Bitcoin is holding firm above the $113,000 level as bulls attempt to regain control, though market indecision continues to dominate price action. With the Federal Reserve set to announce its next interest rate decision on Wednesday, traders and investors are closely watching for signs of a potential rate cut — a move that could inject fresh optimism into risk assets, including crypto.

The broader market remains cautious yet hopeful. A dovish tone from the Fed could reinforce the narrative of easing financial conditions, potentially paving the way for a stronger Bitcoin rally in the coming weeks. On the other hand, a more neutral or hawkish stance might prolong current consolidation.

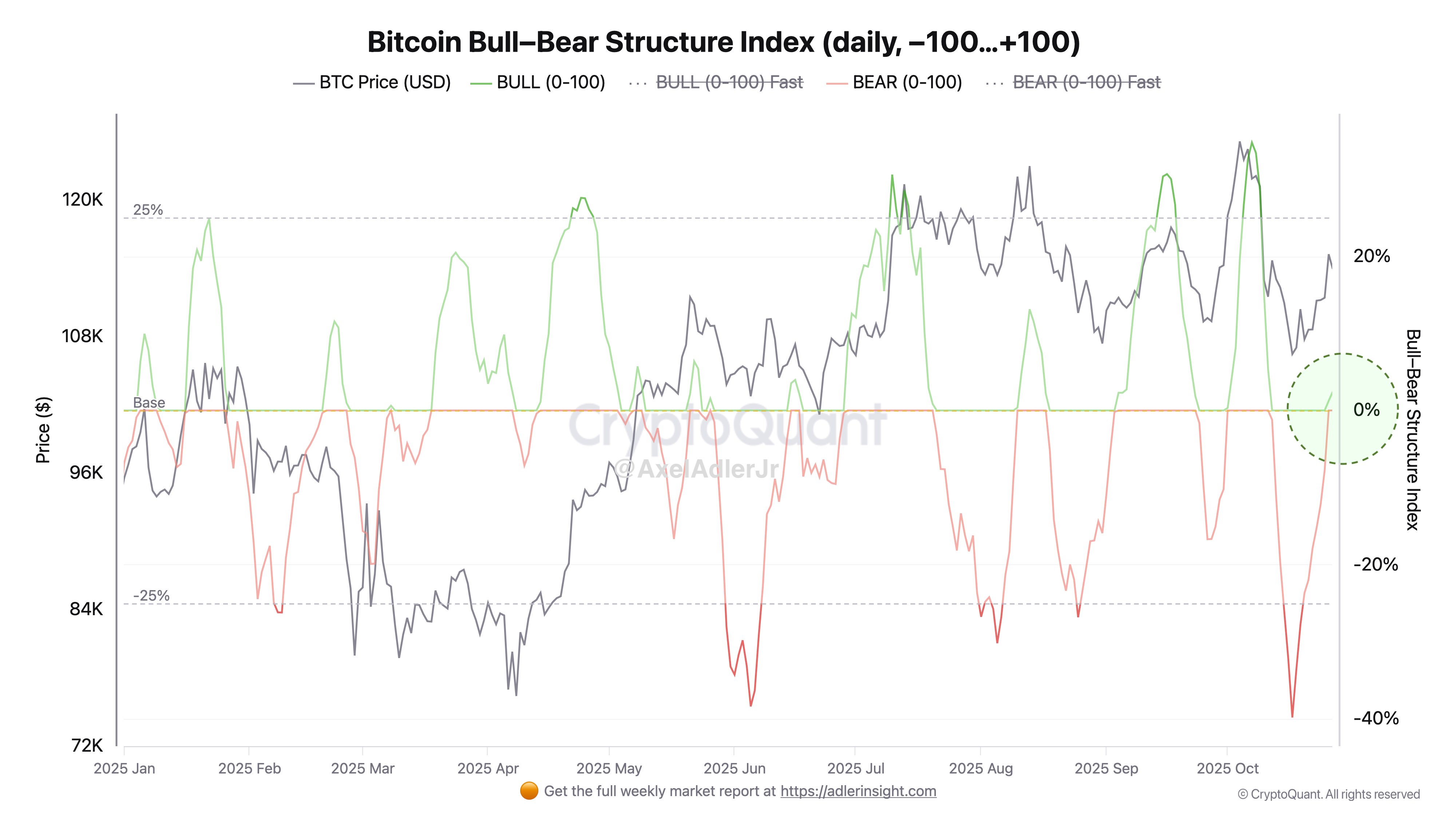

Adding to the growing optimism, top analyst Axel Adler highlighted a key market shift: the Bitcoin Bull-Bear Structure Index has moved above zero for the first time since October 12. This index, which measures the balance between bullish and bearish dynamics based on both price action and on-chain data, suggests that momentum may be starting to tilt in favor of buyers.

Market Sentiment Turns Positive as Bitcoin Faces a Pivotal Week

According to Axel Adler, the Bitcoin Unified Sentiment Index — a composite measure based on CoinGecko Up/Down votes and the Fear & Greed Index — has recently moved into positive territory, signaling a notable shift in investor psychology. This alignment between sentiment and on-chain dynamics often marks the beginning of renewed confidence across the market. When both behavioral and structural indicators converge, it typically reflects that investors are starting to position for potential upside after a phase of fear and uncertainty.

This development comes at a critical juncture. The upcoming Federal Reserve interest rate decision could significantly influence global liquidity conditions. A dovish move, such as maintaining rates or signaling cuts, would likely act as a tailwind for Bitcoin and risk assets, as lower yields generally drive capital toward alternative stores of value. Conversely, a more cautious stance could delay a breakout, keeping Bitcoin range-bound in the short term.

From a macro and technical perspective, Bitcoin’s consolidation around the $113K–$115K zone sets the stage for a decisive move. With sentiment improving, on-chain activity stabilizing, and stablecoin liquidity near cycle highs, conditions appear increasingly supportive for an impulsive leg upward — provided no negative macro surprises emerge.

As markets await the Fed’s tone and broader economic signals, this week could determine whether Bitcoin transitions from consolidation to renewed expansion — or remains trapped in indecision a little longer.

BTC Bulls Attempt to Maintain Momentum

Bitcoin is currently trading around $114,400, showing resilience after a week of consolidation. The chart highlights how BTC has managed to reclaim the 50-day moving average (green line) while finding consistent support near the 200-day moving average (red line) — a technical setup often associated with stabilization before a potential continuation move.

The $117,500 level (marked in yellow) remains the key resistance to watch. This zone has repeatedly acted as both support and resistance in recent months, and a decisive breakout above it could confirm bullish momentum toward the $120,000–$125,000 region. On the downside, short-term support lies near $111,000, where price has previously rebounded, with a deeper floor forming around $107,000.

Traders await the Federal Reserve’s interest rate decision later this week. A dovish policy tone could trigger renewed buying pressure, while a neutral or hawkish statement may cause another short-term pullback.

Bitcoin’s structure remains constructive as long as it holds above the 200-day MA. Sustained strength above $115,000 could serve as confirmation of renewed bullish intent — signaling that accumulation phases might be giving way to the next upward impulse.

Featured image from ChatGPT, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.