Daily Conquest 8.16.22 #062

Everything you need to know of today’s fast-moving crypto markets

Subscribe to this daily newsletter TO NEVER MISS AN ISSUE.

The crypto market is a wild, wondrous and intimidating place; don’t trek alone! Subscribe to The Crypto Conquistador, and let us be your guide.

Overview

- Arthur Hayes’ Ethereum prediction.

- Market pause. Where do we go from here?

- Vitalik wants to punish some validators.

- Can Acala re-establish aUSD peg?

Good morning Fam,

The former BitMEX CEO is at it again by releasing another very informative article where he explains his trading strategies and predictions leading into the major event.

Most of us don’t have time to sit down and read the 30-minute blog post, but I did you the solid of recapping the complex material to its most basic concepts. Just for you!

Hayes is currently reading Alchemy of Finance by George Soros, which inspired him to write the post. The central theory of Soros is the “theory of reflexivity” — a feedback loop between market participants and prices.

Basics of Theory of Reflexivity

- Market participants’ perception of a given market situation influences how the situation plays out.

- Those expectations influence the facts (“fundamentals”).

- Shapes expectations.

- A feedback loop that becomes a self-fulfilling prophecy.

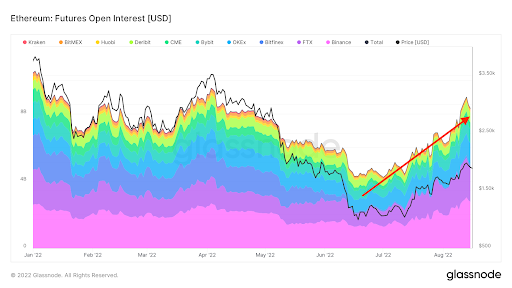

After Hayes spends the majority of the blog post outlining the inputs and outputs per the theory of reflexivity, he then weighs the information against the market’s current outlook for Ethereum. Overall, the futures market appears to hold a short ETH position, which includes traders hedging their spot Ether or participants who plan to receive the free chain-split tokens.

“ Given that the entire curve out to June 2023 is trading in backwardation — meaning that the futures market is predicting ETH’s price by the maturity date will be less than the current spot price — there is more sell pressure than buy pressure at the margin.” *Chart below.

According to Hayes, if the merge is successful, the ETH shorters will likely close their positions, and very few will close long spot positions. As a result, the subsequent setup sets the stage for a strong price rally.

Hayes then mentions some ways to trade the merge:

- Buying spot ETH.

- Buying Lido Finance (LDO).

- Longing ETH futures (Complex and risky).

- Buying ETH call options (Complex and risky).

- Futures hedge (Complex and risky).

Expectations

Hayes expects the structural reduction in inflation (deflation) to happen post-merge and play out like bitcoin halvings (large rallies).

But before the merge, Hayes will continue to buy the dips in ETH, but plans not to close any ETH spot positions.

Writer’s Conclusion and translation

- If the Ethereum Merge fails, traders will likely not want to own ETH, and some will short it.

All the following information is relevant IF The Merge is successful:

- Arthur Hayes is exceptionally bullish on The Ethereum Merge and presents many ways to trade it. However, any derivatives trades hold complicated risks. Unless you’re experienced, DO NOT TRADE THEM.

- Hayes predicts a similar price action to Bitcoin halvings after the structural changes to Ethereum tokenomics.

- Don’t over-trade The Merge. The price will be volatile leading up to the event.

- If we’re lucky, we get a few dips before The Merge.

SPX/USD

The stock market action quelled after two bullish days. The S&P 500 reached a three-month high of $4,325 before closing at $4,305. The index appears ready for a pullback, but a lack of downside catalyst could see stocks continue their month-long rally.

US president Biden signed the Inflation Reduction Act into law, which sets a 15% minimum corporate tax for companies with revenues over $1 billion. Additionally, the bill includes a $369 billion investment into climate and energy policies and $64 billion to extend the Affordable Care Act. The bill’s signing into law had little effect on futures, but tomorrow’s opening might tell otherwise.

High-resolution chart

BTC/USD

The crypto market was relatively quiet, with a few altcoins, such as Dogecoin (DOGE) (up 14.9%), taking the opportunity to climb. BTC looks poised to break the uptrend support on the daily charts, but until a candle closes below the level, the uptrend remains valid. BTC completed the daily candle down -1.00% to $22,854.

High-resolution chart

If you’re enjoying this report and think it’s worth 20 sats (.01 cent), please press the clap button below to help support my writing. (Up to 50 times!) THANKS!

Vitalik won’t have it! Ethereum co-founder, Vitalik Buterin, wants to burn the staked Ether of validators that complied with OFAC sanctions of Tornado Cash. The comments came after analysts began questioning the centralization of the network when validators complied with regulator requests. According to @TheEylon, 66% of validators complied with the censorship requests.

$1 trillion vaporized. The New York Times has released “How two wall street washouts with a can’t-lose crypto hedge fund vaporized a trillion dollars,” which covers Three Arrows Capital’s collapse behind founders Zhu Su and Davies’ aggressive trading strategies.

Solana seeks to improve decentralization. Jump Capital and the Solana Foundation have teamed up to create a secondary validator client for the Solana blockchain. The move would improve the blockchain’s performance and decentralization.

News Tidbits:

- Crypto Lender Hodlnaut applies for creditor protections in Singapore.

- Coinbase releases plans for the Merge.

- Alex Mashinsky was accused of taking control of trading strategies at Celsius early in the year.

- FTX hints at introducing options trading.

- Coinbase premium re-emerges.

- BitBoy sues YouTube personality Atozy over defamation.

At the protocol level ⛓

DeFi giants join Optimism L2: Yearn Finance and Iron Bank have joined the Optimism L2 network. The firms joined the network to improve cross-chain interoperability, security, and capital efficiency for users.

Acala stablecoin is recovering. The Acala native stablecoin aUSD is nearing the $1.00 market after sixteen wallets exploited the network and printed $1.3b worth of aUSD. Acala passed the referendum to burn the excess tokens to re-peg the stablecoin’s dollar value.

Protocol level.

- Thread: Justin Bons accuses Polygon of being highly insecure and centralized.

- Case study of Gains Network token GNS.

- Nearing the launch of the Canto Layer 1 network.

NFT & metaverse update ????

- Owners of CyptoPunks and Meebits non-fungible tokens (NFTs) are now allowed to use them for commercial gain after Yuga Labs released the intellectual property rights for the collections.

- NFT Analytics firm Zash partners with Binance to develop NFT data and intelligence products.

My five cents….

“Best crypto market writer in the world.”

That’s what Raoul Pal said about Arthur Hayes, and I agree. His articles are not only informative, but very entertaining. Who else can successfully compare the dead bodies floating in a river to the crypto collapse as Hayes did in Floaters? Fascinating work.

Nonetheless, these two mega-minds are rooting for ETH before The Merge. Of course, nothing in life is concrete, and every investment is a risk, but the Ethereum Merge presents an opportunity we seldom see in crypto. There’s a slight chance it might not go as planned, but if it does, watch out, ETH supply dynamics will dictate market conditions for many months to come.

Thanks for reading, follow me on Twitter for daily updates!

NOT FINANCIAL ADVICE!