The Daily Breakdown takes a look at US stocks ahead of the monthly CPI report, which could be a market-moving event this week.

Thursday’s TLDR

- Inflation report due up today

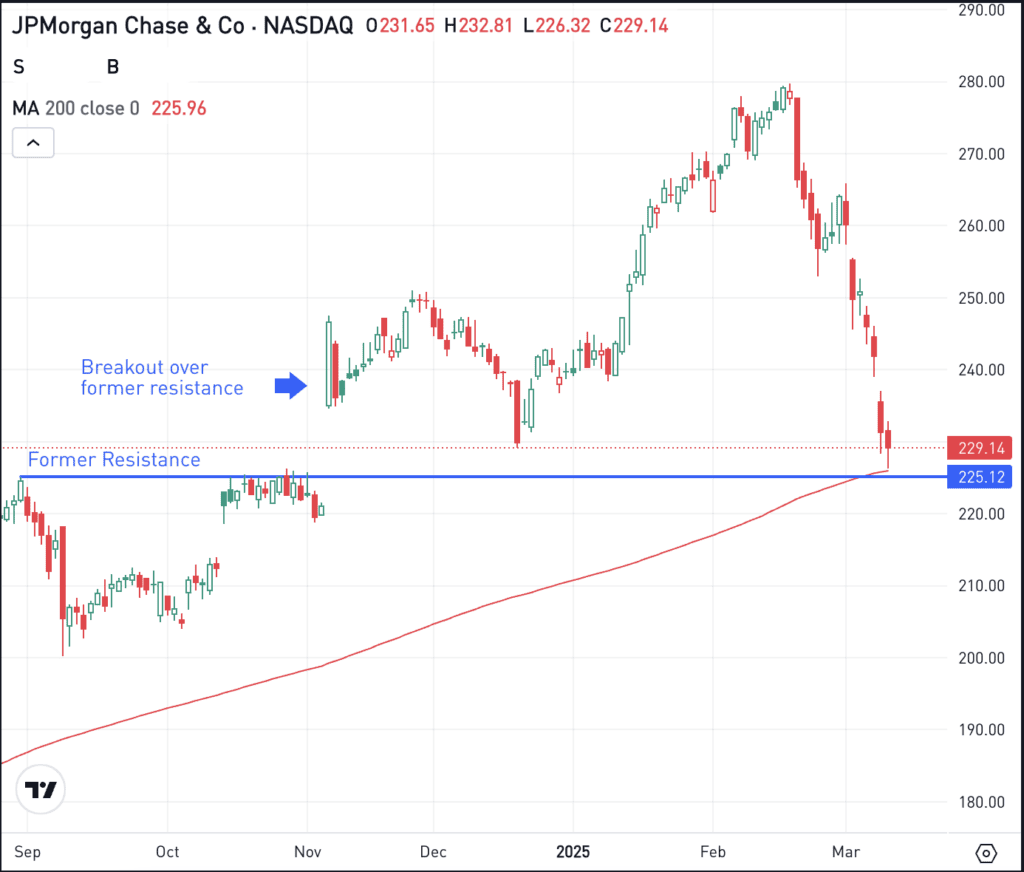

- JPM looks for technical support

- Delta’s disappointing news

What’s happening?

Markets tried to muster up a rally yesterday and came up short, with the S&P 500 and Nasdaq 100 falling 0.8% and 0.3%, respectively. On the plus side, Bitcoin gained more than 5% and tech — while it still fell on the day — outperformed the S&P 500.

Now we’re seeing some follow-through in this morning’s pre-market action, with US indices up about 1%.

There’s just one problem: Inflation.

Today’s inflation numbers drop at 8:30 a.m. with the CPI report. It’s one of two major reports each month that shed light on inflation (the other is the PCE report, which the Fed puts more focus on).

Wall Street fears that inflation is coming back to life at a time where economic strength is deteriorating. An in-line or lower result may give them some relief about that worry, while a higher-than-expected number may fan the flames a bit more.

In either case, it’s all about the reaction to the news.

If this morning’s pre-market rally can carry over to the regular session and gain steam today, perhaps stocks can put together a multi-day rally and finish the week on a stronger note.

However, that possibility loses steam if this morning’s rally falters and stocks react poorly to the inflation report.

Want to receive these insights straight to your inbox?

Sign up here

The setup — JPMorgan

Known as one of the highest quality banking stocks out there, JPMorgan and the financial space has succumbed to the market’s recent selling pressure.

Shares have fallen nearly 20% from their record highs in mid-February, tumbling to a key level on the charts. That’s as JPM tests down into its 200-day moving average and a prior breakout level.

JPMorgan fell hard into what could be a key technical area. If support holds up near $225, then we could see a larger bounce to the upside. On the flip side, support failing could lead to more volatility and selling pressure in the short term.

Shares of JPM trade at roughly 12.5 times forward earnings, well below the S&P 500’s valuation of about 20 times earnings and slightly above its long-term average of about 11.5 times earnings. However, analysts expect roughly flat earnings growth this year, which may be a turn-off for some investors even if JPM is considered a high-quality company.

Options

For options traders, calls or bull call spreads could be one way to speculate on support holding. In this scenario, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

DAL – Delta Air Lines shares tumbled as management slashed its revenue and profit outlook for Q1, citing “macro uncertainty” as its reasoning. American Airlines shares also fell as it reduced its outlook as well, while travel-related stocks like Disney, Uber, Expedia and others were also under pressure because of the news.

INTC – Shares of Intel are in focus this morning, rising more than 5% in pre-market trading on reports that Taiwan Semi has approached chip companies to form a joint venture (JV) and operate the foundry unit. Investors are hopeful that TSMC could also help Intel amid its recent slide.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.