The launch of Bitcoin ETFs in January 2024 was heralded as a groundbreaking moment for the market. Many expected these products to open the floodgates for institutional capital and catapult Bitcoin prices to new heights. But now, a year later, have Bitcoin ETFs delivered on their promise?

For a more in-depth look into this topic, check out a recent YouTube video here: Have Bitcoin ETFs Lived Up to Expectations?

A Strong Start

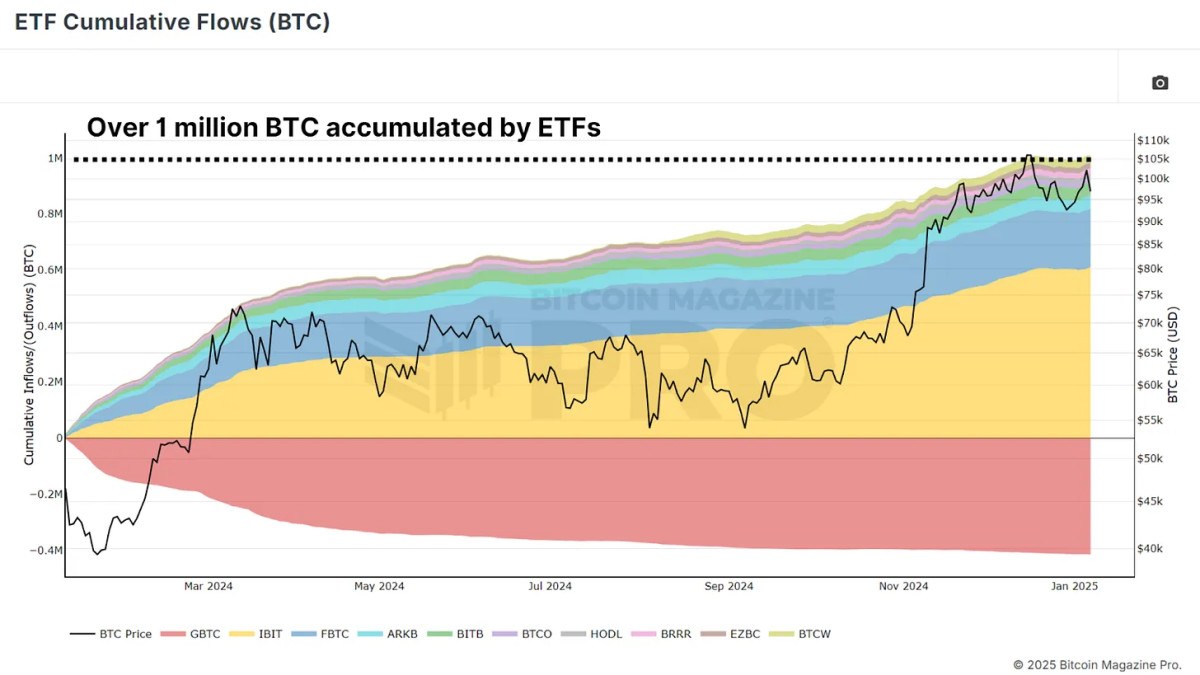

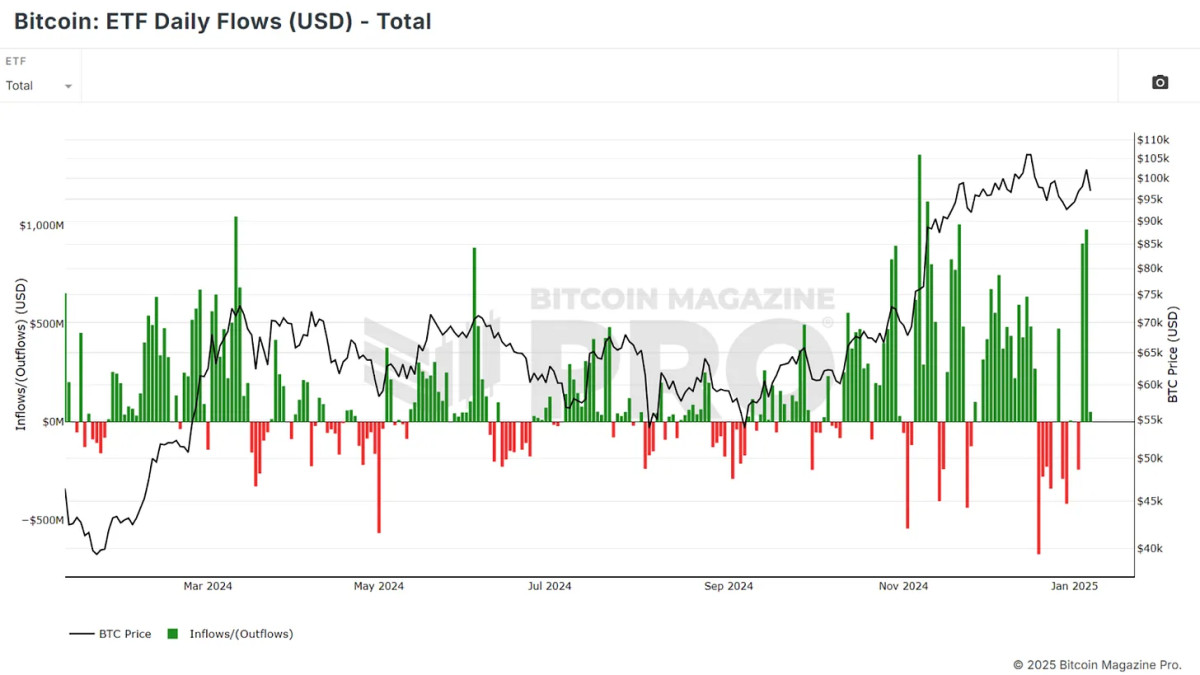

Since their launch, Bitcoin ETFs have accumulated over 1 million BTC, equivalent to approximately $40 billion in assets under management. Even when accounting for outflows from competing products like the Grayscale Bitcoin Trust (GBTC), which saw withdrawals of over 400,000 BTC, the net inflows remain significant at about 540,000 BTC.

View Live Chart 🔍

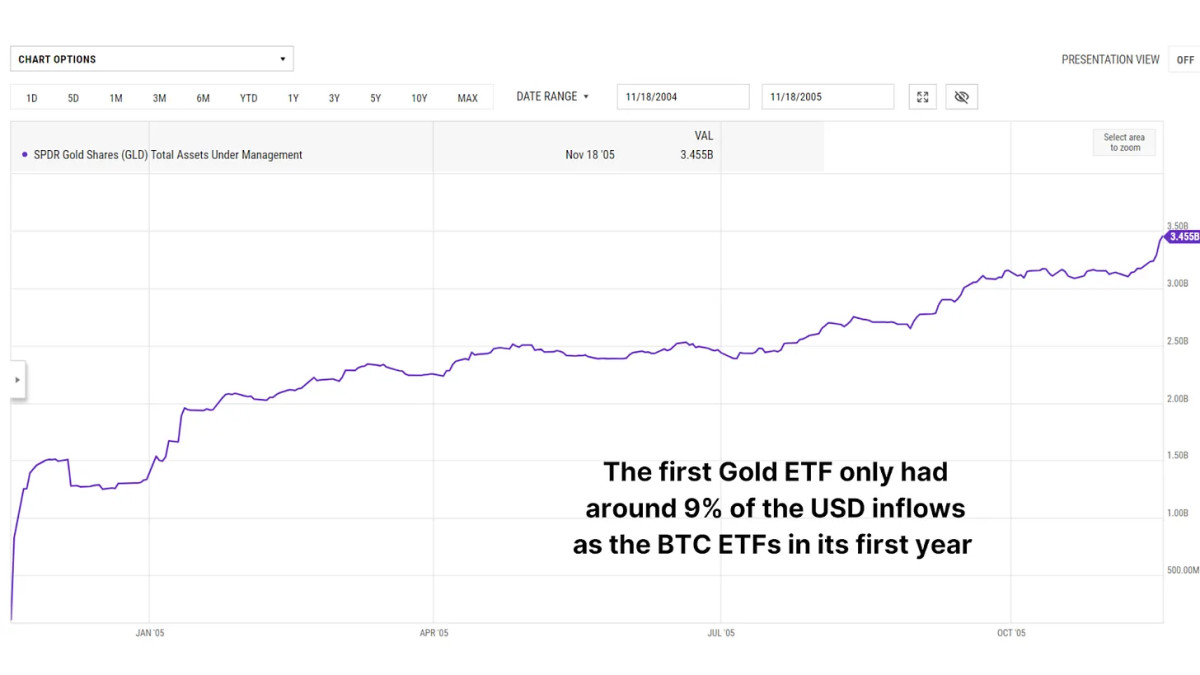

To put this into perspective, the scale of inflows far exceeds what we witnessed during the launch of the first gold ETFs in 2004. Gold ETFs garnered $3.45 billion in their first year, a fraction of Bitcoin ETFs’ $37.5 billion in inflows over the same period. This highlights the intense institutional interest in Bitcoin as a financial asset.

Bitcoin’s Year of Growth

Following the launch of Bitcoin ETFs, initial price movements were underwhelming, with Bitcoin briefly declining by nearly 20% in a “buy the rumor, sell the news” scenario. However, this bearish trend quickly reversed. Over the past year, Bitcoin prices have risen by approximately 120%, reaching new heights. For comparison, the first year following the launch of gold ETFs saw a modest 9% price increase for gold.

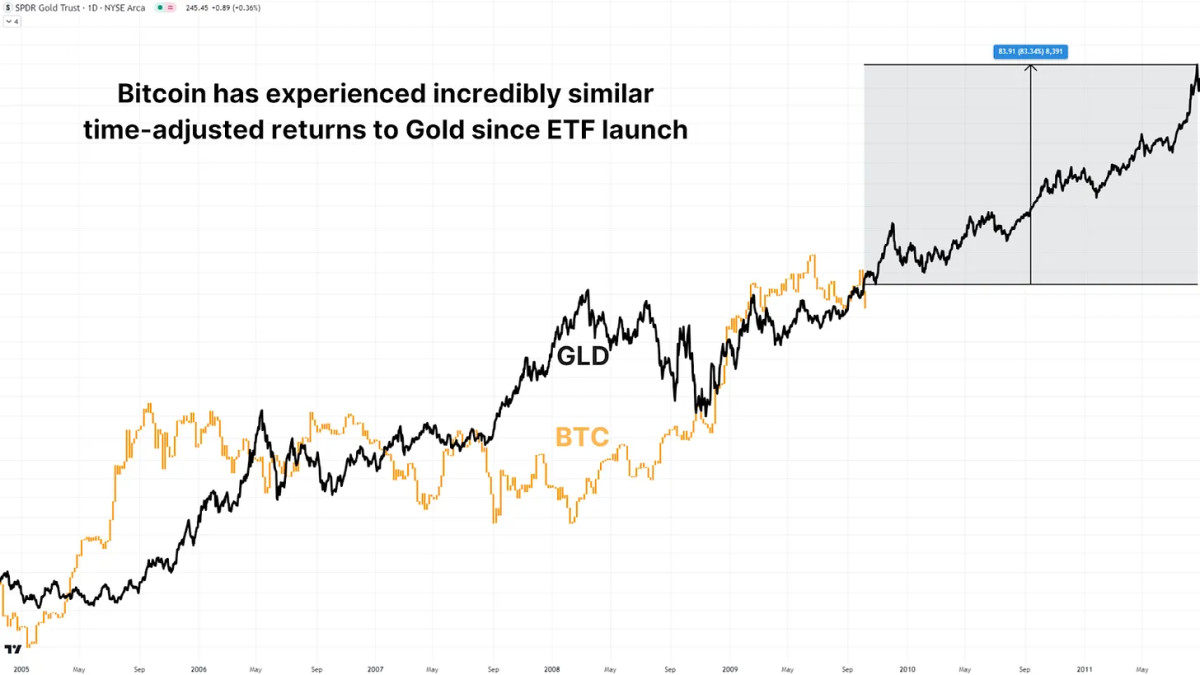

Following the Gold Fractal

When accounting for Bitcoin’s 24/7 trading schedule, which results in roughly 5.3 times more yearly trading hours than gold, a striking similarity emerges. By overlaying Bitcoin’s first year of ETF price action with gold’s historical data (adjusted for trading hours), we can see almost the same % returns. If Bitcoin continues to follow gold’s pattern, we could see an additional 83% price increase by mid-2025, potentially pushing Bitcoin’s price to around $188,000.

Institutional Strategy

One intriguing insight from Bitcoin ETFs has been the relationship between fund inflows and price movements. A simple strategy of buying Bitcoin on days with positive ETF inflows and selling on days with outflows has consistently outperformed a traditional buy-and-hold approach. From January 2024 to today, this strategy has returned 130%, compared to ~100% for a buy-and-hold investor, an outperformance of nearly 10%.

View Live Chart 🔍

For more information on this institutional inflow strategy, watch the following video:

Using ETF Data to Outperform Bitcoin [Must Watch]

Supply and Demand Dynamics

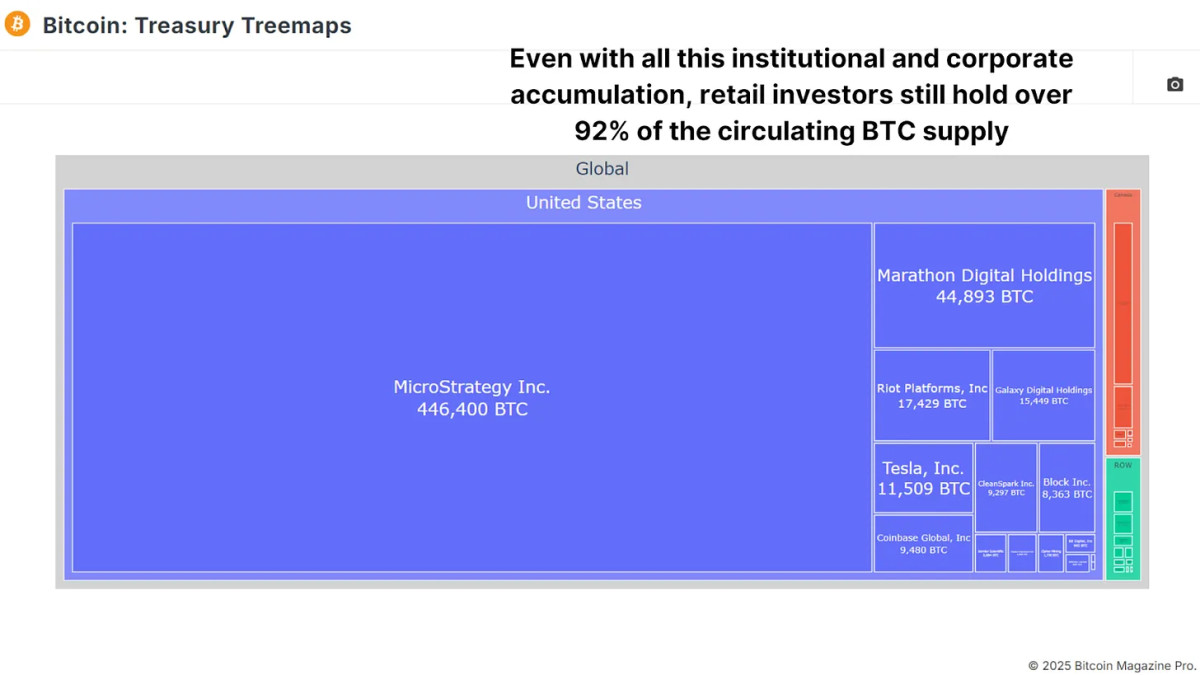

While Bitcoin ETFs have accumulated over 1 million BTC, this represents only a small fraction of Bitcoin’s total circulating supply of 19.8 million BTC. Corporations like MicroStrategy have also contributed to institutional adoption, collectively holding hundreds of thousands of BTC. Yet, the majority of Bitcoin remains in the hands of individual investors, ensuring that market dynamics are still driven by decentralized supply and demand.

View Live Chart 🔍

Conclusion

One year in, Bitcoin ETFs have exceeded expectations. With billions in inflows, a significant impact on price appreciation, and increasing institutional adoption, they have solidified their role as a key driver of Bitcoin’s market narrative. While some early skeptics were disappointed by the lack of immediate explosive price action, the long-term outlook remains highly bullish.

The comparisons to gold ETFs provide a compelling roadmap for Bitcoin’s future. If the gold fractal holds true, we could be on the cusp of another major rally. Coupled with favorable macroeconomic conditions and growing institutional interest, Bitcoin’s future looks brighter than ever.

Explore live data, charts, indicators, and in-depth research to stay ahead of Bitcoin’s price action at Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.