Former Goldman Sachs executive Raoul Pal says one Ethereum (ETH) competitor is presenting one of the most golden opportunities for discounts during the current crypto market crash.

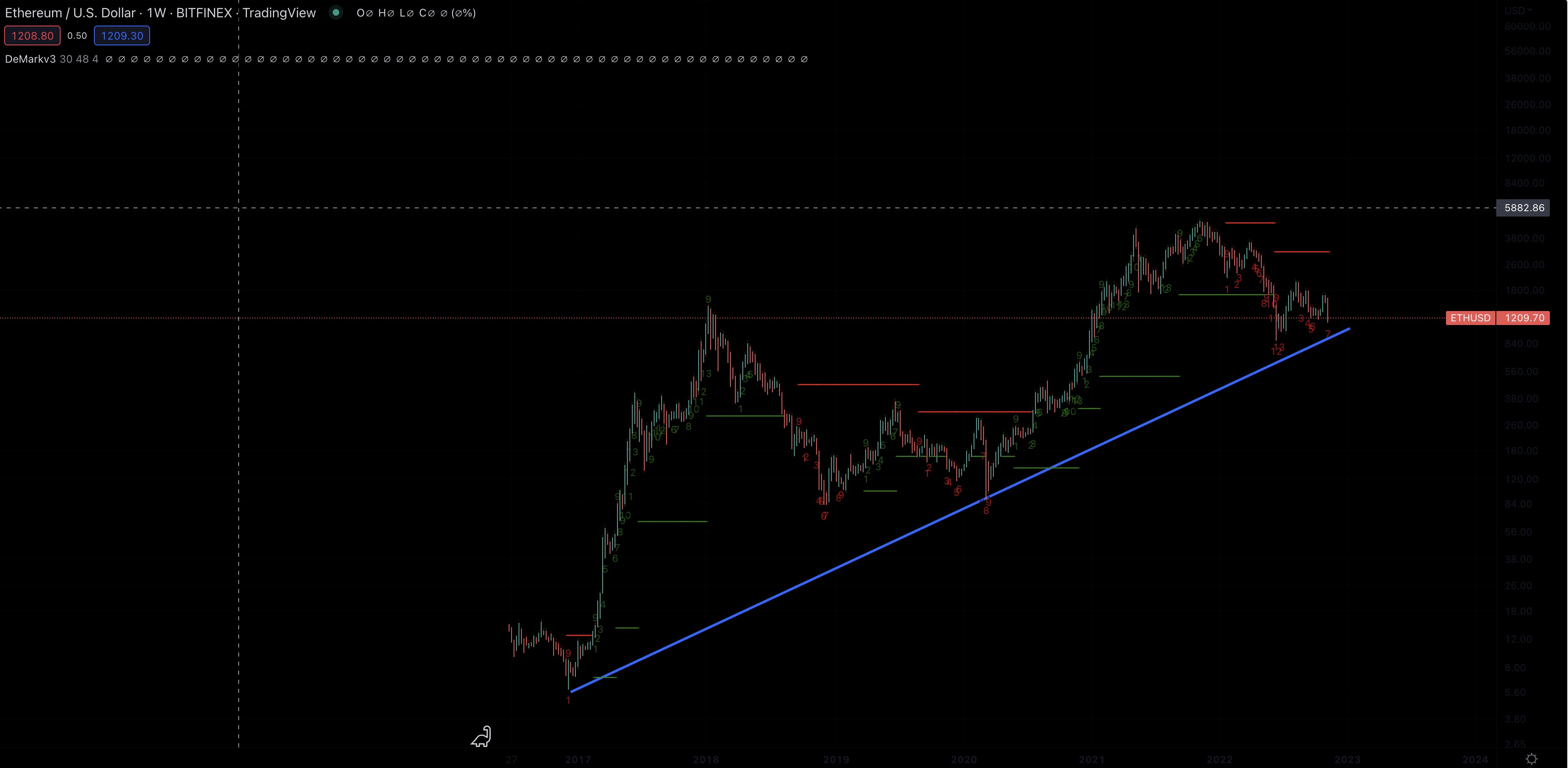

Pal tells his 986,000 Twitter followers that the current market downturn is a secular trend within a long upward impulse, and points to long-term Bitcoin (BTC) and Ethereum price charts as evidence.

“Then decide if you will accept the secular trend or the cyclical trend. The latter is brutal but the former is this in BTC: Size accordingly, as I keep reiterating.”

“Or this in ETH…”

The macro investor says Ethereum rival Solana (SOL) could be one of the most interesting discounts on the market. He cites Solana’s strong network effects and the potential to allocate to SOL at a steep 95% discount, which many altcoins, including Ethereum, have historically dipped to before recovering back to all-time highs.

“For now, can price go lower? Absolutely and quite a bit so. I don’t use leverage and don’t look at my P&L [profit and loss statement] but do look for good levels to add. I added ETH and SOL near the lows in June. I’ll add again at some point soon. SOL is very interesting due to the force liquidations…

I might be able to buy a very vibrant ecosystem token with measurable Metcalfe’s Law effects -95% + from the high, just like some got ETH in 2018. Earlier stage adoption tokens are very volatile but focus on the adoption and not the price. Then look for price to give opportunity.”

At time of writing, SOL is trading at $16.67, 93.5% down from its all-time highs and taking one of the biggest hits of this correction, likely due to Sam Bankman-Fried and Alameda Research’s heavy investments in its ecosystem.

Earlier this week, Bankman-Fried announced FTX was facing liquidity issues, and was entering a tentative agreement for Binance to acquire FTX.com.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Marinamiltusova2250/Sensvector