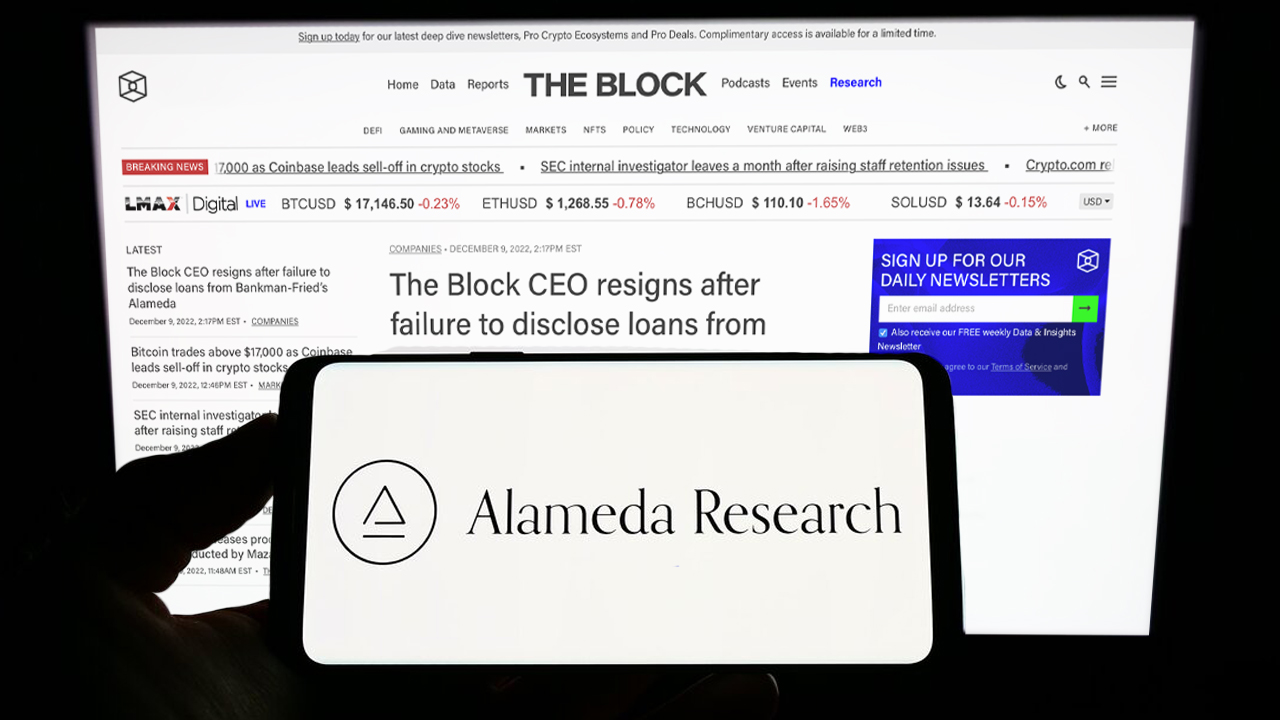

On Dec. 9, 2022, Axios reporter Sara Fischer reported on the CEO of the crypto media The Block after it was discovered that the chief executive was secretly funded by Alameda Research, the now-defunct trading firm co-founded by Sam Bankman-Fried. According to the report, sources say The Block executive Michael McCaffrey received $16 million in one payment and used the funds to purchase an apartment in the Bahamas.

The Block CEO Received 3 Payments of $43 Million From Alameda Research, One Payment Used to Purchase an Apartment in the Bahamas

The Twitter community has been discussing a new revelation that is tied to the disgraced FTX co-founder Sam Bankman-Fried (SBF) and his quantitive trading firm Alameda Research. Reportedly, The Block was funded by Alameda for more than a year, and “one $16 million batch of funding” went toward an apartment in the Bahamas.

The news was reported on by the Axios reporter Sara Fischer on Dec. 9, 2022, and the reporter noted that The Block employees got wind of the situation just before the exclusive report was published.

Axios noted that The Block’s chief revenue officer, Bobby Moran, will take over the CEO role as Fischer said “McCaffrey has resigned as CEO and is leaving the company.” Moran plans to restructure The Block, and attempt to “buy out McCaffrey’s stake in the company.” The news was confirmed by a number of The Block’s employees on Friday via Twitter.

“I’m absolutely gutted by this news, which was briefed to the company this afternoon,” The Block’s Frank Chaparro tweeted. “Underpinning my shock are feelings of utter disgust and betrayal by Mike’s actions, greed, lack of disclosure. He’s literal scum. He kept every single one of us in the dark.”

The former CEO of the media company, Mike Dudas, tweeted that the news was “Horrifying.” “[I am] devastated beyond belief,” Dudas said. “I was given less than an hour’s heads up by the CEO of The Block. If you think you’re shocked, I’m literally lost right now.”

The Block’s VP of research Larry Cermak also tweeted about the situation. “Last few months really can’t get much worse,” Cermak wrote. “Got f***ed by FTX (after naively trusting them like a complete idiot) and now also got f***ed by the CEO. Just like everyone else at The Block, I just found out about this,” the researcher added.

The Block Reports on Firm’s CEO, Story Follows Alleged Circle of Coindesk Buyers

The Block also published an article about the story which cites a statement made by Bobby Moran. “No one at The Block had any knowledge of this financial arrangement besides Mike,” Moran explained in a statement.

“From our own experience,” Moran added. “We have seen no evidence that Mike ever sought to improperly influence the newsroom or research teams, particularly in their coverage of SBF, FTX and Alameda Research.” According to The Block’s own data, McCaffrey received three loans which added up to roughly $43 million.

The news concerning The Block’s funding follows the report published by Semafor that explained the crypto news publication Coindesk received takeover solicitations from a number of investors. Interestingly, Coindesk published a report that had been cited by many (including Wikipedia) as one of the fires that lit the FTX bonfire.

The FTX contagion hurt a number of associated businesses and Coindesk’s parent firm Digital Currency Group (DCG) was indirectly exposed to the blowout. Semafor’s Bradley Saacks and Liz Hoffman cited the FTX contagion spread to DCG and quoted DCG’s founder Barry Silbert in the article. In addition, Semafor itself was funded by FTX co-founder SBF, and Tesla’s Elon Musk recently slammed Semafor’s journalistic integrity over the funding from the disgraced crypto CEO.

What do you think about the news that shows the crypto publication The Block was funded by Alameda for more than a year with $43 million? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.