This is the third chapter of a special Forkast series on crypto newcomer Joel Stein’s adventures in the blockchain world. In Part 1, he opens a crypto wallet and in Part 2, he dives into play-to-earn as an Axie Infinity gamer.

_________________________________

I am overwhelmed with the complexity of crypto trading, but I somehow managed to buy and sell a co-op apartment in New York City with my sanity intact. So I figured I should also start my Web 3.0 investment portfolio with real estate — in the metaverse. More than US$500 million was spent on virtual real estate last year, and Citigroup forecasts that the metaverse market could be worth up to US$13 trillion by 2030. If I could corner just .01% of that, I’d be a billionaire!

To get started on shopping for my first virtual home, I went to Parcel, which calls itself the Zillow of the metaverse. Parcel supports five metaverses, which is four too many metaverses for me. I’d had enough trouble picking a house on one tiny speck in one real-life universe.

Sensing that I needed help, Parcel CEO Noah Gaynor asked me a basic question: What did I want to do with my virtual real estate? This was not a question I had pondered about any of the homes I’ve wanted to buy before, since all I wanted to do was live in them.

But you don’t sleep or raise a family in the metaverse. It’s a commercial space.

“Do you want to simply buy land and hold it for 30 years and cash out one day? Or build an experience like a concert venue? Or sell a lot of ads and have a lot of billboards?” Gaynor asked.

All of those sounded like good ideas, but they also sounded like work, and I wasn’t looking for a job in the metaverse. So I told Gaynor that I was leaning toward something fun, like a social club for journalists. He suggested Mona, where each ownable space is your own personal metaverse.

Each Mona parcel is an NFT that an artist has created. It’s like a video game without the game, just a series of streets or rooms or spaceships for your avatar to wander around in. In one NFT world, there were sharks flying in the sky above me; in another, I was greeted by skeletons in spacesuits. Ranging in price from US$1,000 to US$30,000, Mona properties looked like Roblox reconceived by the guys who spray painted the sides of vans in the 1970s.

Mona was a little too monastic for me though. I didn’t want a whole metaverse to myself. I wanted a communal experience where I’d run into new people to make fun of skeleton astronauts with.

Gaynor suggested that I tour the two largest blockchain real-estate metaverses. The Sandbox has that blocky Lego look where everything is made of voxels (like in Roblox and Minecraft) and focuses on gaming. Decentraland has a more traditional cartoon look and is used for socializing, shopping for digital art, watching movies, and going to concerts.

Decentraland has clearly defined and zoned neighborhoods, including districts for gambling (Vegas City), music (Festival Land), education (University), and porn (District X).

Decentraland districts resemble housing communities with a homeowners association, with “district leaders” making sure everyone sticks to the neighborhood’s rules and original intent.

“The district leader might not be thrilled that you’re squatting on land and not adding to the value of the museum district,” Gaynor said. “It’s political. Decentraland might want certain things and the owners might want different things.” That gave me pause — why come to the decentralized world only to have some functionary middleman tell me what I can and cannot do on my land? The setup didn’t sound very decentralized or Web 3.0 to me.

Parcel sent me information on three parcels in the museum district they thought might appeal to me because the neighborhood had the intellectual vibe that could be helpful to attract people to my salon for journalists. Each 16-by-16 “meter” parcel was selling for around USD$8,000. This seemed like a bargain compared to the hundreds of thousands of dollars that other virtual plots of land have sold for — until I realized the “real estate” here is only a bunch of computer code. Plus, once I had my empty green square of virtual land, I’d have to buy NFT trees and NFT lawns and NFT sofas to keep up with the avatar Joneses, and NFT security guards to stop anyone from stealing all those NFTs.

The other problem was, it was hard to tell what and where I was buying. I had to look at a map on Decentraland to see where the land was, but then go to OpenSea to buy it as an NFT based on the X and Y axes on the map. The prices were listed in MANA, Decentraland’s own cryptocurrency. Because OpenSea has a fair amount of con artists on its site, and there is no title insurance or escrow to protect buyers of metaverse properties, I found myself having to look deep into the seller’s blockchain to make sure that some scammer wasn’t selling me fake virtual land that relies even more heavily on the imagination than real virtual land.

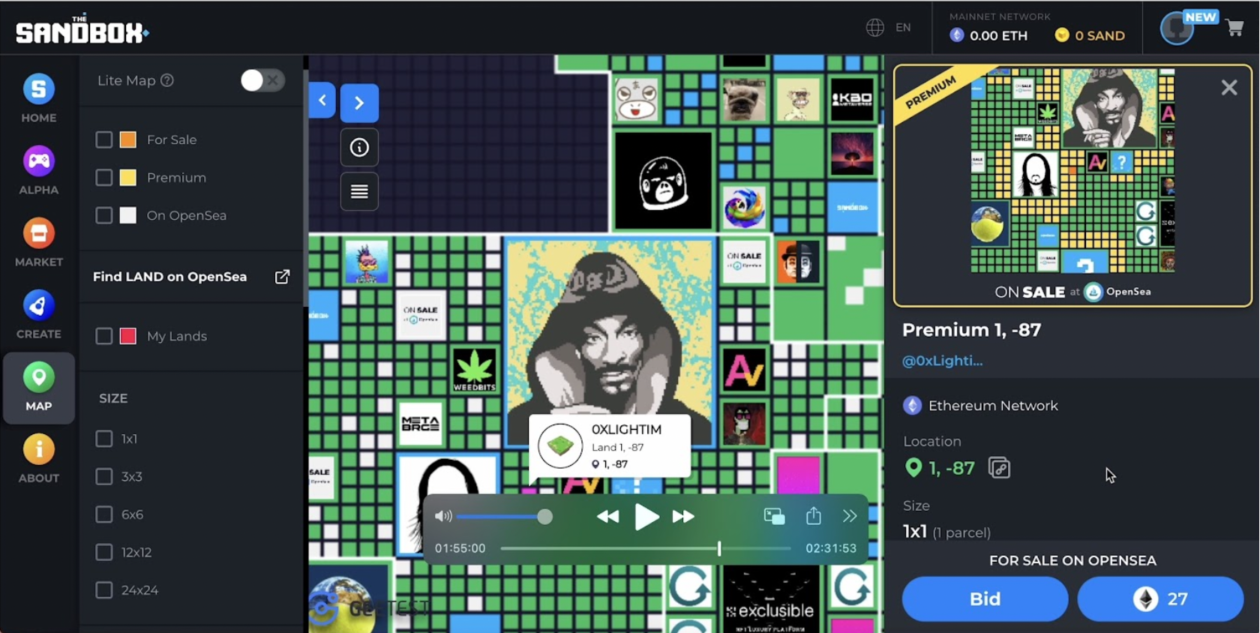

I thought I might be able to do better at The Sandbox. Despite not being fully open yet, the company is already valued at US$4 billion and has sold parcels to Adidas, Atari and Warner Music. Someone recently paid US$450,00 to buy an area near the virtual mansion of Snoop Dogg, the rapper-cum-Sandbox promotional partner.

I still could not decide on a business that I would put on my virtual land. Journalists, I realized, may not be the best customer base for a fee-paying club given how many have lost their jobs. But Sandbox CEO Mathieu Nouzareth told me I’d have no problem making money in the metaverse.

“We think there will be hundreds of thousands of jobs that don’t exist today,” Nouzareth said. “If I were an entrepreneur looking for an idea, being a terraformer is a great idea.”

But I had no idea what a terraformer was.

“It’s not very hard, and there are a lot of companies asking for landscaping,” Nouzareth explained.

And if I thought of something more lucrative than planting pixilated gardens, I could do it. The Sandbox lets users form their own neighborhood without the oversight of appointed dear (district) leaders. But a Libertarian’s utopia it’s not. There’s no gambling or hate speech allowed. “Also, there’s a limit on heights of structures,” Nouzareth said. My fading dreams of building skyscrapers in the metaverse became vivid again when he added, “I forgot the limits.”

To help me sift through all this information, I turned to a metaverse real estate agent. Nick Vivion is mostly a communications consultant specializing in Web3. But he’s also freelancing as a metaverse real estate agent for a few brands, including the Sloomoo Institute, an interactive slime museum in New York City. He agreed to take me on as his first little-guy client.

Nick Vivion, my metaverse real estate agent, took me on neighborhood tours.

Nick set up a time to come to my house to take me virtual real-estate shopping. When I asked why we weren’t meeting up online, he explained that shared experiences in the metaverses require more bandwidth than our home WiFi and MacBooks could handle. This seemed wrong to me, like not being able to visit the neighborhood you might move to with your family because there’s not enough air there for all of you.

I did, however, like that Nick doesn’t own a meatworld home. Or live in one. He and his boyfriend Beau live in an RV that they drive around the country so they can park and stay in different cities. My metaverse real estate agent was already living Ready Player One.

Nick came over on a Saturday afternoon with Beau and their dog Rick, who they said was a chiweenie, a chihuahua dachshund mix. I opened a bottle rosé, and we went shopping in the metaverse.

The Sandbox was open for one of their test runs, so we got to walk around in a small part of it that looked like a town square. I was impressed that my avatar magically looked just like me, until Nick told me that was just the generic avatar they give you — which meant I looked just like a generic white crypto bro.

Nick got excited when we saw a blocky avatar of DJ Blond:ish, who minted sustainable NFTs and would be playing a festival in Miami the following weekend with Diplo. But no matter how many times I tried, I could not get her to talk to me. I was amazed at how well The Sandbox replicated real life.

Just as it would happen in real life, the avatar of DJ Blond:ish ran away from me when I got close and tried to talk to her in The Sandbox metaverse.

The experience was smooth, a lot like a videogame where I used the keyboard to walk, jump and run through a blocky Roblox-like world, but instead of collecting gems, I walked past gems.

I strolled by Farmer Smurf, who was bragging about having won some game; Negan, from the Walking Dead, who insulted me by saying I had “a dead face,” and an automated avatar of Snoop Dogg singing his Sandbox-inspired song, “House I Built,” which — as soon as I stepped on the dance floor next to the DJ Deadmau5 — caused my avatar to do an awkward blocky dance. Again, I was impressed at how much like real life this was.

When I expressed concern that, as a prospective real estate investor, The Sandbox seemed too narrowly focused on gaming, Nick told me I wasn’t picturing gaming’s potential. “What does McDonald’s do in the metaverse? They’re a food brand. So what they have to start doing is games. Everything turns into a game,” he said.

Soon, he predicted, consumers will spend more money on digital goods than physical goods. You only need a few pairs of shoes in real life, especially when you never leave your house. But you can floss like Imelda Marcos in the metaverse with thousands of different NFT shoes, just like in she could do in real life.

Not only was the future right on my screen, but today was a great day to buy. Yuga Labs, the creators of Bored Ape Yacht Club, launched their own metaverse that morning, called Otherside. It sold US$320 million in NFT real estate in the first three hours it went on sale, and the stampede of buyers — burning more than US$175 million in gas fees to get in on the deal — broke Ethereum for three hours.

So The Sandbox was not the hot market right now. And prices had already been down since the boom that came when Facebook decided to go all in on the metaverse idea and changed its name to Meta. Plus, Decentraland plots are sold on Ethereum, and that coin was also down in the dumps. Nick did a quick search of Sandbox parcels for sale in OpenSea’s metaverse land market.

“This is crazy. At the beginning of February, the average was 4.9E and now we’re at 1.3. Everything is just down, down, down, down, down,” Nick said, calling out prices in Ethereum’s Ether. “It’s a good time to buy right now.”

Back at its peak price in November 2020, the cheapest parcel of land on The Sandbox was a little more than US$16,000. Now, it’s less than US$3,500.

Nick zoomed out on the Sandbox map, and I was struck by the size of it, which was the exact same size as my MacBook Air screen.

Next, Nick said, “We need to talk about neighborhoods.”

Being Snoop Dogg-adjacent would be expensive, and frankly, the mere thought of it revived unhappy memories from a previous Snoop encounter.

Many years ago, for a magazine piece I was writing, Snoop and I were supposed to create new slang words together. But it didn’t go over well. Snoop rejected my idea for calling winsome women “figgy pudding,” because, as his friend, a former pimp, said: “the figgy don’t mean with the pudding.”

Then Snoop kept throwing words at me like “bofus” so that I’d have to ask, “What’s ‘bofus’ Snoop?” — and he’d grab his crotch and shout at me, “Bofus dese nuts!”

My time with Snoop ended with my eyes burning with tears, both from my humiliation and the marijuana smoke that the former pimp kept blowing into my face.

Nick showed me a plot far from Snoop in the lower right corner of the map that cost US$4,500. It was in the middle of nowhere, but Nick said it could be valuable once Sandbox finished releasing all its land at the end of the year. “I liken it to buying land in 1800 in Brooklyn and there’s no Fifth Avenue and it’s all farmland and you’re thinking, ‘One day, there will be hipsters here.’”

As with Bitcoin, scarcity is artificially inserted into the metaverse land economy. Scarcity by choice seemed like a leap of investor faith, especially in a real-life world where the real-life computer code underlying these metaverses could be endlessly copied to create more product.

There seems to be a lot of dancing in the metaverse. And Smurfs.

As I gave that some thought, Nick shifted his attention to the upper right corner of the map, near a huge area owned by the South China Morning Post. Those seemed more like my people. The parcel cost US$8,000 and was just nine plots from SCMP. It was called LAND (64, 147), and it was beautiful in the way that a tiny green square on a computer screen is beautiful to behold.

It was also five plots from a giant area owned by Metakey, a company that’s trying to be the American Express Black Card of the metaverse, granting members privileges and discounts in both The Sandbox and Decentraland.

“There’s a lot of transit opportunities here. If the South China Morning Post is rad and Metakey is rad, then people have to go back and forth,” Nick said. “You’d have this potential channel. I like the look of this one.”

When I hesitated, Nick started his hard sell, pointing to my 13-year-old son Laszlo sitting near us and looking up from his Nintendo Switch occasionally. “Let’s say he grows up and has kids. You could be the cool grandad with this awesome metaverse pad that the kids want to hang out in. Do you want to hang out with your grandkids? That’s a pretty good value prop.”

After more than two hours of metaverse real estate shopping, I told Nick I’d need to talk this over with my family and probably open another bottle of wine. He, his boyfriend and their chiweenie left, and I sat and stared at what could soon be my very own little green patch of pixels. US$8,000 seemed like an awful lot. But US$113,000 seemed like a lot in 1998 when I bought a 475-square-foot studio apartment in the Chelsea section of Manhattan. My Sandbox plot might one day be worth millions. And the love of my grandchildren.

To find out how I could finance this purchase, I Zoomed with Ryan Berkum, the CEO of Teller, which gives out loans from a pool of people staking their crypto. Someone got a mortgage on a US$680,000 house in Austin, Texas, using Teller. Maybe I could get crypto mortgage for LAND (64, 147).

Berkum told me that a loan was definitely possible. But not a fixed-rate 30-year mortgage like I have on my house. “Because of the volatility of NFTs, investors are looking at three-to-six-month loans,” he said. And it would be more like a buy-now-pay-later loan than a mortgage, since no one would want to foreclose on LAND (64, 147) if I stop paying my loan. “A mortgage in the crypto world is not about a home you can collateralize. It’s about the attention a certain parcel of space in the metaverse gets. If it’s next to where Snoop bought, it’s going to get more attention.” I got what Berkum was saying, but it sounded bofus to me.

Worse, my crypto loan interest rate would be very high, maybe as much as 25% — so I might as well just put it on my credit card. Which would make my speculative real estate buy from a speculative metaverse company in a speculative asset class even more speculative. Plus, the fear of falling behind on any crypto loans and having a decentralized autonomous organization send a gang of menacing NFT apes after me to hunt my avatar down in The Sandbox was just too much for me to bear.

But before going Chinese tycoon and offering an all-cash deal, I wanted to check out one more thing. Prior to buying my current house in Los Angeles, I knocked on the doors of a few neighbors to make sure none of them seemed the sort who would blow pot smoke in my face.

Proximity to Snoop Dogg raises the value of metaverse land, but I prefer being elsewhere.

So I put on a button-down shirt and a blazer and dropped in for a neighborly call via Zoom with the CEO of Metakey. Like many in the crypto world — including Mx. Satoshi Nakamoto, the creator of Bitcoin who started it all — he prefers using a pseudonym. The CEO goes by DCL Blogger. The “DCL” stands for Decentraland, where he claims he is that metaverse’s largest trader in the world, having transacted nearly US$30 million in virtual real estate.

As DCL Blogger spoke, he held a cat, but not in a James Bond villain way. More like a guy who just like cats. He’s a former civil engineer who had just bought his first real-world house in Melbourne, Australia.

When I asked if he likes to stay up late and make lots of noise, he explained that in the metaverse, you want neighbors who throw big loud parties because they drive traffic to your business. In Decentraland, Metakey is thrilled to be neighbors with Metakoven, the pseudonymous crypto investor who bought a Beeple NFT artwork last year for US$69 million. Metakey has 16,000 members on Discord, so its parties are probably going to rock hard.

Metakey plans to use its property in The Sandbox to host conferences and create games. “We could build co-experiences,” DCL Blogger offered. “Maybe I’ll make a virtual cat so she can come over to your space.”

I haven’t bought any virtual real estate yet, but if I do, I’m pretty set on LAND (64, 147). Partly because DCL Blogger seems like he’d make a nice neighbor. And also because I’d be half a cyberverse world away from Snoop and his friends.