) holds the key to determining the market’s next moves. Its decision could either extend the rally or bring it to a sudden halt.

As the ECB continues its rate-cutting cycle, the primary question remains: how much lower will rates go? A clear roadmap is unlikely to emerge from this meeting, as ECB President Christine Lagarde is expected to sidestep addressing the most pressing issues. Investors should temper their expectations for concrete guidance.

Adding further complexity is the unpredictable factor of Donald Trump. Potentially higher tariffs could have an inflationary effect, creating additional challenges for policymakers. Trump’s trade policies remain a significant wildcard in an already uncertain economic landscape. As a result, the ECB may opt to buy more time to assess the broader economic impact before committing to further actions.

A 25 basis point rate cut seems most likely, with markets anticipating a drop in the benchmark rate to 1.75% by the end of 2025. Such a move could ignite a virtuous cycle: increased lending, higher investment, and rising consumption may provide a sustainable boost to economic growth, even amid persistent uncertainties.

Upcoming: eToro’s annual investment outlook 2025

This week, eToro’s team of market analysts will release its annual investment outlook. As part of the Digest & Invest series, a detailed YouTube video (also available as a podcast) will highlight key takeaways for 2024, major market drivers anticipated in 2025, and in-depth analyses of Europe and the U.S. The report will also include an updated investment outlook for all major asset classes and feature insights from a global poll of over 3,000 retail investors. Don’t miss this comprehensive guide to navigating the markets in the year ahead!

Data releases and earnings reports

Macro data:

U.S. CPI (11/12), ECB monetary policy meeting + speech Lagarde (12/12)

Earnings:

Oracle (9/12), Gamestop (10/12), Adobe (11/12), Broadcom, Costco (12/12)