[ad_1]

Robinhood added Grayscale ETH and BTC trusts after leaning heavily on the crypto industry recently so let’s have a closer look at our latest crypto news today.

For a few years, the trading app Robinhood listed a few cryptocurrencies but in the past month, it’s brought that number to 11 and it is now making available two equities assets related to the price of crypto. As of today, Robinhood added Grayscale ETH and BTC trusts and now the users can buy GBTC and ETHE via the app. Both of these investmetns products trade like a stock and allow investors to get exposure to the price of EBTC and ETH without having to actually buy them. The investment firm took care of the custody in exchange for a management fee and the buyers got a share of the BTC and ETH. While both GBTC and ETHE are tied to the price of the cryptocurrencies which are rarely traded on a 1:1 basis, a part of the reason for the difference in price is the long lockup periods when the larger holders sell and affect the price of the open market.

There’s two new ways to access crypto on @RobinhoodApp. You can start trading $GBTC and $ETHE today. https://t.co/n09aiEVhqEhttps://t.co/6tFrYCsmzx pic.twitter.com/AxKH7xZ0nS

— Grayscale (@Grayscale) May 6, 2022

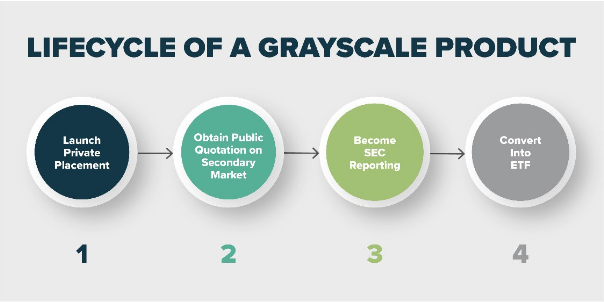

The discrepancy could explain why Robinhood traders don’t have to worry about the custody issues but can get these assets for cheap prices and hope the gap closes. According to the data from Ycharts, ETHE is selling at a discount of 26.1% which means it is 6% cheaper to buy ETHE than ethereum while GBTC is trading at a 25.5% discount. If the SU SEC accepts Grayscale’s proposal to transition the BTC Trust into a BTC ETF, the discount will disappear since ETFs allow them to trade closer to the asset’s price. The SEC however hasn’t approved any BTC-backed ETFs.

Since the Robinhood crypto COO Christine Brown’s departure from the company, the brokerage rolled outa few major additions to the digital asset offerings. It added Polygon, sHIB, Compound, and Solana to the listings of Bitcoin, Bitcoin Cash, Ethereum, Dogecoin, Bitcoin SV, and Litecoin while a week before, at the BTC conference in 2022, it announced its intentions to use the LN for sending faster and cheaper transactions. It also revealed that the users will be able to transfer the crypto assets off Robinhood which is something that the company promised since early 2021.

Crypto has been one of the few bright spots for the company which reported an 18% drop in revenue for Q1 and laid off 9% of the staff. The revenue however was up from $48 million to $45 million for the quarter but still down by 39% from a year-to-year comparison.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link