The ETH liquidations reached $157 million after the Merge upgrade test, following the Beacon Chain block reorganization which led ETH to drop over 7% as we reported earlier in our Ethereum news.

With the bears circling crypto and traditional markets, ETH faced the brunt of it. Ethereum is trading hands at $1,770 down by 3.4% in the past day and the bearish trend is the latest in what was seen as a rather red week for the second biggest crypto by market cap. In the past week, Ethereum shed about 16% of its value and crashed from $2,077 to as low as $1,731 during the early hours on Friday. It recovered some but now stands at around $1,770 down by 3.5% on the day. The huge price shift led to ETH Liquidations reach $175M as per the data pulled from Coinglass. About 75% of them were long positions from the bullish crypto traders.

The Ethereum beacon chain experienced a 7-block deep reorg ~2.5h ago. This shows that the current attestation strategy of nodes should be reconsidered to hopefully result in a more stable chain! (proposals already exist) pic.twitter.com/BkQrKuUlw1

— Martin Köppelmann ???????? (@koeppelmann) May 25, 2022

Most notable was the recent hang-up related to the ETH incoming merge that is set for August. The merge will see the current PoW version of ETH merge with the PoS counterpart. The counterpart is called the Beacon Chain and was in operation since December 2020. The PoW-based version will end and will make Ethereum a PoS network and will also bring a host of new benefits. The Beacon Chain is a sort of ghost version of ETH running in parallel to the current network which experienced a block reorganization event so such an event means that for a short moment, the Beacon Chain was forked and all blocks were processed on another parallel version of the Beacon Chain. The network started producing soon.

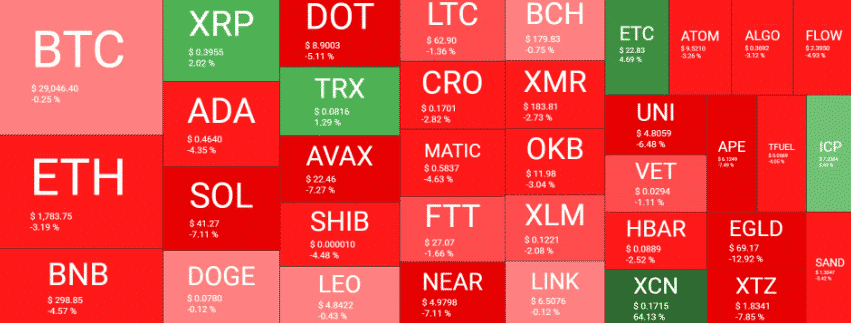

As earlier reported, The altcoins are bleeding out as most of the market took a leg down in the past day and this caused bitcoin’s dominance to surge to new highs that were not seen since last year. Ethereum’s price relative to Bitcoin dropped to the lowest point since last year and at the time of writing, ETH traded at 0.0629 BTC which lastly was recorded in October 2021. in the meantime, today’s pullback saw the ETH dollar value drop by 7% and left some $86 million in liquidated positions. As a matter of fact, in the past day, the most liqudations were of ETH contracts and the biggest single liquidation order took place on OKEX and was an ETH/USDT swap with a face value of $2.24 million.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]