Key Highlights:

- Well-known crypto trader TechnoRevenant has added $7M to Uniswap.

- A $15M move shows that the trade still trusts WLFI, even though there is a huge ongoing drama around the token.

- This move by the trader has helped calm fears about decentralization and has kept trust in WLFI’s ecosystem.

Recently WLFI token has gained a significant amount of attention from the crypto community, not only because of the price rally but also due to major moves that have been made by a well-known crypto trader. Even though the concerns that have been sparked recently by Justin Sun due to the recent freezing of his WLFI tokens, the market has responded with surprising resilience.

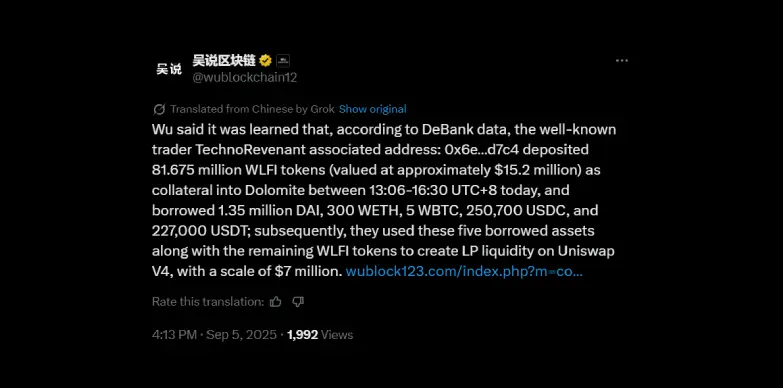

According to DeBank data, a well-known crypto trader, TechnoRevenant has deposited around 81.675 million WLFI tokens (price at around $15.2 million) into Dolomite, which is a decentralized finance (DeFi) platform. All of this happened between 13:06 and 16:30 UTC+8 on Thursday, which was right after Justin Sun’s tokens were frozen. Using this collateral, the trader then has borrowed various assets such as 1.35 million DAI, 300 WETH, 5 WBTC, 250,700 USDC, and 227,000 USDT.

Instead of cashing out or simply holding, the trader combined the borrowed assets with their remaining WLFI tokens and crated a $7 million liquidity pool on Uniswap V4.

Why Does This Move Matter?

If you look at it, this move by TechnoRevenant looks like a very normal DeFi play, where you put tokens down as collateral. After these tokens have been put down as collateral, you borrow other assets and then provide liquidity to earn the trading fees. However, with all that has happened with WLFI, this move means much more than just a normal DeFi move.

Let’s talk about the Justin Sun drama. Recently, a large batch of WLFI tokens that were linked to Justin Sun were frozen. This incident sparked concerns regarding centralization where questions were raised on how decentralized the World Liberty Financial system really is. Secondly, a question was also raised that if such a huge amount of tokens can be locked up, will there still be enough tokens moving around for others to trade?

This is exactly where the trader, TechnoRevenant, stepped in. The trader added a fresh $7 million liquidity pool on Uniswap and managed to address both the concerns at once. The trader kept the trades smooth by making it easier for people to buy and sell WLFI without wild price jumps, which is a very important aspect of keeping confidence in the market. The trader with this move shared his vote of confidence for the project.

Price Uptick Adds Momentum

At the same time, the price of the WLFI token has been on the rise, and this makes the move by the trader even more strategic. Depositing WLFI as collateral while its value is high allows for greater borrowing power. In other words, the trader leveraged the rally to maximize what they could draw against their holdings, without needing to sell the tokens.

This indicates that the trader is not letting go of his WLFI tokens but they are doubling down on it. The trader is using their tokens to unlock additional assets while still actively supporting WLFI’s liquidity ecosystem.

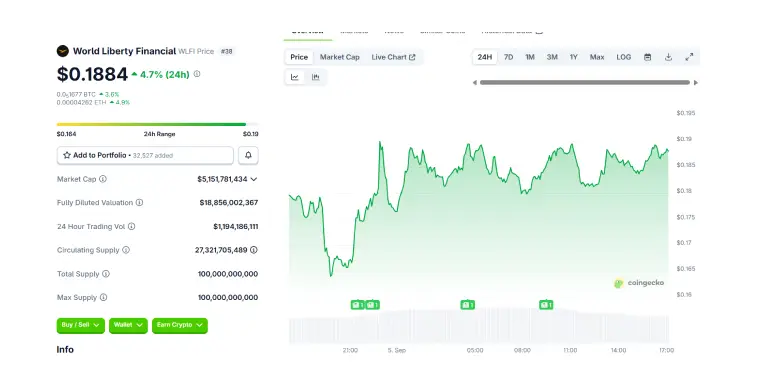

At press time, the price of the token stands at $0.1884 with an uptick of 4.7% in the last 24 hours as per CoinGecko.

Looking Ahead

The token as of now faces challenges that are related to its association with Justin Sun and questions over governance and transparency. For now, it looks like the token is regaining trust and momentum within the community. If this WLFI rally can sustain itself or not is yet to be seen.

Also Read: Pudgy Penguins, Blur Market Drop Cast Doubt on PENGU ETF