Analyst Weekly, March 31, 2025

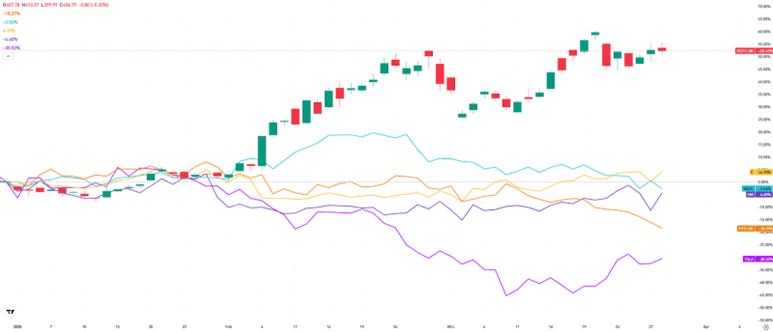

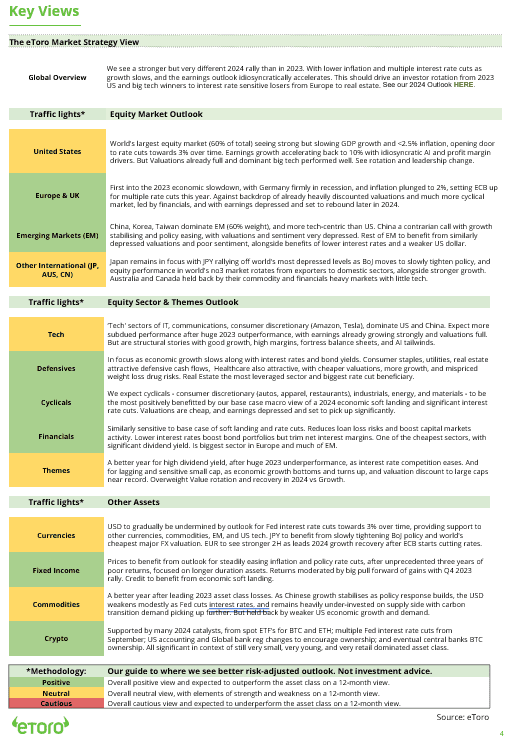

The winds of trade war are picking up again – but this time, they’re blowing in from both Washington and Beijing. As the US ramps up tariffs ahead of “Liberation Day,” China is quietly shoring up its defences. And investors are left to rethink which sectors, strategies, and stocks still make sense in a world where policy is driving the market.

Tariff Tantrums- Trump’s Pre-game Show

Although April 2- aka “Liberation Day”- is billed as Trump’s big trade policy drop; he already fired two major shots last week:

1. 25% Auto Tariffs Incoming: Starting April 3, imported cars and certain auto parts will get hit with new tariffs. That includes parts from Canada and Mexico. These surprise measures come despite earlier signals that sector-specific tariffs were unlikely. Markets? Not thrilled. Automakers like General Motors (GM) and Toyota (TM) felt the pressure.

2.Oil-for-Tariff Swap: Trump also announced 25% tariffs on imports from countries that buy oil from Venezuela. India’s Reliance Industries immediately backed out; China hasn’t – yet. If it doesn’t, total US tariffs on Chinese imports could rise to a whopping 45%, following previous hikes.

Reciprocal Tariffs Expected (2 Apr.): The big reveal? Matching (and taxing) other countries’ tariff rates, VATs, and non-tariff barriers. If enacted fully, this could add up to est. $165 bil. in new tariffs (on top of $50 bil. from reciprocal only), disproportionately hitting Mexico, Ireland, and Vietnam. And since VATs are sticky, this could turn into a permanent tariff regime – not just a negotiating tactic.

WHAT IT MEANS FOR INVESTORS

Amid trade uncertainties, the services sector emerges as a beacon of stability. Companies less tethered to global supply chains are better positioned to weather tariff-induced disruptions.

- Companies that are pro-border-adjustable tax (winners): Boeing (BA), General Electric (GE), Caterpillar (CAT), financials such as Bank of America (BAC), JP Morgan (JPM), Mastercard (MA), Prudential (PRU.L).

- Companies which are anti-border-adjustable tax (losers): Walmart (WMT), Nike (NKE), Gap (GAP)., Toyota (TM).

China- Stimulating From The Shadows

While the US is tightening the screws on trade, China is building its economic moat. Beijing is injecting a massive $72 bil. into four major state-owned banks – Bank of China, China Construction Bank, Bank of Communications, and Postal Savings Bank.

- The goal? Shore up capital, boost domestic lending, and cushion the blow from slowing exports, a deflating property market, and yes – rising tariffs. From an investments point of view, it’s also a reminder that China’s megabanks aren’t just lenders – they’re policy engines, channeling capital into government-backed priorities like infrastructure, green energy, and tech innovation.

Car tariffs push investors into defensive mode

The US trade tariff fears are back: Trump has announced 25% tariffs on car imports, set to take effect on 2nd April. Tariffs are essentially additional costs. Carmakers can pass these costs on to consumers, but that would risk hurting demand. Alternatively, if they absorb the costs themselves, it puts downward pressure on profit margins. Trump is using tariffs as a strategic instrument of power. According to his statements, the tariffs are not negotiable — they are intended to be permanent. His goal: to bring car production to the US and strengthen the domestic auto industry. Additional revenue from tariffs could also help lower taxes and reduce debt.

Nearly every second car sold in the US is imported: The new tariffs will hit manufacturers hardest that don’t produce in the US at all. This includes luxury brands like Porsche and Ferrari. The Porsche stock hit a new record low last week. Ferrari is pursuing a hybrid solution: it plans to raise prices in the US by up to 10%, while absorbing the remaining tariff costs itself. German carmakers are particularly affected. In 2024, 57% of European vehicles sold in the US were imported directly from Germany. The new US tariffs could cost German auto companies up to €11 billion. However, the tariffs will also drive up prices for American brands like GM and Ford.

Power dynamics in the auto industry are shifting: Chinese manufacturers are not only dominating their domestic market with affordable EVs but are increasingly pushing into the global export market. BYD overtook Tesla in revenue in 2024, and the stock has risen by 50% since the beginning of the year. Traditional automakers are losing competitiveness. The threat of new tariffs is worsening the crisis. But tariffs aren’t just about higher costs – constantly changing trade conditions are also holding back investment, delaying site decisions, and making it harder to build stable supply chains.

The markets are nervous: Uncertainty is clearly felt – investors are holding back and avoiding larger risks. The four auto stocks in the DAX now represent only about two-thirds of SAP’s market value. SAP has overtaken Novo Nordisk to become the most valuable listed company in Europe. This highlights that another sell-off in auto stocks would have a much smaller impact on the broader market than it would have a few years ago. However, tariff concerns currently overshadow everything else, and the negative sentiment is already spilling over into other sectors.

Bottomline: Trade tensions are once again intensifying. It remains unclear how far Donald Trump will actually go in the trade conflict. Only signs of de-escalation seem likely to calm the situation at this point. Some manufacturers will certainly consider shifting production to the US, but such a move would involve significant time and cost. The standoff is hardening, and a quick resolution appears unlikely. Companies and investors must prepare for uncertainty to persist for the time being.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.