Introduction

Ray Dalio’s All Weather Portfolio is one of the most famous investment strategies designed to perform well across various economic environments whether in times of growth, inflation, recession, or deflation. The core principle behind the All Weather strategy is risk parity, which balances asset classes based on their risk contributions rather than capital allocation alone.

However, the unprecedented rise in interest rates in 2022 triggered by the Federal Reserve’s aggressive monetary tightening posed significant challenges to this strategy. Bonds, traditionally a stabilizing force in the portfolio, suffered historic losses, while equities also declined due to recession fears.

In this article, we will:

- Examine the original composition of the All Weather Portfolio.

- Analyze how it performed in 2022 amid rising rates.

- Discuss adjustments that could improve its resilience in a high-rate environment.

- Evaluate whether the All Weather strategy remains viable for long-term investors.

1. The Original All Weather Portfolio: A Risk-Parity Approach

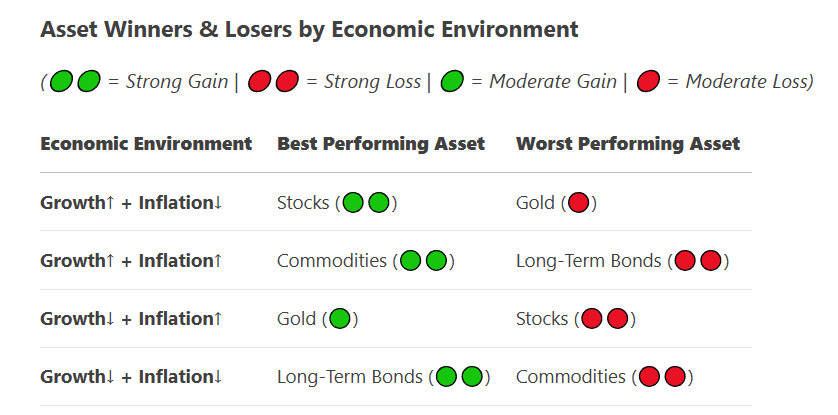

Ray Dalio’s All Weather Portfolio was designed to deliver steady returns regardless of economic conditions by balancing four key economic environments:

- Rising Growth (Economic expansion)

- Falling Growth (Recession)

- Rising Inflation

- Falling Inflation (Deflation)

The traditional allocation is:

- 30% Stocks (e.g., S&P 500 or global equities)

- 40% Long-Term Treasury Bonds (for deflation protection)

- 15% Intermediate-Term Treasury Bonds (for stability)

- Additional allocations to gold (7.5%) and commodities (7.5%) for inflation hedging.

The logic was that:

- Stocks perform well in growth environments.

- Long-term bonds thrive in deflationary/recessionary periods.

- Gold & commodities protect against inflation.

Why It Worked Before 2022

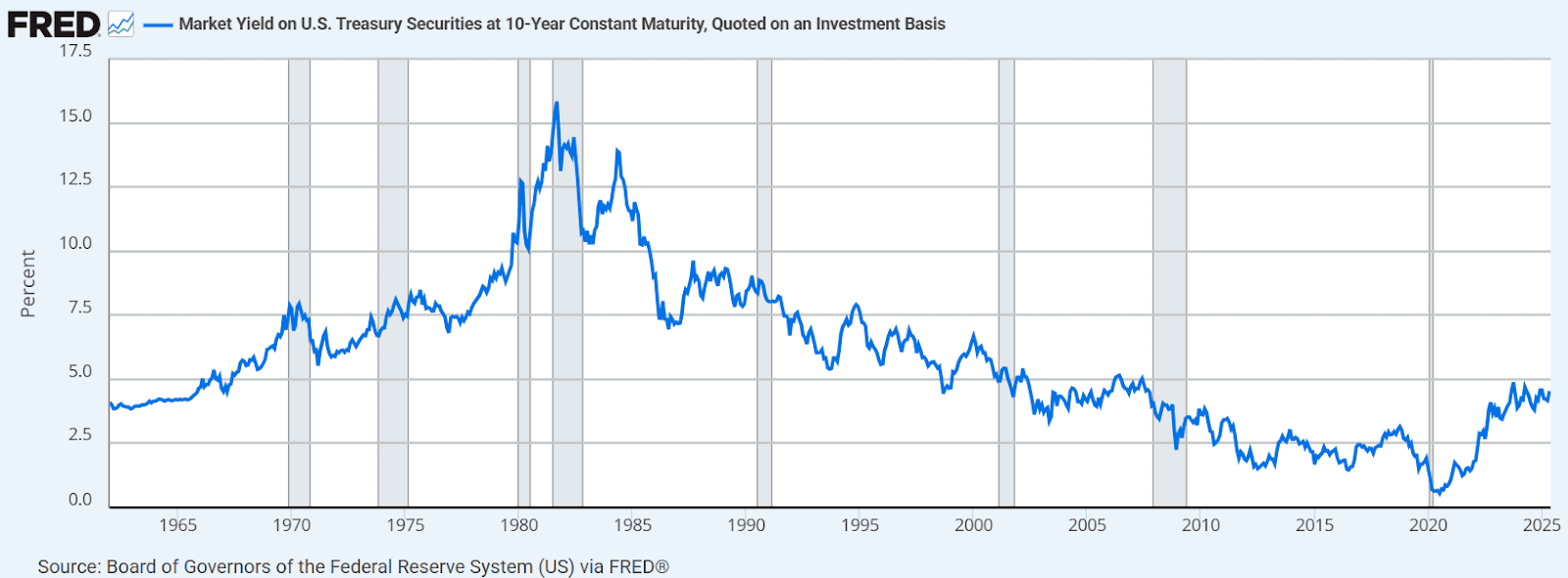

From the 1980s to 2020, the All Weather strategy benefited from:

- Falling interest rates, which boosted bond returns.

- Low inflation, which kept volatility in check.

- Stable economic growth, supporting equities.

However, the 2022 market regime shift disrupted this balance.

2. The 2022 Stress Test: Rising Rates and Portfolio Drawdowns

In 2022, the Federal Reserve raised interest rates from near 0% to over 4% to combat inflation, the fastest tightening cycle in decades. This had severe consequences for the All Weather Portfolio:

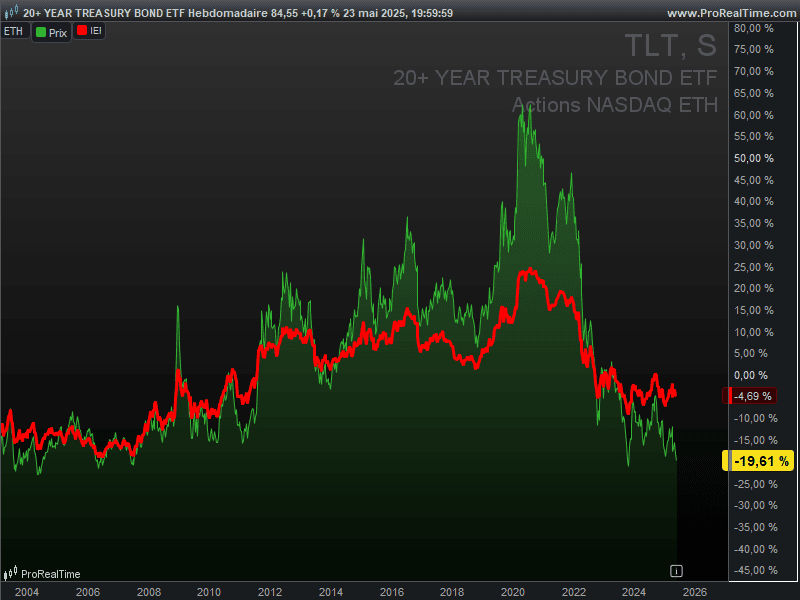

A. Bonds Suffered Historic Losses

- Long-term Treasuries (TLT in green) fell ~30%, their worst year on record.

- Intermediate bonds (IEF in red) dropped ~10%.

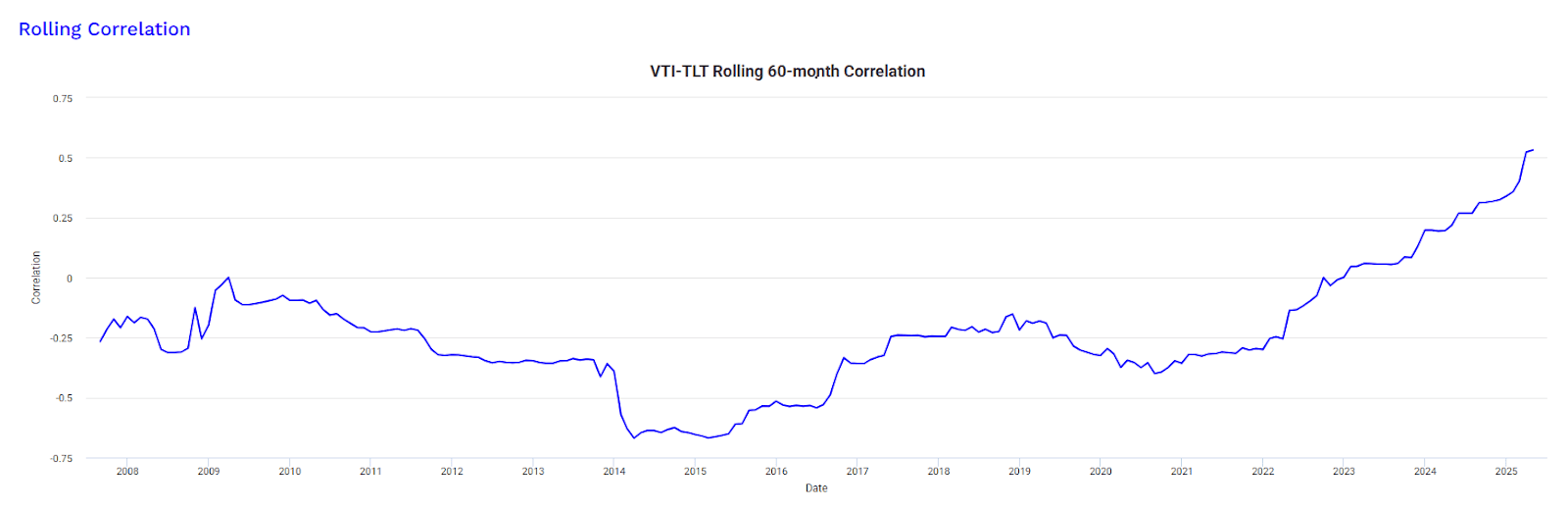

- Normally, bonds act as a hedge against stock declines, but in 2022, both stocks and bonds fell simultaneously, breaking the traditional 60/40 portfolio’s diversification benefits.

This chart reveals a significant shift: the decades-long negative correlation between TLT and VTI has disappeared since 2022.

B. Stocks Declined Due to Recession Fears

- The S&P 500 dropped ~20% in 2022.

- Growth stocks (especially tech) were hit hardest as higher rates reduced their future cash flow valuations.

C. Gold & Commodities Were Mixed

- Gold was flat to slightly negative (no yield in a rising-rate environment).

- Commodities (oil, metals) surged early in 2022 but later corrected.

Result: The All Weather Portfolio Underperformed

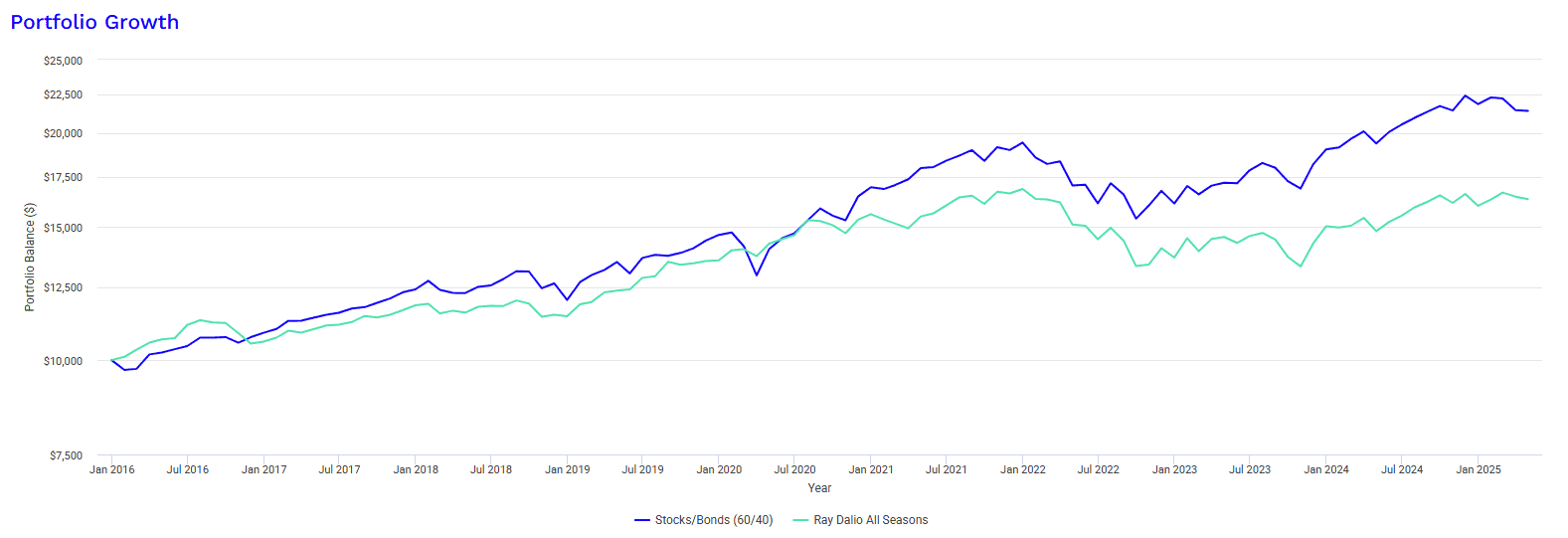

While it still fared better than a pure 60/40 stock/bond portfolio, the All Weather strategy saw significant drawdowns (~15-20%), challenging its reputation as a “set-and-forget” approach.

3. Adjustments for a Higher-Rate Environment

Given the regime shift, should investors abandon the All Weather strategy? Not necessarily but some adjustments could improve resilience:

A. Duration Risk Management

- Shorter-duration bonds typically exhibit less sensitivity to interest rate changes

- TIPS are specifically designed to adjust for inflation, though their performance varies

B. Real Asset Allocation

- Commodities have historically shown resilience during inflationary periods

- REITs may offer dual benefits of income and potential inflation correlation

C. Diversification Approaches

- Trend-following strategies demonstrated effectiveness during recent volatile markets

- Current yield environment makes cash instruments more attractive than in recent years

D. Adaptive Portfolio Construction

- Macroeconomic indicators can inform allocation adjustments, though timing is challenging

- Regular portfolio reviews help align with changing market conditions

Note on Implementation

These observations represent general market principles. Actual portfolio decisions should incorporate individual circumstances, risk tolerance, and professional guidance. Market conditions and investment outcomes are never guaranteed.

4. Is the All Weather Strategy Still Viable?

Despite the 2022 challenges, the All Weather Portfolio remains a robust long-term strategy because:

- It’s designed for all cycles, not just low-rate environments.

- Higher bond yields now improve future returns (10-year Treasuries at ~4.5% offer better income than in 2020).

- Inflation may stabilize, restoring bonds’ hedging role.

However, investors should:

- Expect lower returns than in the 2010s.

- Be prepared for higher volatility in a world of elevated rates and inflation.

- Consider a more flexible version of risk parity (e.g., Bridgewater’s current approach).

Conclusion

Ray Dalio’s All Weather Portfolio faced its toughest test in 2022 as rising rates disrupted both stocks and bonds. While its performance was disappointing, the core principles of diversification and risk balancing remain sound.

Going forward, investors may need to:

✔ Shorten bond duration to reduce interest rate risk.

✔ Inflation linked bond (TIPS) to benefit from unexpected inflation rise.

✔ Increase real assets (commodities, REITs).

✔ Stay flexible with tactical adjustments.

The All Weather strategy isn’t broken but like any portfolio, it must adapt to changing market regimes. For long-term investors, it remains a valuable framework, provided they understand its limitations in a high-rate world.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.