We’re getting a whirlwind of earnings, with the latest heavy-hitters including Alphabet, Meta and Microsoft. The Daily Breakdown digs in.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

At Wednesday’s close, Alphabet, Meta, and Microsoft held a combined market cap of $9.25 trillion — a number likely to shift today as investors digest their earnings. All three topped expectations on both revenue and profits, but are mixed on the reaction.

Alphabet shares are extending their recent momentum, jumping about 8% in pre-market trading. Meta is down by a similar amount after recording a $15.9 billion one-time tax charge — though adjusted earnings of $7.25 per share still beat estimates of $6.69 a share. Microsoft shares are down 1% to 2% this morning amid a more muted reaction.

The Big Take

Going into these reports, I was focused on two things: how this group would perform after a strong rally and whether AI spending would stay robust.

Alphabet lifted its full-year CapEx outlook — capital expenditures, or a company’s investment in growth assets and infrastructure — from $85 billion to between $91 billion and $93 billion. Meta again raised its 2025 CapEx forecast, while noting that “capital expenditures dollar growth will be notably larger in 2026 than 2025.” Microsoft’s CapEx hit $34.9 billion for the quarter — above Wall Street’s forecasts — and CFO Amy Hood said fiscal 2026 CapEx growth will outpace 2025, reversing previous expectations for a slowdown.

Up Next: Apple and Amazon both report today after the close.

Want to receive these insights straight to your inbox?

Sign up here

The Setup — SPY & Fed

The S&P 500 and the SPY ETF hit new record highs yesterday, rallying as the Federal Reserve cut interest rates for a second time this year. However, Chair Powell stated that a December rate cut is “far from” a foregone conclusion, which gave investors some pause about how aggressive the Fed would be with future rate cuts. While Nvidia and other large cap companies helped buoy major indices, others — like small caps and crypto — didn’t fare quite as well.

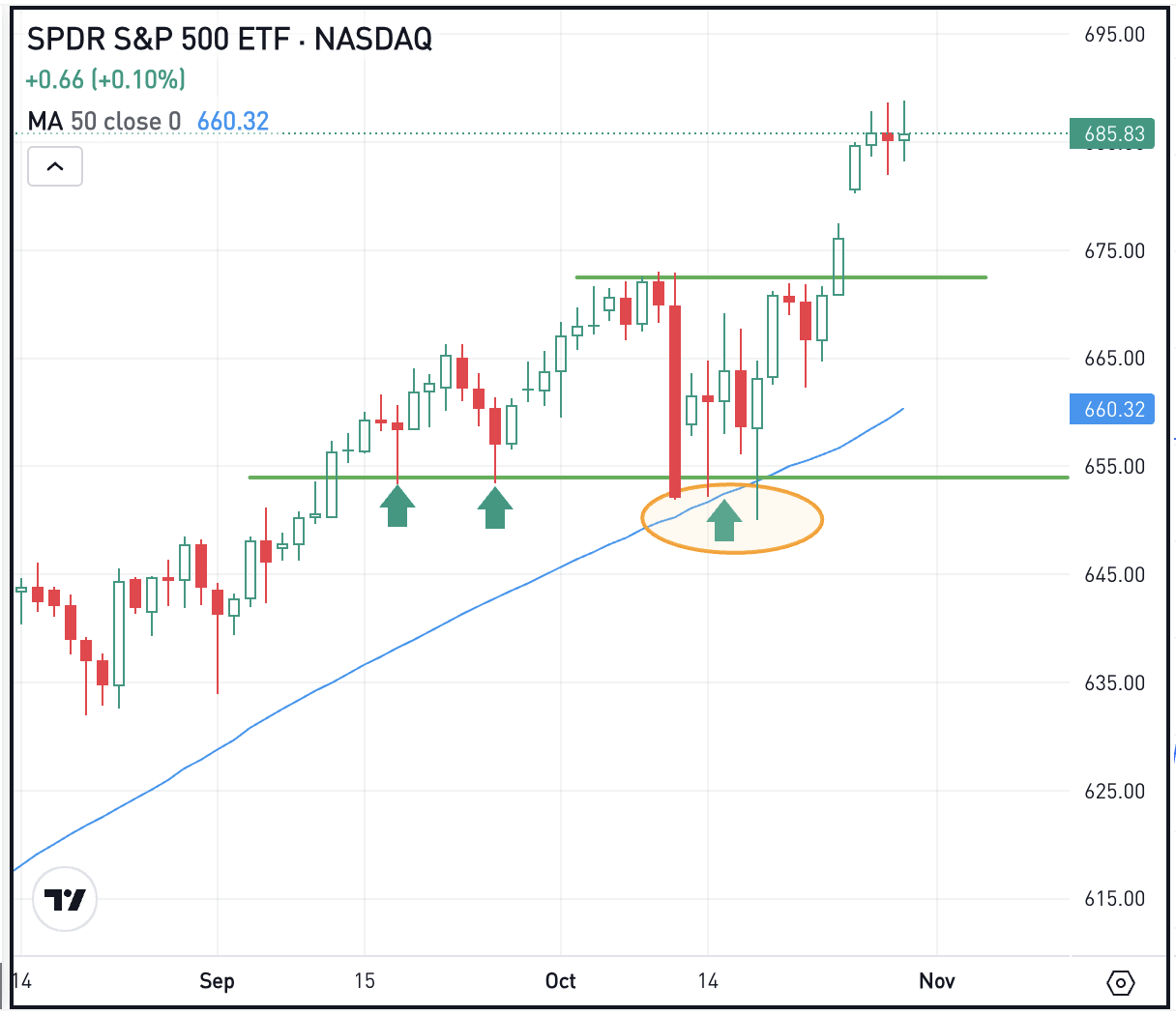

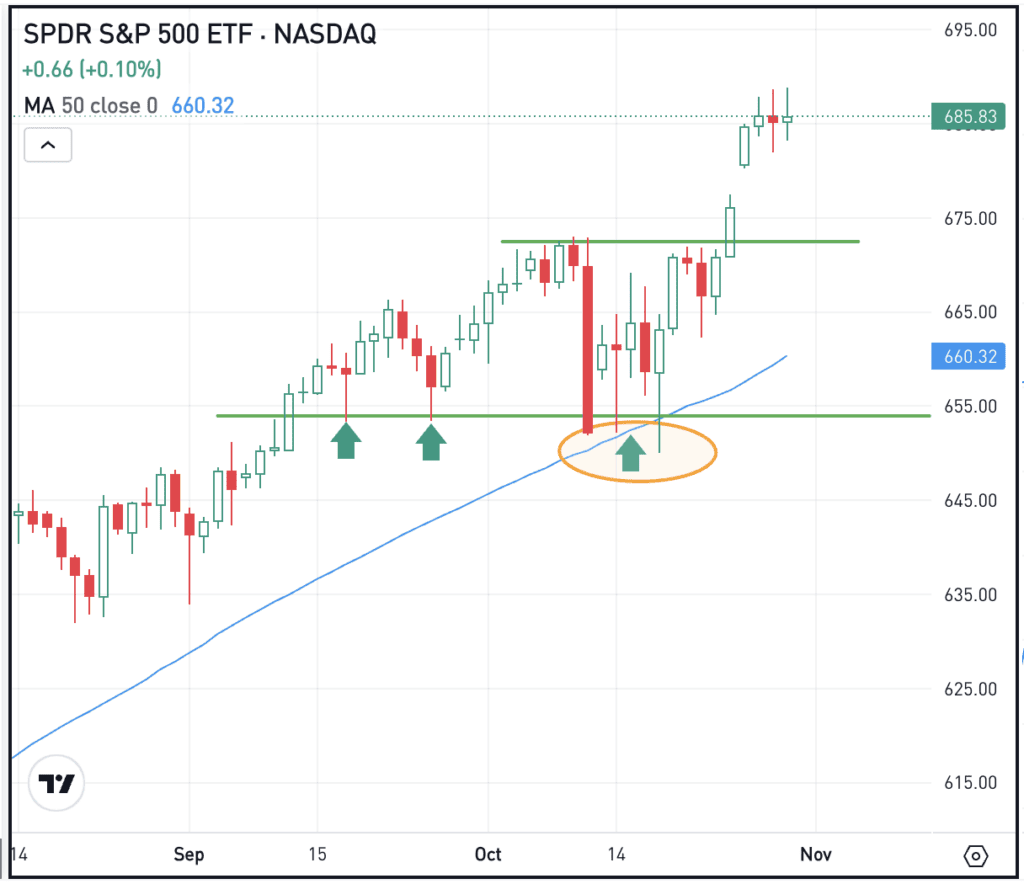

The SPY ETF did a great job finding support near $655 and the 50-day moving average, as shown on the chart above (orange circle). It has since broken out over the $672 area, which had been resistance for most of the month. From here, investors will want to see this level act as support. If it does, momentum can remain in the bulls’ favor. If not, bulls aren’t completely out of luck, although momentum could slow enough to force a retest of the 50-day moving average, followed by a possible retest of the $655 level.

Options

One downside to SPY is its share price. Because the stock price is so high, the options prices are incredibly high, too. This can make it difficult for investors to approach these companies with options. In that case, many traders may opt to just trade a few shares of the common stock — and that’s fine. However, one alternative is spreads.

Call spreads and put spreads allow traders to take options trades with a much lower premium than buying the calls outright. In these cases, the maximum risk is the premium paid.

Options aren’t for everyone — especially in these scenarios — but spreads make them more accessible. For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

CMG

Shares of Chipotle are tanking this morning, down more than 15% after another disappointing quarter. The company slightly missed on revenue expectations, while earnings were in-line with Wall Street’s outlook. Management was forced to cut its same-store sales outlook for the third straight quarter. Dig into the fundamentals for CMG.

BTC

Wondering about Bitcoin lately? The world’s largest cryptocurrency is currently trading near $109,500 as bulls will try to avoid a fourth straight daily decline in BTC. Crypto investors aren’t panicking about the Fed’s latest commentary that a December rate cut is not a “foregone conclusion,” but they certainly didn’t love it, either. Check out the charts for BTC.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.