The Daily Breakdown takes a closer look at Lululemon, which has falling sales but a historically low valuation. What’s next for LULU?

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Deep Dive

Lululemon Athletica shares have been decimated this year, down 58% in 2025. Worse, it’s down almost 69% from its all-time high made in December 2023. What’s going on with this once darling apparel maker?

The company’s products are not appealing to its core customers the way they once did. Increased competition from companies like Vuori and Alo have hurt, while tariffs are impacting the firm’s margins. These problems have led to a major headache for investors, as US sales continue to stall.

At the same time, investors are looking at the stock and wondering when enough is enough.

Will Sales Rebound?

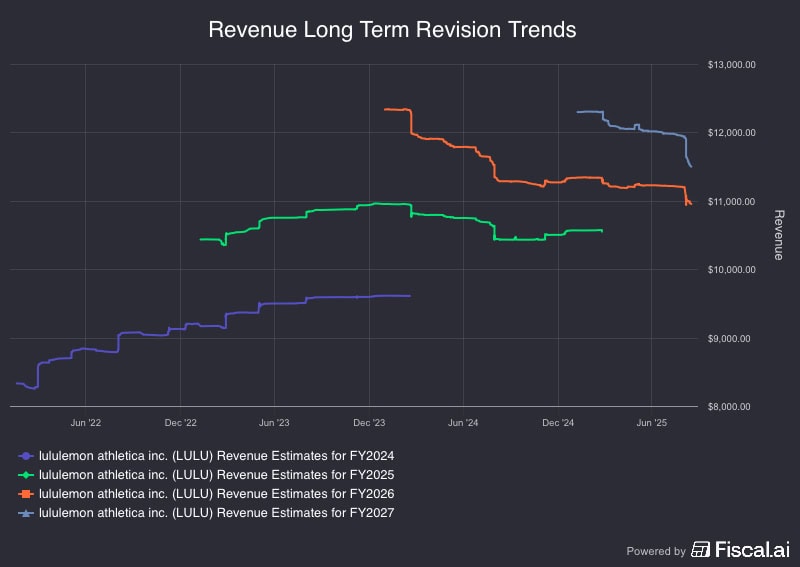

We’re halfway through Lulu’s fiscal year. When the company reported on Sept. 4th, management cut its full-year sales outlook to $10.85 billion to $11 billion. The outlook for 2026 and 2027 have become more pessimistic as well, as noted on the graphic above.

On the plus side, analysts actually expect growth — it’s just not impressive growth.

Consensus estimates call for revenue growth of 3.5% this year, 4.8% next year, and 5.8% in the following year. That’s currently mid-single-digit growth and hardly warrants a premium valuation.

Worse, earnings growth estimates are less consistent. Analysts expect an earnings decline of roughly 11% this year — which is likely already priced into the stock at this point, given its tumultuous fall — followed by estimates for just 1% growth in fiscal 2026 and about 8% growth in 2027.

The Bottom Line: Lululemon’s business could be near a trough, but the lack of clarity and excitement for growth in the out-years has investors feeling defeated.

Want to receive these insights straight to your inbox?

Sign up here

Diving Deeper

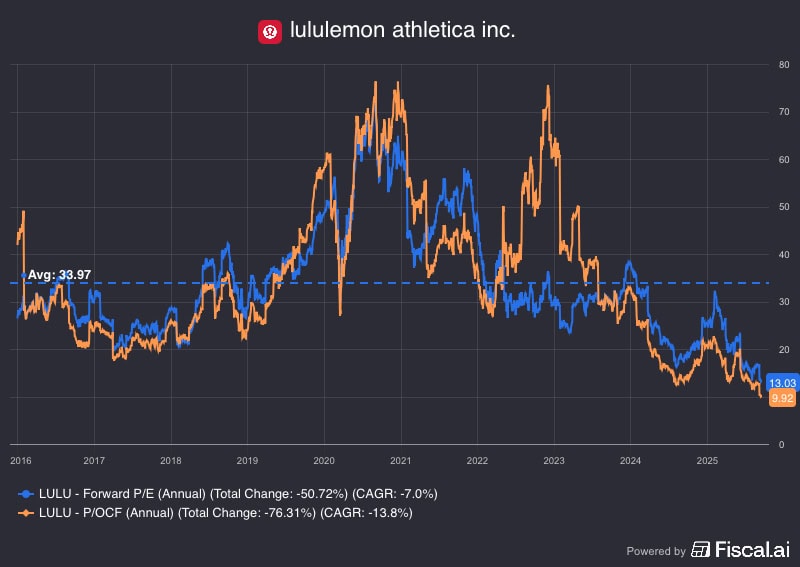

With a near-70% decline from the highs — down from ~$516 to ~$160 in less than two years — it’s obvious that something isn’t working and the stock is out of favor with Wall Street. For investors though, the question becomes: At what point is the valuation too low to ignore?

Note: Wall Street’s consensus price target on LULU stock is ~$203, implying roughly 27% upside from current levels.

The chart above highlights the company’s forward P/E multiple, with shares trading at just 13 times expected earnings. Valuation can be a tricky thing though.

While this is by far LULU’s lowest valuation in the last decade, there’s no guarantee that it will be supportive for the stock. If earnings estimates turn out to be too high, the valuation is actually not as low as it appears right now. Further, investors may not assign a premium valuation to this company anymore given its operational issues. Instead, a discounted valuation may be the new norm.

These are risks that investors have to accept if they take a position in LULU stock.

Too Stretched?

Despite meager revenue growth, this company remains profitable and free-cash flow positive. Outside of lease obligations, Lululemon runs a pretty tight balance sheet with very little debt. From those perspectives, it’s reasonable for investors to wonder if the stock is oversold.

At the same time, there’s nothing that says the stock’s freefall is unwarranted or that shares will rebound meaningfully from current levels.

If Lululemon can find a trough in its business and return to growth, shares could rebound. But if management is forced to revise its outlook even lower, then the stock could have more downside ahead — and that is one of the key risks for investors to assess.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.