ETH eyes mini breakout above $3K after the Coinbase ETH outflows reached new record levels while the macro headwinds continue to hamper the long-term upside prospects so let’s read more today in our latest Ethereum news.

Ethereum’s native token ETH is poised for a mini bull run above $3000 due to the bullish reversal pattern on the shorter-timeframe chart and a huge spike in outflows from Coinbase. ETH’s price was forming a falling wedge pattern since late March which increases the prospects of undergoing a breakout move in May. The falling wedges seem to show up when the price trends lower inside the range defined by the descending and contracting trendlines. As a rule of technical analysis, the wedges resolve after the price breaks out of range to the upside and rises to a new level equal to the maximum distance between the pattern’s upper and the lower trendline when measured from the breakout point.

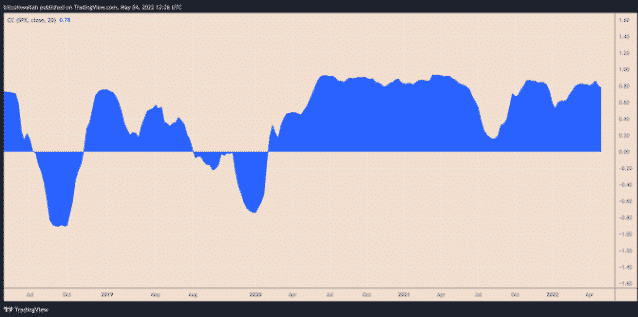

$ETH Coinbase Outflow hits an all-time-high

Live Chart ????https://t.co/PiITw2ZFf3 pic.twitter.com/tlFQndUhvQ

— CryptoQuant.com (@cryptoquant_com) May 4, 2022

The falling wedge height is around $395 so if the price rises above $2850 the breakout point have a likelyhood of irising by another $395 towards $3150 and will be higher. The interim upside outlook on the market coincides with the bullish on-chain data. The number of ETH leaving coinbase reached its highest level as per the data on CryptoQuant. The ETH balance on the crypto exchanges dropped to its lowest level since 2018 as per the Glassnode on-chain metrics so both indicators implied a surge in the traders’ preference to hold ETH tokens over the trading them for other assets.

ETH eyes mini breakout as the balances tick higher across retail addresses and the price trends lower, indicating that the traders were buying ETH at local lows which further supports the falling wedge bullish reversal setup. Ether’s likelihood of surpassing $3000 hasn’t plucked it out of the long-term bearish setup since ETH risks breaking below this triangle range of Q2/2022 and with the downside target sitting between $1820 and $2670 depending on the breakout point.

More downside cures came from macro fronts with rivals like BTC still holding a positive correlation with the US Stocks. The US Central bank will release a policy statement followed by the chairman Jerome Powell’s press conference and officials signaled that they will increase benchmark rates by 0.5% with plans to unwind their $9 trillion asset portfolio.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]