Join Our Telegram channel to stay up to date on breaking news coverage

AAVE (Aave) has recently experienced impressive bullish momentum, driven by increasing demand within the decentralized finance (DeFi) sector. However, with the current downturn in the broader cryptocurrency market, many are questioning whether AAVE can maintain its upward trajectory and revisit its recent high of $396.

AAVE Key Statistics

- Current Price: $371

- Market Cap: $5.5 billion

- Trading Volume (24h): $1.32 billion

- Circulating Supply: 15 million AAVE

- Total Supply: 16 MILLION AAVE

- CoinMarketCap Ranking: #28

AAVE has dipped 2.76% from its recent highs over the last 30 and 7 days, yet it has showcased an extraordinary rebound, soaring by 147.49% and 60.88% from its lowest levels in the same periods. This impressive recovery highlights the coin’s growing strength and sustained bullish momentum despite a general downtrend at the time of this analysis.

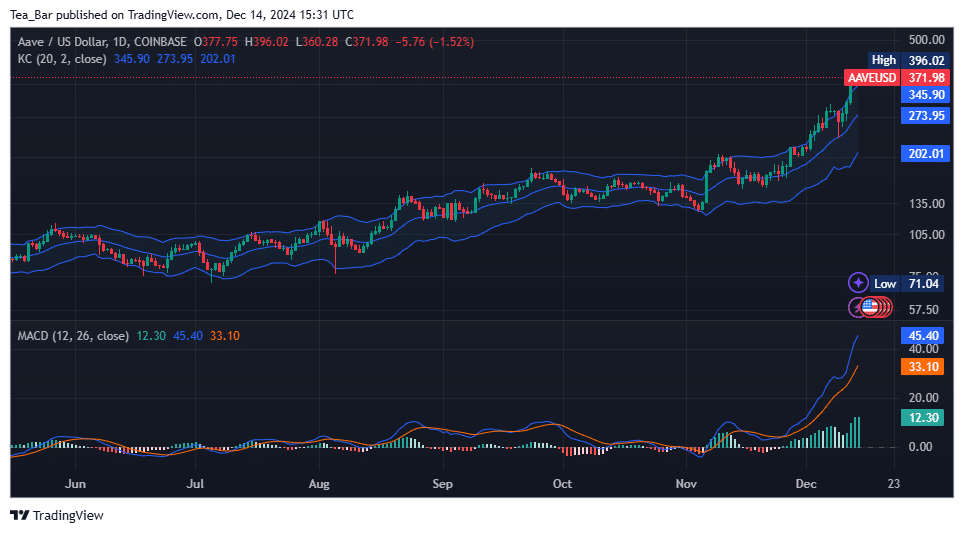

AAVE/USD Market

Key Levels

- Resistance: $396, $410, $445

- Support: $345, $273, $202

The AAVE/USD daily chart highlights an impressive bullish run, with the price consolidating around $371.98 after reaching a high of $396.02. The upward momentum has placed AAVE near critical resistance levels, with the nearest at $396.02 (recent high). A break above this level could open the path toward the $410 mark, a psychological barrier, followed by $445, which aligns with the next potential target based on historical price action. However, signs of overextension in the MACD histogram suggest that the rally may encounter selling pressure in the near term.

On the downside, immediate support lies at $345.90, corresponding to the midline of the Keltner Channel, which has acted as a reliable dynamic support during the uptrend. If bearish momentum intensifies, further support can be found at $273.95 (lower Keltner Channel boundary). A deeper correction could push the price to $202.01, a key level that previously marked consolidation zones. Conditional on MACD trends and volume stability, AAVE could either resume its upward climb or enter a corrective phase, providing critical decision points for traders.

Can AAVE Overcome Market Downturn to Retest $396? Key Factors to Watch

Given the current bearish sentiment in the broader market, where most cryptocurrencies are experiencing declines, AAVE’s ability to meet its recent high of $396 becomes more challenging. In a “red” market, the likelihood of sustained upward momentum for AAVE is diminished unless it can significantly outperform its peers. The overall market downturn may exert downward pressure on AAVE, particularly if there is continued weakness across major cryptocurrencies like Bitcoin and Ethereum. As a result, AAVE could struggle to break through its resistance level at $396 in the short term.

How High Can Aave Go?

In such market conditions, AAVE’s price might face increased volatility, potentially revisiting lower support levels like $345.90 or $273.95. While the fundamentals of Aave’s DeFi platform remain strong, external factors such as global economic uncertainty, regulatory developments, and investors’ risk appetite will play a crucial role. If the market sentiment shifts to more favorable conditions, AAVE could still make an attempt to retest $396, but caution is advised in the face of widespread market weakness.

AAVE/BTC Performance Insight

The AAVEBTC daily chart indicates a strong upward trend as AAVE trades above the upper Keltner Channel (KC) band, signifying bullish momentum. The MACD histogram reflects continued buying interest, with the MACD line maintaining a notable gap above the signal line. Despite a slight pullback (-1.85%), the price remains significantly elevated from its recent low of 0.001157 BTC and continues to hover near its peak of 0.003913 BTC. This suggests that bulls maintain control, though a potential retracement toward the middle KC band (0.002789 BTC) could provide stronger support before resuming the uptrend.

Meanwhile, market intelligence platform, Santiment noted that Aave (AAVE) has surpassed $300 in market value for the first time in over three years, supported by a broader altcoin rally. A significant drop in AAVE’s “Mean Dollar Invested Age” indicates major stakeholders are reactivating dormant tokens, driving bullish momentum. They also highlighted strong average returns for 30-day (+33%) and 365-day (+109%) active traders, reflecting AAVE’s impressive performance. While whale activity continues to fuel the rally, Santiment cautioned that a retracement is possible if large holders reduce circulation.

📈 As several altcoins grow today, AAVE has erupted to a market value of over $300 for the first time in over 3 years. Pay attention to projects that have massive drops in “Mean Dollar Invested Age” like AAVE. This indicates major key stakeholders are moving previously stagnant… pic.twitter.com/VmywKxRTzh

— Santiment (@santimentfeed) December 11, 2024

Alternatives to AAVE

Aave has firmly established itself as a pioneer in decentralized finance (DeFi), renowned for its revolutionary flash loan feature that allows users to borrow and repay funds within a single transaction, all without the need for collateral. Although Aave continues to dominate, newer projects are rapidly gaining traction, with Wall Street Pepe ($WEPE) emerging as a standout. Despite the current market turbulence, $WEPE has successfully raised an impressive $20.3 million during its presale, signaling strong interest from investors. At its current price of $0.000364, it presents an enticing opportunity for those looking to enter early.

Wall Street Pepe’s unique charm lies in its clever twist on the iconic Pepe the Frog meme, seamlessly integrating it with a utility-focused ecosystem designed for everyday crypto investors. At the heart of this ecosystem is a private insider community where traders can exchange insights and refine strategies. This is enhanced by a suite of advanced trading tools, real-time market signals, and actionable advice that aims to support smaller investors navigating the complexities of crypto trading.

Elon Musk Loves Wall Street Pepe

The project’s momentum is further evident in its rapidly growing online presence, particularly the expanding “WEPE Army” on Twitter. With more than 4.7 billion $WEPE tokens staked at an impressive annual yield of 167%, Wall Street Pepe is positioning itself as an attractive option for retail investors eager to explore its trader-centric ecosystem. As development continues, the project has the potential to carve out a profitable niche in the cryptocurrency space.

Visit Wall Street Pepe.

Related News

Newest Meme Coin ICO – Wall Street Pepe

- Audited By Coinsult

- Early Access Presale Round

- Private Trading Alpha For $WEPE Army

- Staking Pool – High Dynamic APY

Join Our Telegram channel to stay up to date on breaking news coverage