[ad_1]

The two biggest cryptos, Ethereum and Bitcoin are down by over 50% from their all-time high and the exchange flows show different pictures despite the bearish price action on the market so let’s have a closer look today at our latest crypto news.

Having spent the past five weeks in decline, the industry’s two biggest cryptos by market cap Bitcoin and Ethereum are down by 50% from their ATH that was posted in 2021 during the bull run. Bitcoin dominates 41.8% of the market with a capitalization of $628 billion and it is trading at $32,947 which is a level not seen since 2021 as per the data aggregator CoinMarketcap. The figure recorded a 51.9% drop in value since BTC set to an ATH of $68,789 in 2021 and it is a similar story with Ethereum as well.

Ethereum has a marekt dominance of 19.2% with a current marekt cap of $289 billion but it is trading at $2,395 or about 50.9% of the former high of $4,891 that was posted in November 2021. Apart from the BTC recent price movement can be understood in light of the inflows and outflows on exchanges and the bigger inflows often signal an imminent bear market as investors moved their holdings on exchanges to sell for fiat or fiat-pegged stablecoins.

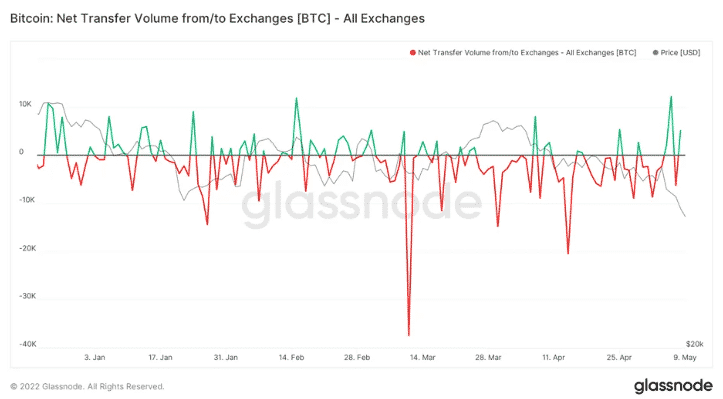

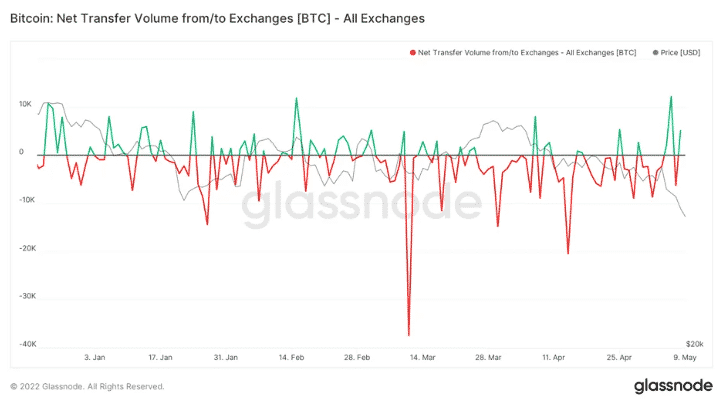

The bigger outflows can be a bullish signal as investors could be moving their holdings to cold storage wallets for holding in the long run. As per the data from Glassnode, Bitcoin’s 15% dip over the past week also correlated with net transfer volumes to various exchanges and on May 6, there was a net inflow of 12,246 BTC or $402 million at today’s prices. Ethereum’s net transfer volumes for the month indicated that most investors were moving their holdings off of exchanges and the contradiction between the recent bearish price action accompanied by larger outflows from exchanges only suggests that there could be other forces at play for the second-biggest cryptocurrency.

Ethereum holders could be pulling their idle coins from exchanges for staking purposes which leads up to the network’s merge that is expected in Q3. Investors can dump their holdings on different decentralized exchanges in the world of DEFI but when comparing transaction volume for ETH on coinbase and DEFI biggest decentralized exchange Uniswap, the latter reported a trading volume of $1.63 billion in the past 24 hours while former reports just over $500 million.

If not in the DEFI sector, the ETH leaving from exchanges could be getting deployed in lending or borrowing protocols that are used to mint stablecoins or host other DEFI activities which don’t result in selling the asset.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link