The analyst who called this year’s Bitcoin (BTC) collapse is predicting more corrections for Cardano (ADA) and mid-cap altcoin Cronos (CRO).

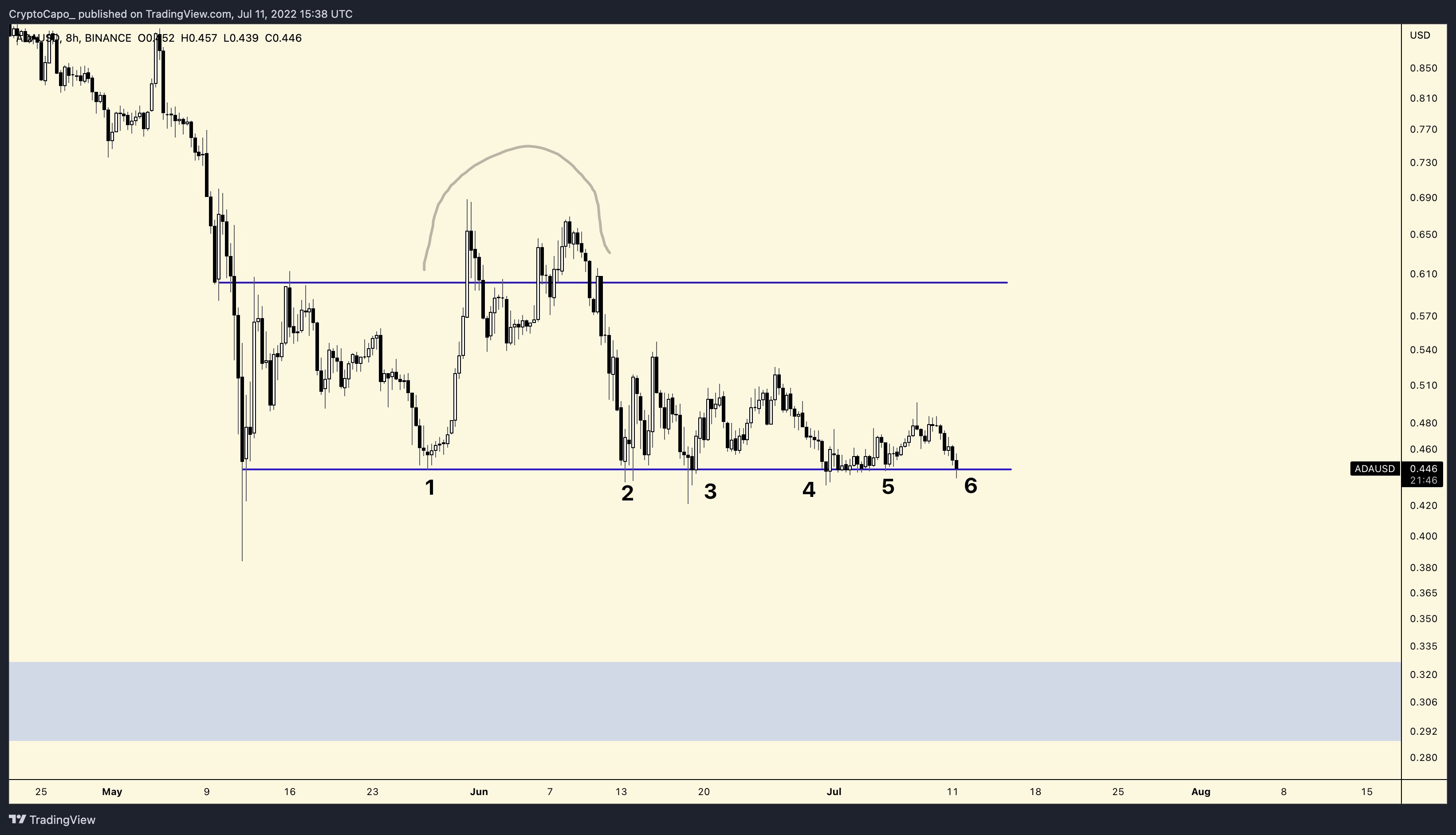

Pseudonymous analyst Capo tells his 438,400 Twitter followers that Cardano’s support around $0.44 is about to cave in after six touches in less than two months.

“Sixth touch of support. Getting weaker and weaker. Next support: $0.29-$0.31.”

At time of writing, Cardano is changing hands for $0.43, below Capo’s support level and down nearly 6% in the last 24 hours.

Another altcoin on the trader’s list is Cronos, the cryptocurrency that powers the Crypto.com payment, trading and financial services platform. According to Capo, CRO has broken down from its horizontal and diagonal support levels and looks poised to start the next leg down.

“CRO update: $0.055-$0.065.”

At a current price of $0.11, a move to Capo’s target suggests a downside potential of nearly 50% for Cronos.

The crypto strategist is also issuing a general warning to crypto market participants, positing that fresh inflation data could drive digital assets to new 2022 lows.

“All the charts show weakness. New lows are just a matter of time. CPI [consumer price index] this week.”

New CPI data is scheduled for release on June 13th. Traders keep a close watch on the CPI as high inflation numbers could signal that the Federal Reserve might introduce a fresh round of interest rate hikes which often does not bode well for risk-on assets like cryptocurrencies.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/nemovljatko