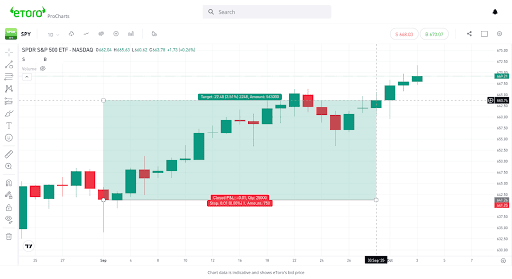

September is historically considered the worst month for the stock market. On average, the S&P 500 loses around 1% of its value during this month, which has created the superstition that after summer, investors should sell their stocks and wait for a downturn. But this year, the exact opposite happened. The stock market rose by more than 3.5% in September. This reminds us that markets are driven by economic fundamentals and corporate results, not by dates on the calendar.

The so-called September effect is based on statistics. It has traditionally been the weakest month of the year for equity markets — the only month in which markets have historically ended lower more than half the time (about 55%).

There are several theories as to why this may be the case. Some explain the effect by pointing to fund managers returning from holidays, rebalancing portfolios, or taking profits. Others attribute it to financial market cycles — for example, hedge funds closing their fiscal year in September, which leads to portfolio adjustments and tax-loss harvesting. Another explanation is the revival of the bond market, which can drain capital from equities.

Whatever the reason, this year clearly showed that blindly following such seasonal effects can be dangerous for retail investors. The market can move in the exact opposite direction. September is one of the especially dangerous months for trying to time the market. The others are October, November, December, January, February, March, April, May, June, July, and August.

Where is the market really heading?

Despite ongoing uncertainty, the long-term growth trend remains strong. In September, the U.S. Federal Reserve cut interest rates for the first time in nearly a year and plans to continue doing so — historically a clearly positive signal for equities. In addition, many multibillion-dollar investments, especially in the AI industry, were announced, along with relatively encouraging economic data. All of this supported continued stock growth, making September one of the best months of the year.

September is proof that timing the market does not pay off. The true path to success lies in investing regularly, with patience and a long-term horizon.